A little gesture can go a long way is a sentiment investors of Snap Inc. (SNAP) can relate to this week. On Friday, the multimedia messaging app received an upgrade from Perform to Outperform by a prominent Wall Street analyst, instigating an uptick in the face-changing app’s share price. Although the 4.4% gain is a small drop in the ocean of massive gains year-to-date, the upgrade is indicative of current sentiment about the mobile app’s prospects.

The upgrade is from JMP Securities’ Ronald Josey, and comes alongside a price target of $20, conveying the analyst’s belief in Snap’s ability to add 31% to its share price in the coming year. (To watch Josey’s track record, click here)

The move on the 5-star analyst’s part is an interesting one, since Snap has already significantly outperformed the market in 2019. Whereas the talk has been of the S&P 500’s fantastic 28% gain so far this year, the social networking company’s stock has soared by 178% year-to-date. To the casual observer, then, it might seem that after such a sustained run, the analyst is throwing caution to the wind.

Not so, according to Josey, who said, “We are incrementally confident in Snap’s ability to grow its user base, increase engagement given newer products and services, and improve overall monetization as the service attracts more advertisers and share of ad budgets.”

The surge has, naturally, not materialized out of thin air, and is backed up by some very positive figures. Among the array of impressive numbers posted this year, were latest earning beats, with revenue, EBITDA and DAUs (daily active users) besting the Street’s estimates. During Q3, SNAP reported revenue growth that accelerated for the third quarter in a row, record gross margins, smallest EBITDA loss to date, and double-digit DAU growth, which all factored into the company’s rise.

According to Josey, 90% of Americans aged 13 to 24 are Snapchat users, an age group with strong appeal to advertisers. As traditional advertising methods no longer extend their reach to young consumers, the platform is therefore highly valuable to ad makers.

Josey added, “Importantly, we believe that the organization is now more stable than it was when entering 2019, and as we look into 2020, we believe Snap is well positioned to continue to add DAUs and close the monetization gap with other major social networks as its sales force reorg is now behind it and the company launches new and innovative advertising products.”

Josey is not alone in thinking the social app’s rise has yet to run its course. Loop Capital’s Alan Gould recently upgraded his rating, too, from Hold to Buy, while also raising his price target from $15 to $20. He cites the app’s “continued under-monetization relative to its peers” and a belief that following renewed user engagement, Snap’s ad revenue growth will further outperform the industry in 2020, as reasons to be confident in its continued success. (To watch Gould’s track record, click here)

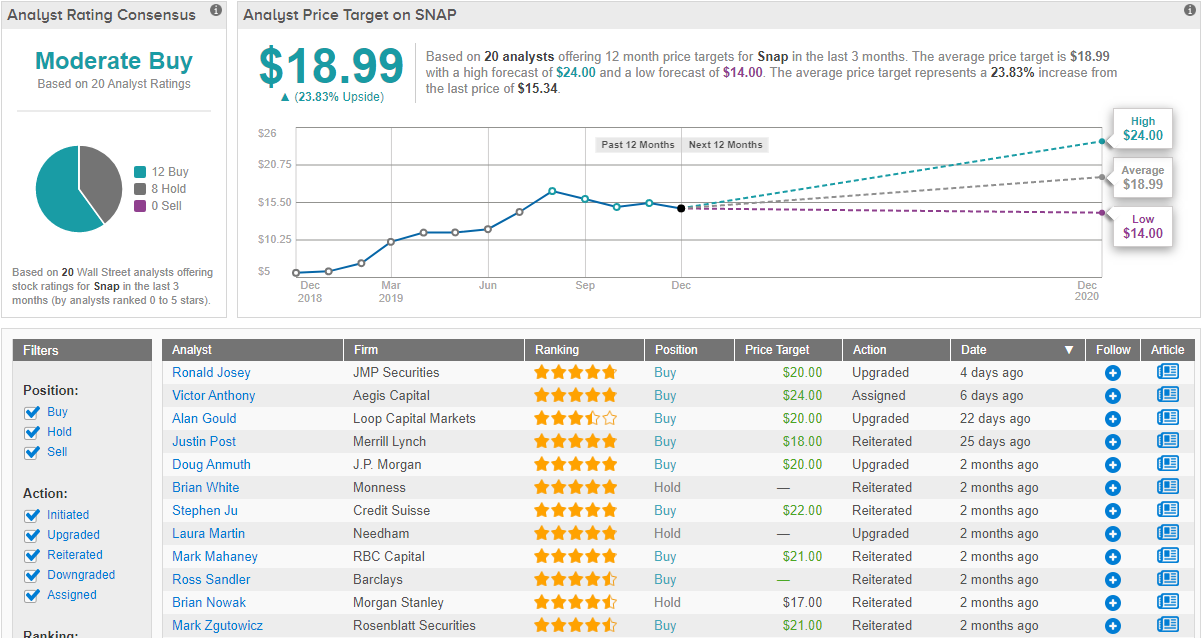

Amongst the rest of the Street, Snap’s breakdown of 12 Buys and 8 Holds mark the social photo app as a Moderate Buy. The average price target is similar to Josey’s and Gould’s, coming in at $18.99, and indicating upside potential of 24%. (See SNAP stock analysis on TipRanks)