ETFs (exchange-traded funds) offer a diversified way to invest in several securities, such as stocks, bonds, or commodities. They often have lower expense ratios compared to traditional mutual funds, making them a cost-effective way to invest. Also, since ETFs trade on stock exchanges, they provide investors with greater liquidity and flexibility. Today, we have shortlisted two ETFs – iShares Russell 2000 Value ETF ($IWN) and iShares Core MSCI Europe ETF ($IEUR) – with more than 10% upside potential projected by analysts over the next twelve months.

Let’s take a deeper look at these two ETFs.

iShares Russell 2000 Value ETF

The IWN ETF tracks the performance of the Russell 2000 Value Index. This index is composed of small-cap U.S. stocks with low price-to-book ratios, low price-to-earnings ratios, and high dividend yields.

IWN has $12.7 million in assets under management (AUM), with the top 10 holdings contributing 5.2% of the portfolio. Importantly, it has a low expense ratio of 0.24%. The IWN ETF has returned 16.1% in the past six months.

Overall, the IWN ETF has a Moderate Buy consensus rating. Of the 1,428 stocks held, 862 have Buys, 516 have a Hold rating, and 50 have a Sell rating. At $201.38, the average IWN ETF price target implies a 13.9% upside potential.

iShares Core MSCI Europe ETF

The IEUR ETF provides investors exposure to a diverse range of European stocks. It tracks the MSCI Europe Index, which includes large, mid, and small-cap stocks from 15 developed European countries.

The IEUR ETF has $4.5 billion in AUM and an expense ratio of 0.11%. Its top 10 holdings contribute 18.92% of the portfolio. Over the past three months, IEUR ETF has generated a return of 0.27%.

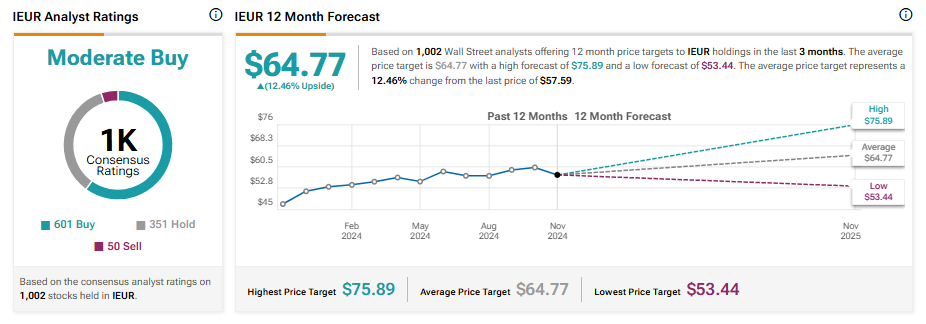

On TipRanks, IEUR has a Moderate Buy consensus rating based on 601 Buys, 351 Holds, and 50 Sells assigned in the last three months. At $64.77, the average IEUR ETF price target implies a 12.46% upside potential.

Concluding Thoughts

ETFs are a low-cost, diversified, and transparent way to participate in the market. Investors looking for potential ETF recommendations could consider IWN and IEUR due to the upside potential expected by analysts.