The market can be a brutal place — just ask SAP (SAP). The German software giant’s share price nosedived by 27% this week, its sharpest drop in 12 years, after COVID-19 impacted Q3 results and inflicted cuts on the firm’s full year guidance.

SAP reported Q3 revenue of €6.54 billion, missing the estimates by €310 million and indicating a year-over-year drop of 4%. One-time benefits boosted the bottom line as Non-GAAP EPS of €1.70 beat the forecasts by €0.40.

Optimism was provided by the pure-cloud category, with revenue increasing by 11% to €1.98 billion. However, most results missed across the board, and operating profit declined by 12%. Looking ahead, SAP toned down its full-year revenue guidance to $32.5 billion, 2% below the company’s previous estimate.

RBC analyst Alex Zukin believes SAP’s focus on transitioning to the Cloud “means lower margin targets over the next few years.” However, the analyst believes that in the long run, the efforts “could result in a more robust model.”

Expounding on this, the 5-star analyst said, “After a better than expected 2Q, SAP assumed continued recovery. With COVID continuing to weigh heavily, that didn’t materialize, particularly at quarter end. With customers telling management they are looking to accelerate their Cloud moves, SAP chose to double down now. A key part of this will be the coming announcement of a simplified bundled commercial package; The result is likely a mix shift away from high margin license and maintenance to subscription, reducing midterm revenue expectations, and 2023 operating margin ambitions by 4-5pp, but could be a growth catalyst down the road.”

All in all, Zukin reiterated a Market Perform (i.e. Hold) on the shares yet reduced the price target significantly from $162 to $110. The new figure implies shares will stay range-bound for the foreseeable future. (To watch Zukin’s track record, click here)

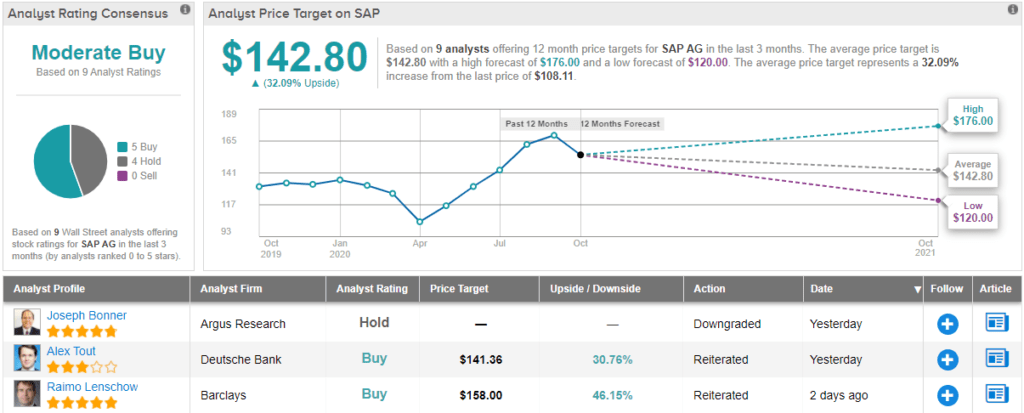

SAP’s analyst ratings are a mixed bag. Based on 5 Buys and 4 Holds, the stock qualifies with a Moderate Buy consensus rating. Following the sharp decline, the $142.80 average price target suggests possible upside of 32% in the year ahead. (See SAP stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.