Unity Software ($U), a leading global platform for interactive, real-time 3D (RT3D) content creation and operation, has seen its stock rally roughly 11% in the new year despite significant losses in 2024. The recent surge is unconnected to any new fundamental news about the company, but a post by influential investor Roaring Kitty may have driven increased interest. Unity has become a dominant force within the mobile gaming industry, seizing a majority market share for game engines while expanding into PC games, consoles, and VR/AR applications. Analysts remain optimistic about Unity’s prospects, predicting growth acceleration into the second half of 2025.

Growing Market Share

Unity, the leading global platform for creating and operating interactive, real-time 3D (RT3D) content, is much more than a tool for game developers. Architects, automotive designers, and filmmakers use Unity to create interactive 2D and 3D content across various platforms, including mobiles, tablets, PCs, consoles, and augmented and virtual reality devices.

The company’s game engine, also named Unity, functions as a comprehensive operating interface for video games. In the past, major game studios often created their own graphics engines, but Unity exploited a gap in the market, helping smaller developers create and monetize simpler, mobile-targeted games. This strategy enabled Unity to obtain more than a 50% market share in the mobile game engine market. The platform’s versatility lets creators build a game for one platform, like a PC, and easily transfer it to mobile or consoles.

In 2020, Unity perfectly positioned itself to benefit from the growing gaming market, with people spending more time at home due to the pandemic. Developers invested heavily in new game projects, particularly in the casual market, which attracted diverse demographic groups into the gaming world. While this has led to significant growth in revenue, the company has yet to see profitability.

In a recent development, investing influencer Roaring Kitty posted a cryptic clip featuring the late musician Rick James, who had a song called “Unity,” which sparked (most probably) an immediate surge of 11% in the company’s stock. As mentioned above, the reason behind the post is like the post itself – cryptic.

Mixed Recent Financial Results

Unity recently unveiled its third-quarter financial results, posting revenues of $446.52 million, surpassing analysts’ expectations by $18.32 million. However, this marks an 18% decrease from the previous year. The revenue from ‘Create Solutions,’ a branch of Unity’s strategic portfolio, experienced a 5% year-over-year increase to $132 million, driven by a 12% subscription revenue boost due to higher renewal and upgrade pricing. This contrasted with the ‘Grow Solutions’ revenue, which dropped by 5% to $298 million from the previous year.

Despite these mixed results, Unity’s adjusted EBITDA came in at $92 million, exceeding the guidance range of $75 to $80 million. On the downside, Unity reported a net loss of $125 million, identical to Q3 2023’s loss and slightly less than the preceding quarter’s loss of $126 million. The company’s earnings per share (EPS) was $0.22, which was above consensus projections by $0.08.

Looking ahead, Unity’s management has projected fourth-quarter strategic portfolio revenue to fall between $422 and $427 million, with total company adjusted EBITDA estimated between $79 and $84 million. The company has revised its full-year outlook and expects revenue of around $1.7 billion, up from the previous estimate of $1.685 billion. Adjusted EBITDA predictions have also been lifted to $363-$368 million, from the previously estimated range of $340 to $350 million.

Positive Price Momentum

The stock has been trending downward over the past year, shedding -38% of its value in that time. It trades near the middle of its 52-week price range of $13.90 – $39.29 and demonstrates positive price momentum as it trades above major moving averages. It trades at a premium with a P/S ratio of 4.75x compared to the Information Technology sector average of 3.36x.

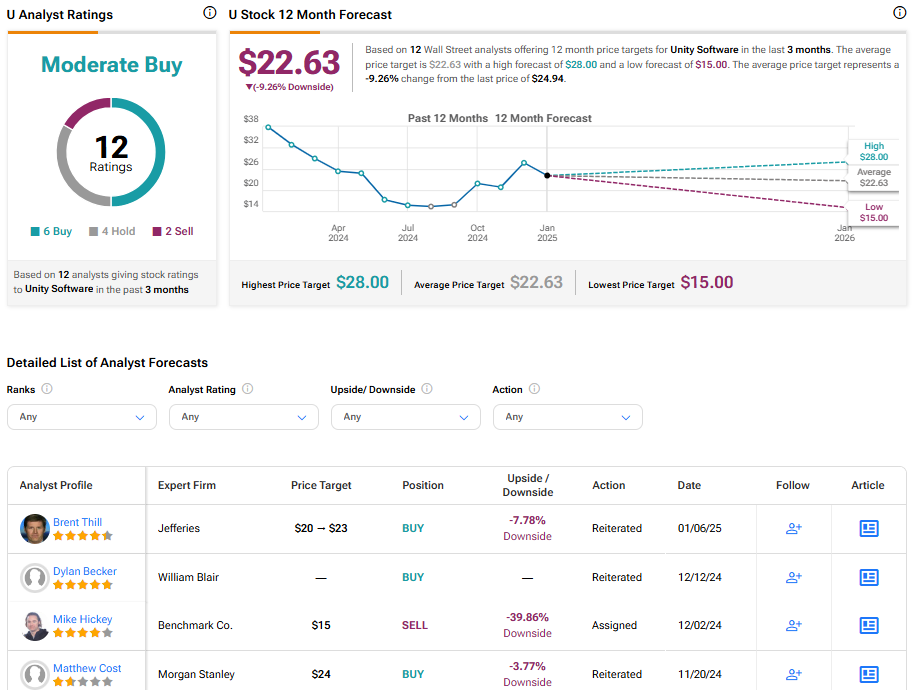

Analysts following the company have mainly had a cautiously optimistic outlook on U stock. For example, Jefferies analyst Brent Thill, a four-star analyst according to Tipranks’ ratings, recently raised the price target to $23 (from $20) while keeping a Buy rating on the shares, noting expectations of a seasonally challenging Q1 but acceleration in the second half of 2025, potentially delivering positive revisions on conservative guidance.

Unity Software is rated a Moderate Buy overall, based on the recent recommendations of 12 analysts. Their average price target for U stock is $22.63, which represents a potential downside of -9.26% from current levels.

Bottom Line on Unity

Unity Software has made notable strides, becoming a leading force in the mobile gaming industry, capturing the majority of market share in game engines, and extending its reach into PC games, consoles, and VR/AR applications. Despite mixed financial results indicative of a challenging economic landscape, the company’s growth is predicted to accelerate into the second half of 2025. Looking past the recent stock volatility and shifts in market valuation, Unity’s position remains relatively optimistic making it potentially appealing to investors willing to be patient.