Markets remain volatile as 2023 gets into full swing, with a strong two-week gain followed by several days of losses. The headwinds remain the obvious: inflation, though moderating, remains high, and the Federal Reserve remains committed to battling the surge in prices, even at risk of a recession. On the other hand, stocks found support from a general improvement in sentiment, as investors believe that the downward trend in inflation rates may be here to stay.

So the market landscape presents something of a maze, a combination of solid ground and pitfalls. So how do you find the next hot stock to buy in this environment? One way might be to screen for stocks that have been endorsed by analysts at major investment banks in particular, such as Wall Street banking giant J.P. Morgan.

The firm’s stock analysts have picked up two stocks they see as winners for the coming year – and winners with considerable upside, on the order of 40% or better. After running the tickers through TipRanks’ database, it’s clear the rest of the Street is in agreement, with each earning a “Strong Buy” consensus rating. Let’s check the details.

Cinemark Holdings, Inc. (CNK)

First up is Cinemark Holdings, one of the world’s largest movie theater companies. Cinemark’s brands include Century, Tinseltown, and Rave, and the company has a total of 5,835 screens operating in 517 theaters spread across 42 states in the US and 15 countries in Central and South America.

Like many entertainment-industry companies, Cinemark suffered heavy losses during the period of pandemic restrictions in 2020 and into 2021. Since the latter half of 2021, however, the company has seen a revival – governmental and public health authorities began to lift restrictions, and customers began to seek out leisure activities away from home, including at the movies. Cinemark’s revenues started rising in 2021 and hit a peak in Q2 of last year. In the last reported quarter, 3Q22, Cinemark showed a top line of $650 million. This number was up an impressive 50% year-over-year.

The revenue results were driven by a hefty increase in patron attendance. For the three months ending September 30, 2022, the company recorded 48.4 million attendees, in both the US and international markets. This was up 57.6% year-over-year. The nine-month numbers, for January to September 2022, were even more impressive: a jump from 57.5 million in 2021 to 133.5 million, for a 132% increase.

Cinemark will report its 4Q22 numbers late in February. The results should be interesting, as they will include the release of the blockbuster films ‘Black Panther: Wakanda Forever’ and ‘Avatar: The Way of Water,’ and the company’s deal with ESPN to screen the college football playoff and championship games in December-January.

Down by nearly 45% from its July highs, Cinemark stock rides the rollercoaster of investor sentiment. But the good news for shareholders is that this sentiment may take a turn for the better. JPMorgan analyst David Karnovsky is advising his clients to buy the stock, and he believes it could hit $15 within a year. For perspective, Cinemark stock closed at 10.70 yesterday, so this implies an upside of 40%. (To watch Karnovsky’s track record, click here)

“We believe the risk/reward is more favorable to take a positive view on the stock. The sell-off we note was largely driven by the performance of Avatar: The Way of Water, which released on Dec 16th; while the opening weekend underperformed our expectation, the film has since demonstrated strong legs and is likely to end up in the top ten highest domestic grossing movies of all time. The upshot is that we think the market has drawn the wrong read-through to broader moviegoing, instead of seeing the sequel as another proof point for resilient demand, especially amid a softening economy,” Karnovsky explained.

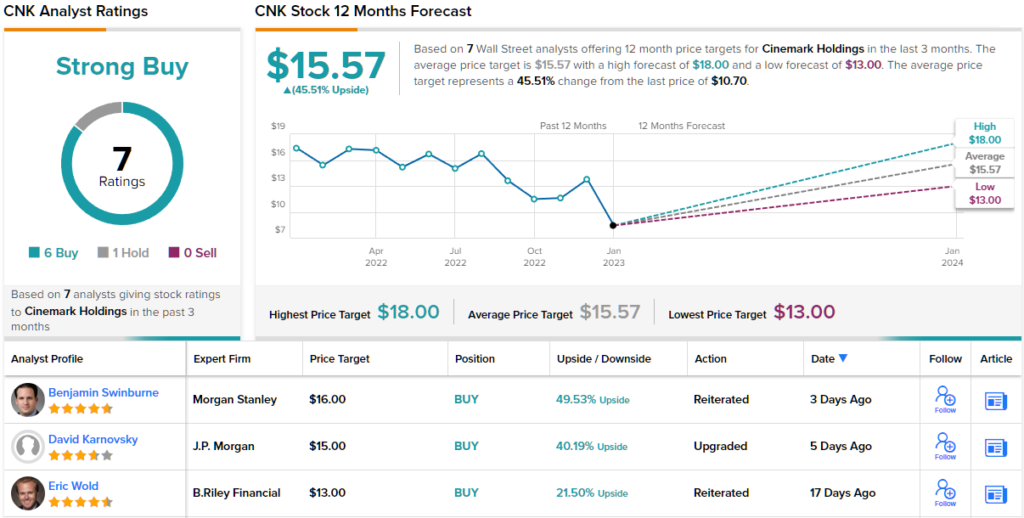

With 7 recent analyst reviews on record, including 6 Buys and just 1 Hold (i.e. Neutral), CNK shares have earned their Strong Buy consensus rating. The stock is selling for $10.70, and its $15.57 average price target implies a one-year gain of ~45% from that level. (See CNK stock forecast)

Copa Holdings, S.A. (CPA)

From movies, we’ll shift focus to airlines – specifically, to one of Latin America’s major carriers, Copa Holdings. Copa is a parent company, operating through two subsidiary airlines: Copa Airlines, the larger carrier, is based in Panama and serves destinations in the Caribbean, northern South America, and into North America, while Copa Colombia is a domestic carrier in its namesake country, with routes into cities in northern South America and to the Copa Airlines hub in Panama. A third subsidiary, Wingo, is a low-cost regional carrier. The holding company is based in Colombia.

In the last reported quarter, 3Q22, Copa had a top line of $809.4 million. Acknowledging that COVID restrictions had badly distorted the data for 2020 and 2021, the company provided comparative information for 2019, the last pre-pandemic year. The 3Q22 revenues were up 14.3% compared to 3Q19. Quarterly net income, at $115.9 million, was also up, by 11.4% compared to the pre-pandemic 3Q19. Copa also reported a solid cash holding, of $1.1 billion. This total was equivalent to 42% of the total revenues from the previous 12 months.

Copa Holdings also releases monthly traffic statistics from across its airlines. Turning to the most recent stats, Copa showed gains in December, with available seat miles (a measure of total seating capacity) increasing 7.7% from 2019 levels, and revenue passenger miles (measuring paying passenger traffic) was up 6.1% from 2019.

In his coverage of this stock for JPMorgan, analyst Guilherme Mendes lays out a set of compelling reasons to buy into Copa now. He writes, “In our view Copa offers an interesting combination of: (i) Discounted valuation, currently trading at a 25% discount to its historical EV/EBITDA average; and (ii) a relatively comfortable balance sheet situation, with leverage expected to end 2023 at only 1.8x net debt to EBITDA, the lowest among LatAm carriers. Added to that, Copa’s immediate liquidity over short-term payables is the best among the cluster. Our 2023 EBITDA is 2% above consensus estimates.”

To this end, Mendes gives the shares an Overweight (i.e. Buy) rating, and a price target of $132, implying that a gain of ~44% lies ahead for the shares.

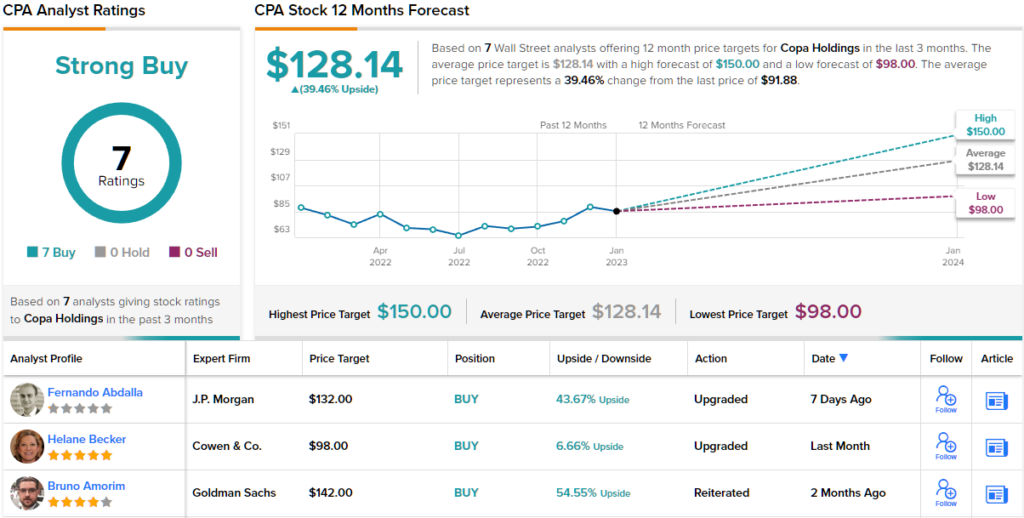

Overall, it’s clear that Wall Street generally agrees with the bulls here; the stock has 7 recent reviews and they are all positive, for a unanimous Strong Buy consensus rating. Shares in CPA are priced at $91.88 and their $128.14 average price target implies ~40% gain on the one-year horizon. (See CPA stock forecast)

Subscribe today to the Smart Investor newsletter and never miss a Top Analyst Pick again.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.