With Square (SQ) stock down more than 25% since August 1st, is now the time to buy?

That’s what some investors are asking right now. Though shares have plunged over the past month, and trading at 42% of its 52-week high, the numbers are still strong for the company. Second-quarter revenue grew 46% year-over-year, while profit surged 55%. The primary factor in Square’s decline isn’t so much its poor performance, but that analyst lofty expectations were not met in Square’s outlook guidance. Furthermore, the company’s recent sale of Caviar has contributed to some confusion among investors, even though management say it will help them focus on core products and growth.

5-star Guggenheim analyst Jeff Cantwell clearly sees the light at the end of the current dark tunnel, as he reiterates a Buy rating and $80 price target on SQ stock. (To watch Cantwell’s track record, click here)

Cantwell held meetings with Square management, where he came away mostly positive but still “mixed.” He says the “Cash App opportunity seems significant,” but “seller business increasingly feels like it is in ‘reboot’ mode.” And while management believes the Caviar sale will help with core revenue focus, Cantwell believes the surprising sale “complicates matters as it precludes management from providing much-needed clarity on the outlook for ’20E,” a main driver in other analysts’ pessimistic views.

One of Cantwell’s most positive views is on the Cash App. The analyst says the app “stands out as a success” for Square and believes this can be a significant source of revenue and EPS over the long-term. But he also believes the product development “remains important given (valid) investor concerns related to the [long-term] sustainability of Cash App’s Instant Deposit-related revenue stream.”

On a more cautious note, Cantwell says “competition is impacting SQ’s ability to grow GPV,” with Adyen recently signing longtime Square customer Joe & the Juice. As a result, the analyst sees Square “increasing spend to help counter rising competition from other high-quality payments companies.”

Square’s shifting strategy appears to “be unsettling investors in the near-term,” but updated guidance and an Investor Day early next year “would give [Square the] opportunity to re-calibrate investor expectations for” the short-term.

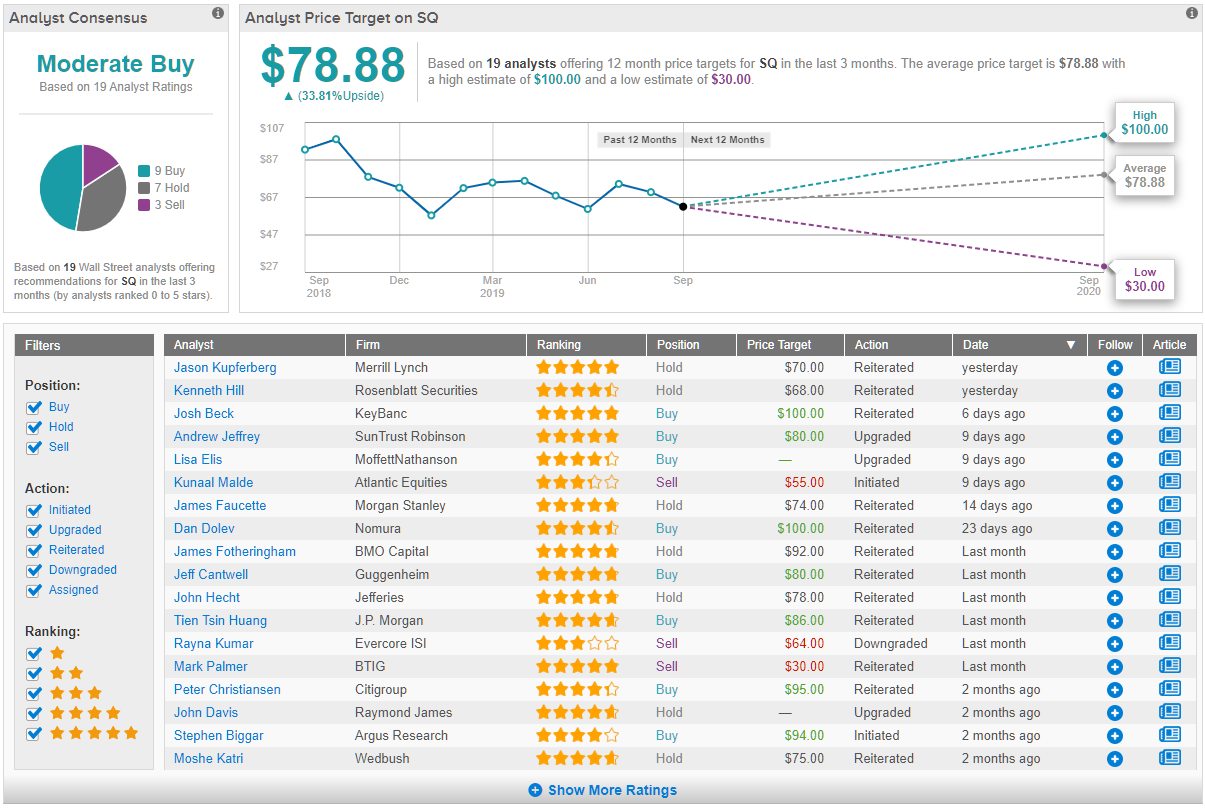

All in all, though some analysts are concerned about the short-term, Wall Street is generally bullish on Square stock. TipRanks analysis of 19 analyst ratings shows a consensus Moderate Buy, with nine analysts recommending Buy, six saying Hold and three suggesting Sell. The average price target of $78.88 represents a 34% upside from current levels. (See SQ’s price targets and analyst ratings on TipRanks)