Ocugen (OCGN) is a latecomer to the coronavirus stock party. But in true latecomer fashion, it has made a dazzling entrance. Shares are up year-to-date by 544%, as investors have cheered on the biotech firm’s endeavor to bring to the U.S. market another Covid-19 vaccine.

It’s a risky proposition, especially considering the rollout has been gathering pace, and there are now three authorized vaccines and another most likely on the way. Is there still room for one whose development is still some distance behind?

H.C. Wainwright’s Swayampakula Ramakanth seems to think so.

Ocugen has a deal with India-based Bharat Biotech to bring Bharat’s Covid-19 vaccine COVAXIN to the U.S. market. The agreement stipulates Ocugen will upon itself the jobs of U.S. clinical development, getting the vaccine regulatory approval, and all U.S. commercialization aspects, for which it will get to keep 45% of any profits.

In India, the vaccine had already been granted emergency use authorization, even before interim analysis of its Phase 3 trial showed an efficacy rate of 81%. In fact, earlier this week, Prime Minister Narendra Modi was publicly given his first dose, following which, he implored all eligible Indians to take the vaccine. This currently includes everyone in the 60+ age group.

Ramakanth believes Modi’s vaccination and public announcement “represent a major vote of confidence,” and thinks COVAXIN will most probably become the “vaccine of choice in the world’s second most populous country.”

So, all good for India, but additionally, Ramakanth thinks the latest developments could also strongly impact its chances of U.S. success.

“We believe the latest news further boosts the likelihood of COVAXIN receiving approval in the US,” the 5-star analyst said.

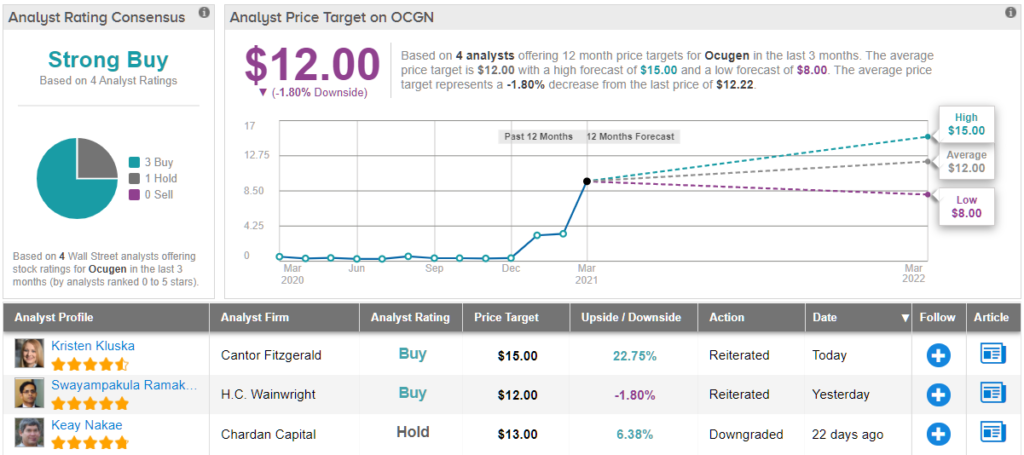

All of which results in a serious upgrade to Ramakanth’s price target; the figure moves from $4.5 to $12. However, OCGN’s latest surge means the current price is ~2% higher than the analyst’s revised target. Ramakanth’s rating remains a Buy. (To watch Ramakanth’s track record, click here)

The rest of the street is faced with a similar problem; the gains have pushed the share price far beyond the $12 average price target, which sits slightly below the stock’s current trading price. With a total of 3 Buys and 1 Hold, the analyst consensus rates Ocugen a Strong Buy. (See OCGN stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.