J. C. Penney Company, Inc. (JCP) announced Tuesday that it will furlough the majority of its 95,000 employees on April 2, as its stores and offices will remain closed due to the coronavirus pandemic.

In addition, the U.S. apparel and home retailer listed a number of measures it is taking to improve its cash position and financial flexibility, including deferring capital expenditure, using funds from its revolving credit line, hiring freeze, cutting spending, reducing receipts, and extending goods and services payment terms. It is also suspending its 2020 merit increases.

“We remain optimistic about J. C. Penney’s ability to weather this pandemic,” said Jill Soltau, chief executive officer of J. C. Penney. “We also believe these short-term solutions will have a long-term benefit.”

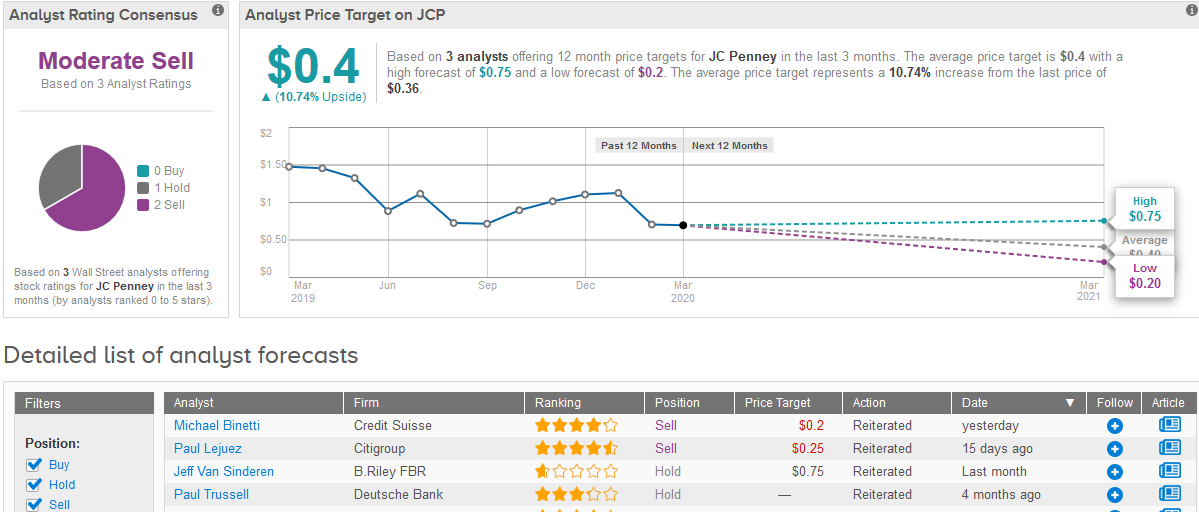

Wall Street analysts have a Moderate Sell consensus rating on the stock based on 2 Sells and 1 Hold. Should the $0.4 average price target be met, investors could be looking to gain about 11% in the coming 12 months. (See J.C. Penney stock analysis on TipRanks)

J. C. Penney said furloughed workers enrolled in its benefits program will continue to receive health benefits. In addition, the company plans to cover 100% of employee-paid premiums. Many employees are also eligible to receive state unemployment benefits, which were recently increased with the passage of the federal stimulus bill, the company said.

The company’s eCommerce distribution centers and online business operations will remain open. J. C. Penney operates 850 stores across the United States and Puerto Rico.

Related News:

Goldman Sachs: 3 “Strong Buy” Stocks to Snap Up Now

3 Penny Stocks With Triple-Digit Upside Potential

Don’t Buy Roku Stock, Says Analyst; The ‘Coming Recession’ Is a Risk