Is now the right time to unleash a new product? Whether it is or not, according to one analyst, Apple (AAPL) is readying to unveil its new budget iPhone model, the iPhone 9/SE2, the follow up to the iPhone SE.

Wedbush analyst Daniel Ives says that according to available supply chain information and various retail websites, the launch is weeks away. The unveiling – originally slated for March – was delayed on account of supply chain issues caused by the COVID-19 pandemic. If the timing of bringing a new product to market appears curious, there is a reasonable explanation.

“While launching a mid-cycle budget/entry-level smartphone into the backdrop of a consumer global lockdown and unprecedented pandemic will be a head scratcher to some, we note that Apple is viewing this as a low volume, low touch release with little fanfare as the phones are already ready to ship,” Ives said.

Ives believes that taking into consideration the “underlying demand and the prior SE cycle,” dispatching between 20 and 25 million of the new models in the first six to nine months of the cycle, is a “realistic target.”

Taking a step back, in the broader scheme of Apple’s plans for 2020, the launch was always meant to be a relatively low-key affair. Apple’s big launch this year is for the much-anticipated iPhone 12, its first model boasting 5G capabilities. The release is set for September, but Ives has questioned whether the planned launch will go ahead, due to COVID-19’s impact on consumers’ spending power and its disruption to the global supply chain. The analyst believes the launch will be pushed back to later in the year, possibly the holiday season, to accommodate a more receptive macro environment. The importance of a smooth rollout of its flagship product cannot be overstated, Ives notes, as it is one of the most important product launches in Apple’s history.

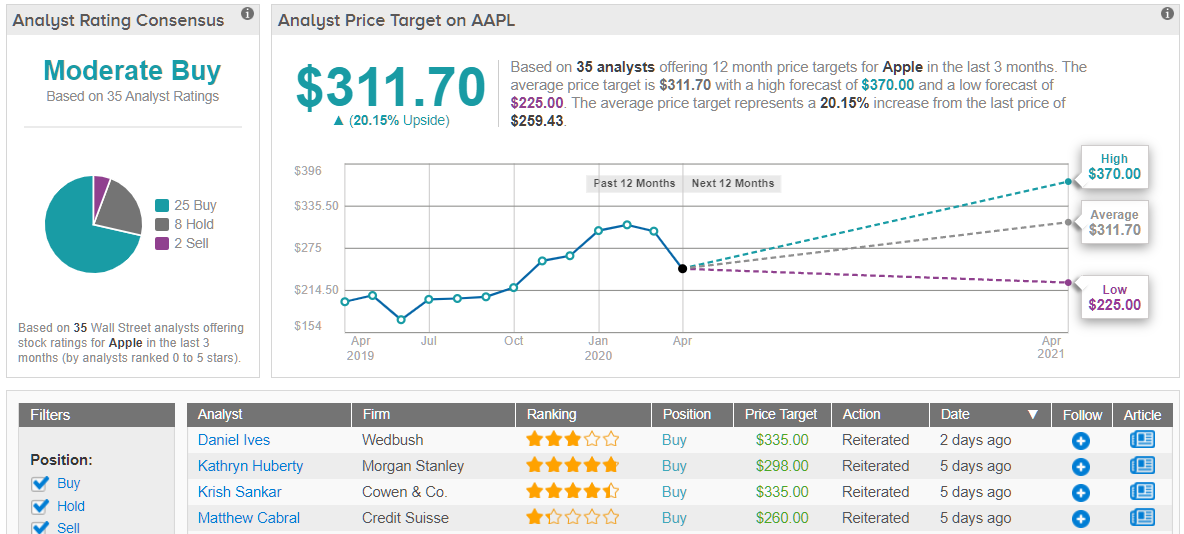

All said, Ives maintains an Outperform rating on Apple shares, along with a $335 price target. The implication for investors? Potential upside of 29%. (To watch Ives’ track record, click here)

Taking a step back, we can see that the tech giant’s stock shows a Moderate Buy consensus rating on TipRanks- with 25 analysts advising investors to “buy” AAPL in the last three months. That’s versus 8 “holds” ratings and only 2 “sell” ratings published in the same period. Meanwhile the average analyst price target stands at $311,70, which implies about 20% from current levels. (See Apple stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.