On Tuesday, Google (GOOGL) announced via a blog post that it is making changes to its product search platform. From next week, businesses will be able to list products on the search giant’s Shopping platform for free. Whereas before, any company would have to pay for ad placement, these will only be required for top placements. According to commerce president Bill Ready, the plan was already in place but was sped up to help businesses during the economic crisis.

According to 5-star Baird analyst Colin Sebastian, there are a number of reasons for the change.

First of all, in addition to the obvious benefits to merchants, the move will help consumers by expanding the selection of products on offer. Google will obtain access to a wider range of product listings and information, which will lead to a better shopping experience due to the improved relevance of the results.

Furthermore, citing Alibaba as an example, Sebastian says the “improved utility” will provide Google with the ability to “launch more comprehensive marketplace services.” With Google’s weight, as estimated by Sebastian, already behind a third of online shopping volumes, it will further enhance its status in the field. “We believe that Google Shopping can still become an even more important growth driver over the long term for Alphabet as an alternative to 3P marketplaces,” Sebastian said.

There’s another reason for the opportunistic move. Over the last few years, Amazon has taken a big chunk out of e-commerce search, in turn restricting Google’s expansion in the lucrative area. The shift should help Google “compete more effectively with Amazon.”

“Google may sacrifice some near-term revenues to accomplish this goal,” Sebastian concludes, “But these changes should enable the company over time to monetize traffic in different ways.”

Sebastian reiterates an Outperform rating on Alphabet shares along with a $1,400 price target, which implies a 10% upside from Thursday’s closing price. (To watch Sebastian’s track record, click here)

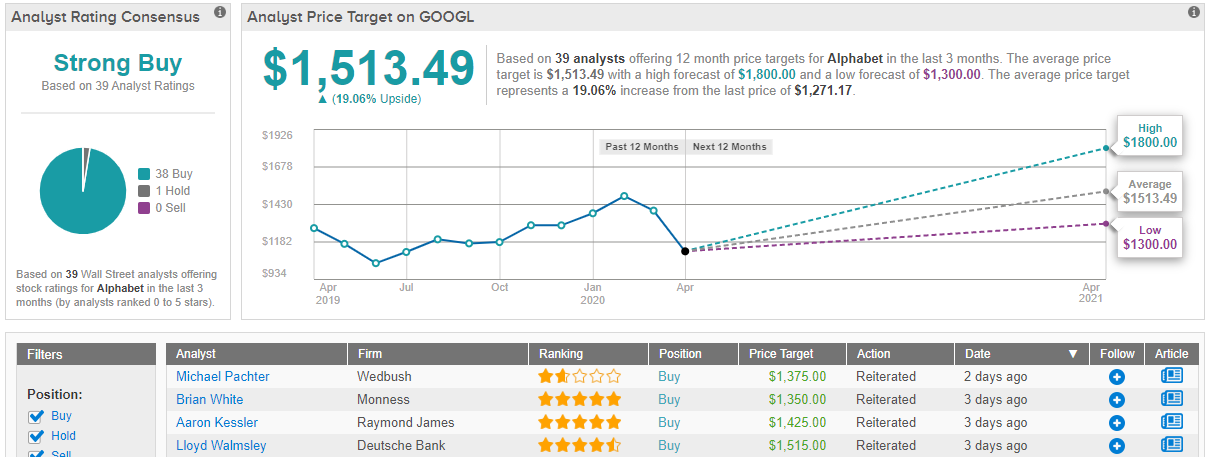

Overall, the bulls are out in heavy attendance for GOOGL. Barring a single Hold rating, all 38 other analysts who published a review over the last 3 months, recommend the stock as a Buy. With an average price target of $1,513, the analysts foresee further upside of 19% in the months ahead. (See GOOGL stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.