Digitization of the world we live in has disrupted the healthcare industry, giving rise to the healthcare information technology (IT) segment of the market. The emergence of this space and the technology it offers has transformed the way healthcare providers and organizations care for patients. Not to mention efficiency has improved dramatically. Demand for these digital solutions isn’t expected to slow anytime soon, with Grand View Research predicting that the digital healthcare market will expand at a CAGR of 27%, reaching $509.2 billion by 2025.

Bearing this in mind, investing firm J.P. Morgan took a look at several healthcare IT names ahead of their upcoming fourth quarter earnings releases.

“Sentiment on the group has been largely favorable, with the group up 12% since Q3 earnings in November vs the remaining Healthcare Technology & Distribution group up 14% and the SPX 8%-plus,” analyst Anne Samuel commented.

In the report, the firm highlights two tickers in particular that it believes can not only deliver solid prints, but also reward investors through 2020 and beyond. After using TipRanks’ Stock Screener tool, we found out each boasts a “Strong Buy” consensus rating from the Street, and has a substantial upside potential from the current share price. We’re talking more than 50% here.

Health Catalyst Inc. (HCAT)

With its cloud-based data platform, Health Catalyst offers data and analytics solutions to healthcare organizations. As the company gears up for its February 27 earnings release, J.P. Morgan has high hopes.

The investment banking firm’s analyst, Anne Samuel, notes that she will be focused on how many new Data Operating System (DOS) clients were added during the year as well as dollar-based retention. Additionally, Samuel highlights the fact that the company thinks the Medicity conversion opportunity is approaching an inflection point in 2020 given that this past summer, cross-sell conversations kicked off.

Based on Samuel’s estimates, the analyst expects net new customers for 2019 to land at 14, which would reflect 28% year-over-year customer growth. In terms of 2020 guidance, she is forecasting 18 net new DOS subscription customers and 7% same-store growth, amounting to 25% DOS subscription revenue growth. However, thanks to Medicity drag, the total revenue gain is expected to come in at 22%. As a result, this brings the 2020 revenue prediction to $186 million, which falls in line with the consensus.

While Samuel does point out that HCAT operates in a highly competitive environment and that there could be an expense shift of $200,00 from Q3 into Q4, her bullish thesis remains very much intact. “We see significant white space in an $8 billion TAM, with over 20% revenue growth driven by mid-teens annual customer wins. We estimate the company reaches EBTIDA profitability in the next four years as a maturing customer base drives incremental leverage. The model is predictable with over 90% recurring revenue, 107% net dollar-based retention, and a sticky customer base, never having lost an all-access customer,” the analyst explained.

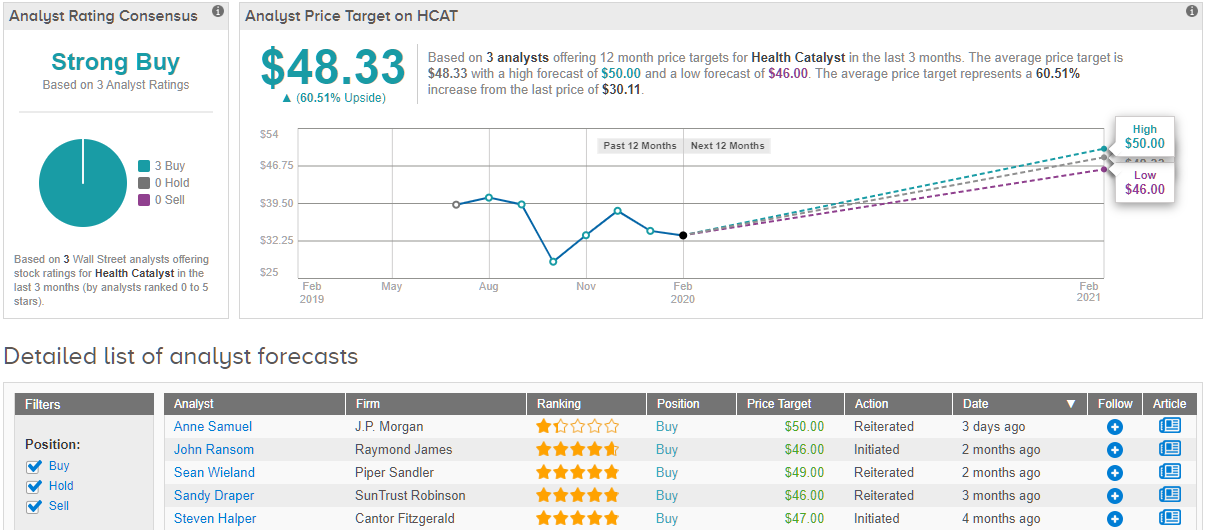

Taking all of this into consideration, Samuel maintained both her Overweight call and $50 price target. Should this target be met, shares could be in for a twelve-month gain of 66%. (To watch Samuel’s track record, click here)

Overall, it has been relatively quiet when it comes to other analyst activity. In the last three months, only 3 analysts have issued ratings. However, as they were all Buys, the word on the Street is that HCAT is a Strong Buy. Based on the $48.33 average price target, shares could climb 60% higher in the next twelve months. (See Health Catalyst stock analysis on TipRanks)

Livongo Health Inc. (LVGO)

Moving on to the firm’s next pick, we come across Livongo Health. For patients battling chronic health conditions, its digital health platform makes it easy to access personalized digital guidance and health coaching through a smart connected device. While the healthcare name has experienced significant volatility, the firm remains optimistic.

Ahead of its Q4 earnings release on March 2, Samuel, who also covers this stock, wrote that LVGO already “blessed Street numbers on its Q3 call for $276 million equating to 63% year-over-year growth.” She added, “Looking at the economic value added (EVA) that they reported in Q3, a 40% conversion rate on $208 million year-to-date EVA would equate to a 70% revenue growth run rate on our math.”

When the results are announced, Samuel anticipates that the Street will be paying close attention to 2020 guidance and the sustainability of rapid growth, noting that management stated 2020 will be an “investment year”. On top of this, the analyst is hoping for an update on enrollment, pipeline for new growth and any changes in the competitive landscape.

In terms of the fourth quarter figures, Samuel is calling for revenue of $49.4 million and an EBITDA loss of $5.5 million, both of which would land within the guided range. For 2020, the analyst expects the company to guide for $281 million in revenue, a 66% increase if achieved, gross profit margins of 72% and a fiscal 2020 EBITDA loss of $25 million.

Despite the EBITDA figure being in the red, Samuel believes LVGO will be able to reach operating income profitability in 2021. Additionally, the analyst argued, “The company is minimally penetrated in a vast and growing chronic disease market, as more than half of the U.S. population has one or more chronic conditions and an additional 4,000 Americans are diagnosed with diabetes each day. LVGO’s rapid growth profile is attractive, and unique in Healthcare IT with our model calling for an 85% revenue CAGR over the next 3 years as the company increases its member base.”

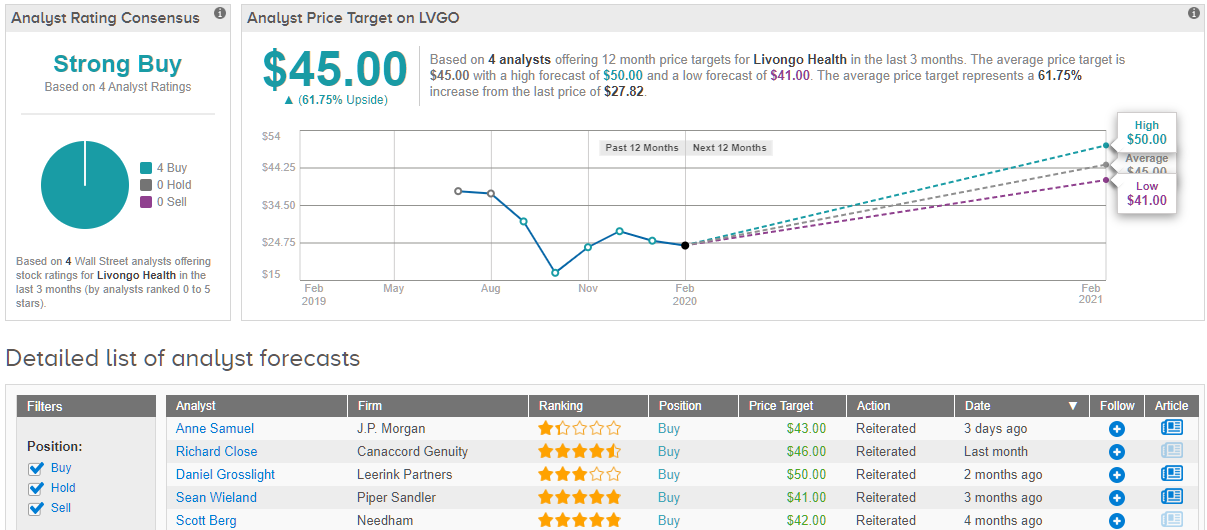

In line with her optimistic take, Samuel kept an Overweight rating and price target of $43 on the stock. This target conveys her confidence in LVGO’s ability to climb 55% higher in the next twelve months.

What does the rest of the Street think about LVGO? As it turns out, other analysts are on the same page. With 100% Street support, the message is clear: the stock is a Strong Buy. Not to mention the $45.67 average price target implies 64% upside potential. (See Livongo stock analysis on TipRanks)