Beyond Meat (BYND) has had a beyond bad few weeks in the market, down by roughly 50% from its trading price at the start of October. The dump came following its Q3 report which was released just prior to the expiry of its lockup period – the moment when pre-IPO investors are permitted to finally sell their shares.

Ironically, the horror show comes off the back of an earnings report which exceeded expectations. But it seems this wasn’t enough to reassure investors from stampeding to the exit doors, with several explanations in place for the selloff. Among those is the simple reason — the stock price had shot up over 700% from its initial IPO price of $25, peaking at $239.71 in July. Even with the steep downturn, BNYD stock is still up 17% from its May 2 launch. Another concern is the new competition entering the market. Joining the animal meat industry disruptor are other large companies who smell opportunity and are likely to take a bite out of future profits.

Subscribing to this narrative is Credit Suisse’s Robert Moskow, who said, “We don’t see anything stopping Beyond from reaching $1.0 billion in sales in the near-term. But Impossible Burger’s entrance into retail stores, Nestle’s entrance into the category, and the likelihood of greater private label availability makes the path to $2.0B+ a bit more complicated in our view.”

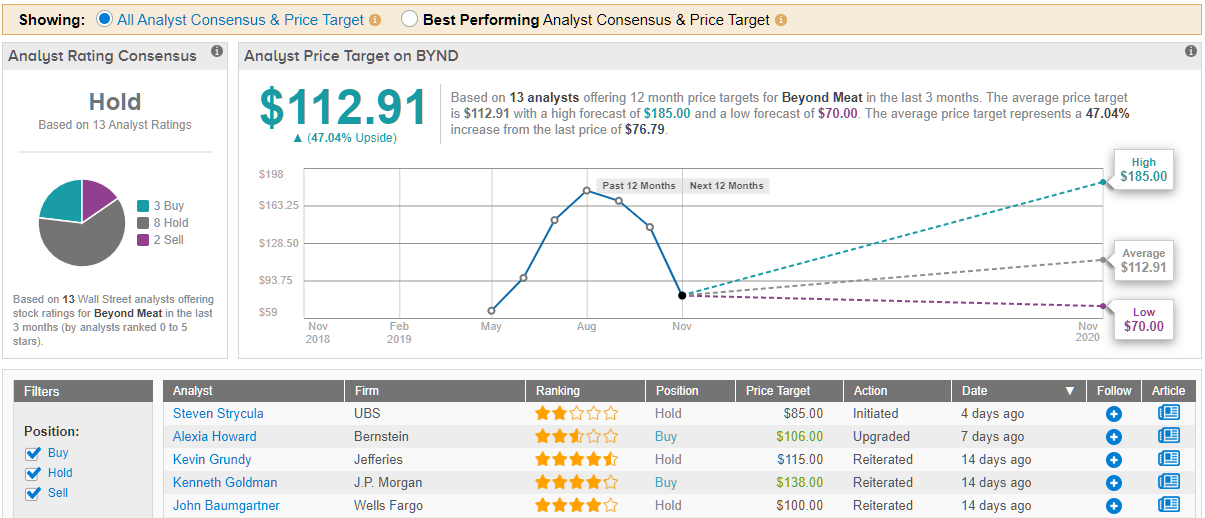

Moskow reiterated a “hold” rating on BYND stock, but his $115 price target still implies about 50% from its current price. (To watch Moskow’s track record, click here)

Barclays’ 4-star analyst Benjamin Theurer is rather more bullish, noting, “We see BYND as a well positioned company with the potential to capture a significant share of a market that could represent up to 10% of the global meat industry. We are considering BYND’s pace of growth, the improvement of its products and the relevant market potential, and we forecast BYND to deliver both solid top-line and earnings growth.” Theurer sees BYND’s price at $185, or 140% premium to today’s closing price.

Another bull that hasn’t lost faith in BYND is 4-star J.P. Morgan analyst Kenneth Goldman: “We believe in the BYND story and think the shares are undervalued, we think it is prudent to model steady growth in the out-years rather than an acceleration […] Importantly, we remain confident about Beyond’s near- and medium-term potential, and we think guidance for 4Q19 is conservative. For investors seeking beat-and-raise stories, we still favor this name.” Goldman rates the stock an Overweight along with $138 price target.

All in all, the market’s current view on BYND is a mixed bag, indicating uncertainty as to its prospects. The stock has a Hold analyst consensus rating with only 3 recent “buy” ratings. This is versus 8 “hold” and 2 “sell” ratings. However, the $112.91 price target suggests an upside potential of nearly 50% from the current share price. (See Beyond Meat stock analysis on TipRanks)