Stock markets saw spectacular drop yesterday, as rising hospitalizations in states such as Texas and Arizona promoted fears that an uptick in coronavirus cases could cause more economic damage. It’s a clear sign that traders are not going to be easily reassured in the current crisis.

Yet, according to J.P. Morgan strategist Nikolaos Panigirtzoglou there’s a light at the end of the tunnel. Panigirtzoglou argues that the massive amount of cash currently in the financial system could be the spark that pushes risk assets higher, noting that billions could be pumped into equities. This potential, however, could come at the expense of bonds as portfolios are rebalanced.

To support this stance, the strategist cited the fact that $1.2 trillion have been put into money-market funds, with fund managers holding on to cash, $591 billion overall, like never before, based on data reported by Bank of America. This means that investors can still prop up the market even during a tumultuous period of time.

“Investors are still underweight equities and signs of overextension are confined to momentum traders. There is still plenty of room for investors to raise their equity allocations,” Panigirtzoglou wrote.

Bearing this in mind, we wanted to take a closer look at two stocks that just received a thumbs up from J.P. Morgan. With the firm’s analysts projecting more than 25% upside potential for each, we ran the tickers through TipRanks’ database to get the rest of the Street’s take. As it turns out, both have been praised by other analysts.

Viavi Solutions (VIAV)

Offering intuitive instruments, systems and technologies, Viavi Solutions helps service providers and IT organizations manage the network lifecycle for complex 5G and Fiber networks. Given the progress related to its field work and its compelling valuation, J.P. Morgan is jumping on board.

Representing the firm, analyst Samik Chatterjee tells clients the field instruments segment was hit hard by COVID-19. “VIAV on its latest earnings call highlighted that within the revenue shortfall in the NSE group, the portion attributable to lower demand in C1Q largely related to field instruments, which remains largely a book & ship business for every quarter… Production equipment has seen modest headwinds, more specific to end-markets with severe challenges, but have still been more resilient relative to Field instruments, which are impacted by the absence of technicians in the field,” he commented.

Having said that, Chatterjee argues that the easing of social distancing measures and outdoor field work restrictions will allow demand for test and measurement equipment to recover in the near-term. This is essential for VIAV as field instruments make up 60% of its core NE revenue. Long-term, the demand should remain largely unimpacted. He also pointed out, “Companies in our coverage universe are citing unchanged robust plans from service providers to drive 5G as well as 400G adoption, both of which VIAV has leverage to.”

On top of this, Chatterjee believes any M&A activity could serve as a major catalyst for shares. “The test & measurement landscape remains fragmented relative to suppliers and the disruption offers an opportunity for VIAV to further consolidate its position. Recent actions to establish a $300 million short-term credit line despite ample liquidity hints to similar intent,” the analyst explained.

Should the company acquire an asset with a complementary portfolio, Opex leverage could emerge as a possible synergy. Not to mention if the asset has profits from the U.S., Chatterjee thinks it “will enable the company to accelerate usage of NOLs driving a higher valuation.”

Expounding on VIAV’s valuation, the analyst stated, “Additionally, with VIAV shares now trading at ~18x NTM EPS, i.e., below recent year P/E of ~20x, unlike most companies in the coverage universe that are trading at premiums to their recent year valuation multiples on account of credit for trough earnings during the pandemic, we see an attractive opportunity for investors to position themselves for upside.”

Based on all of the above, Chatterjee upgraded his rating from Neutral to Overweight, and bumped up the price target from $14 to $16. This target implies shares could climb 25% higher in the next twelve months. (To watch Chatterjee’s track record, click here)

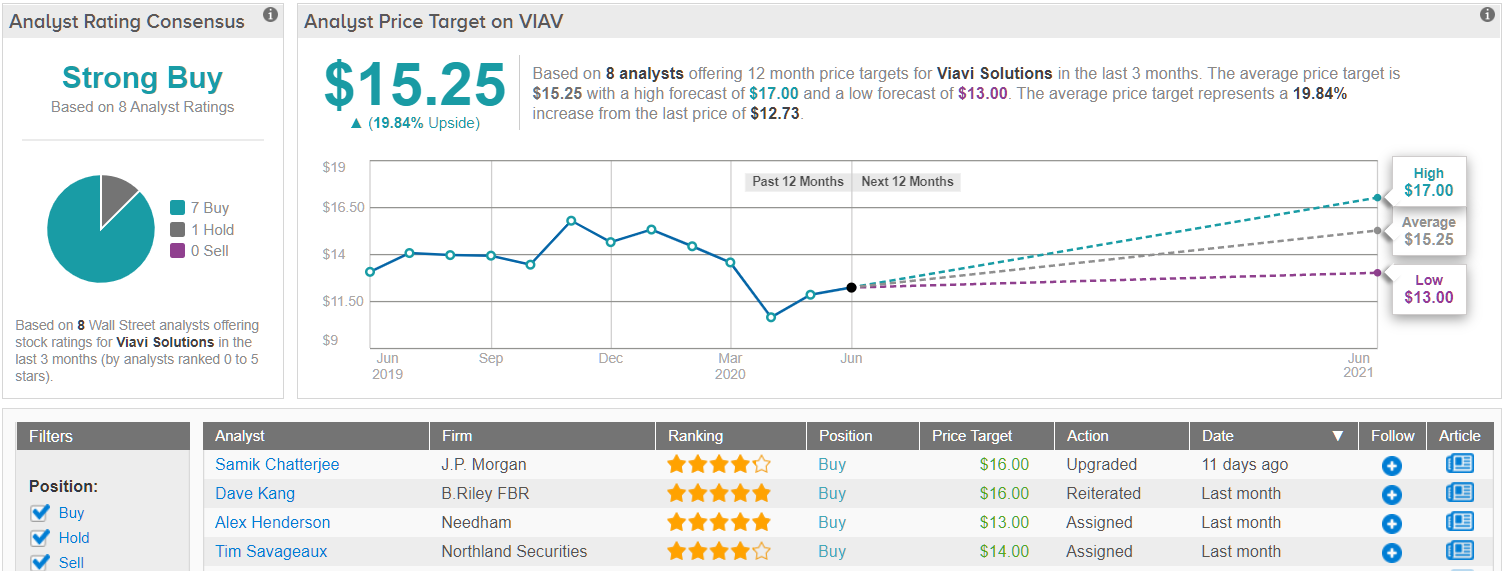

Like Chatterjee, most other analysts also take a bullish approach. VIAV’s Strong Buy consensus rating breaks down into 7 Buys and 1 Hold. Given the $15.25 average price target, the upside potential lands at 20%. (See Viavi stock analysis on TipRanks)

Stratasys (SSYS)

As for J.P. Morgan’s second pick, we have Stratasys, which provides 3D printing and additive solutions. With its materials and services delivering speed, innovation, performance and customization, it’s no wonder the firm handed out a ratings upgrade.

Analyst Paul Coster highlights the fact that in Q2 and Q3, SSYS is going to place a significant focus on resizing actions in order to cut operating expenses by 10% and yield $30 million in annualized run-rate savings, which should also bode well for COGS.

Weighing in on this development, Coster said, “We previously anticipated cost reductions in 2020 but not of this magnitude, so we are only taking about $15 million out of 2021 PF operating expenses, nonetheless the action – overdue, in our view – is significantly accretive for shareholders. The new CEO is delivering for shareholders.”

While Coster reduced his estimates for 2020-2021 gross margins to account for lower product volumes, it should be noted that this is his second upgrade for SSYS recently. Citing the launch of new products expected to come over the next 12-18 months, the analyst believes the company will slowly start to see growth again. “With the expense reductions that the new CEO is pushing through, a return to modest growth should deliver operating leverage, and we think the stock will appreciate on upward revisions to estimates,” he stated.

That said, it will take some time for these gains to materialize, according to Coster. With COVID-19 still impacting activity in several of SSYS’s end-markets, including autos and aerospace, lackluster Q2 revenues and near-term pressure on gross margins could be on the horizon.

This fact, however, does not offset all of the positives, in Coster’s opinion. In line with his more bullish take, the analyst gave his rating a boost, from Neutral to Overweight. The price target got a lift as well, increasing to $22 from $19. Should the target be met, a twelve-month gain of 32% could be in store. (To watch Coster’s track record, click here)

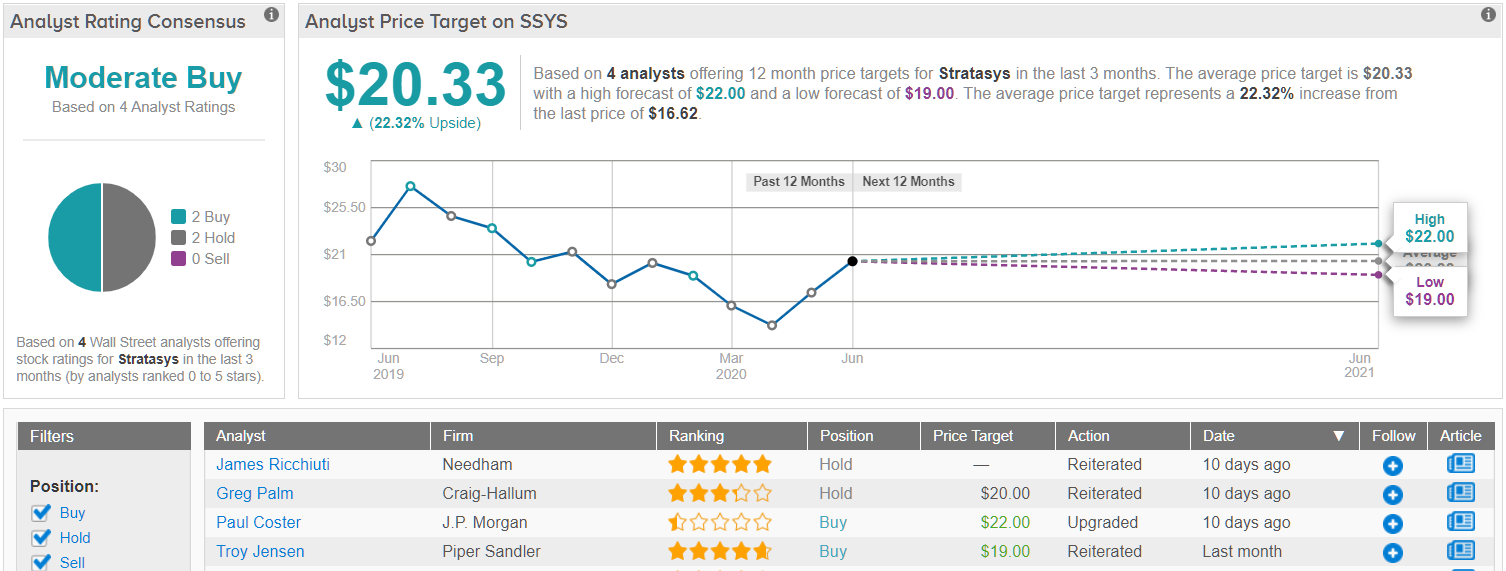

What does the rest of the Street think about SSYS? Opinions are split evenly down the middle, with the stock receiving 2 Buys and 2 Holds in the last three months. As a result, the consensus rating is a Moderate Buy. Additionally, the $20.33 average price target suggests 13% upside potential. (See Stratasys stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.