The chances US – China trade tensions will cool down any time soon appear as likely as the coronavirus is to disappear in the near term. The recent talks of a ban on Chinese owned TikTok, along with the UK apparently bowing to Trump by cancelling its 5G arrangement with Huawei, indicate a prolonged tussle might be in the cards.

While Baird’s Colin Sebastian admits Alibaba (BABA) is not immune to the vicissitudes of an uncertain macro climate, the 5-star analyst argues “the pace of retail recovery and impressive ramp in cloud adoption,” indicates Alibaba has more upside potential over the next 12 months.

“Given China’s swift response to the initial COVID outbreak and relatively quick return to “normal,” we believe consensus estimates may not fully reflect the extent of the China retail recovery and BABA’s accelerated near-term market share gains. While growth in the quarter was ostensibly limited by a slow start to April as China reopened the economy gradually (e.g., warehousing, transportation), the Trivium National Business Activity Index indicated the country was operating at 87% output by May 12, with further improvement continuing through June,” Sebastian said.

There is more positive data to support the Baird analyst’s sentiment. According to the Chinese National Bureau of Statistics (NBS), although total retail sales dropped in June by 1.8% year-over-year, this was an improvement on May’s figures, which were down by 2.8% compared to the same period last year. Within retail, e-commerce sales grew considerably; In Q2 online retail was up by 14.3%, indicating 21.5% year-over-year growth compared to the 5.9% year-over-year increase exhibited in Q1.

No doubt this is all good news for the world’s largest online commerce business, as Alibaba accounts for more than 58% of all retail e-commerce market share in China.

Q2 has provided other highlights for Alibaba, including record sales from its 6.18 Mid-Year Shopping Festival.

Furthermore, in April the company announced a 3-year plan to invest ¥200B (roughly $28B) in its cloud business, indicating to Sebastian, that it “reflects Alibaba’s ongoing focus on driving market share gains in lieu of segment profitability.”

“Given the likely acceleration of cloud adoption globally as a result of COVID,” Sebastian concluded, “We expect the company will continue to invest aggressively in new product innovations, especially as domestic competitors such as Tencent continue to ramp their enterprise cloud ambitions.”

All this leads Sebastian to reiterate an Outperform (i.e. Buy) rating on BABA along with a $275 price target. Investors could be taking a home an 8% uptick, should the figure be met over the next months. (To watch Sebastian’s track record, click here)

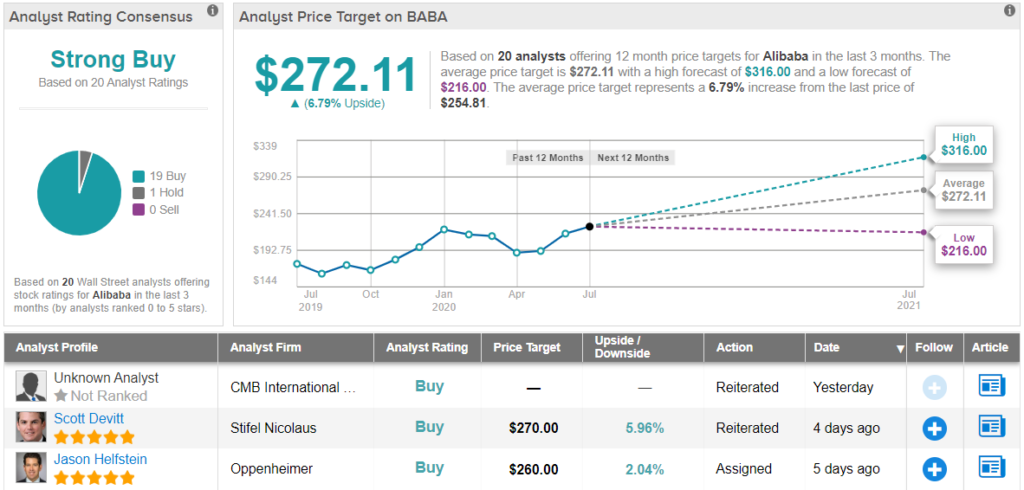

Sebastian’s colleagues are no less enthusiastic. 1 Hold rating is soundly trounced by 18 Buys and results in a Strong Buy consensus rating. At $272.11, the average price target implies shares will add nearly 7% of brawn in the year ahead. (See BABA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.