Investor sentiment has been improving, but the contrarians haven’t gone silent. Legendary British investor Jeremy Grantham is predicting hard times ahead, as he lays out his case for doom and gloom to cast a shadow on the markets.

In Grantham’s view, the pandemic stock gains were a bubble, and that bubble hasn’t fully popped yet. Putting some numbers to this view, Grantham believes that a further drop of 20% is possible this year – and in his worst-case scenario, he says that the S&P 500 could collapse as much as 50% from current levels.

Backing his view, Grantham says of that worst case, “Even the direst case of a 50% decline from here would leave us at just under 2,000 on the S&P, or about 37% cheap. To put this in perspective, it would still be a far smaller percent deviation from trendline value than the overpricing we had at the end of 2021 of over 70%. So you shouldn’t be tempted to think it absolutely cannot happen.”

So, what is an investor to do with all this doom and gloom talk? Well, it should prompt a natural turn toward defensive stocks, and especially to the high-yield dividend payers. We’ve opened up the TipRanks database to pull the details on two such equities that offer a market beating dividend yield of at least 8% and a Strong Buy rating from the analyst community. Let’s dive in.

CTO Realty Growth, Inc. (CTO)

We’ll start with a real estate investment trust (REIT), as these companies have long been known as dividend champions. CTO Realty Growth operates in nine states, including such major growth areas as Florida and Texas, and manages a portfolio of income-generating properties in the shopping mall and retail niches. Most of the company’s real estate assets are in the Southeast and Southwest regions. CTO also maintains a 15% interest in another REIT, Alpine Income Property Trust.

CTO Realty has shown some mixed trends in revenue and income over the past 12 months, which can be seen in the last quarterly report, from 3Q22. At the top line, the total revenue of $23.1 million was up 40% year-over-year, while the bottom line net income attributable to the company fell almost 80%, from $23.9 million to $4.8 million over the same period. During that time however, CTO shares have been outperforming the overall stock market; the S&P 500 is down more than 7% over the last 12 months, while CTO is up 7%.

The company will release its 4Q22 results, and its full-year 2022 results, on February 23, less than a month from now. We’ll see then how the trend lines are holding on revenues and earnings.

On the dividend front, CTO has been consistently strong. The company has been raising the quarterly common share payment gradually since the first quarter of last year. On an annualized basis, the dividend pays $1.52 per common share – and is yielding a solid 8%. This beats inflation by 1.5 points, ensuring a real rate of return. But more importantly, the company pays out reliably – it’s history of keeping up dividend payments stretches back to the 1970s.

BTIG analyst Michael Gorman, in his recent note on real estate investment trusts, revised his top pick in the niche – and named CTO Realty.

“We think CTO should be able to invest accretively in the coming quarters given its ability to monetize its free-standing properties as well as the unique access to ‘other assets’ on the balance sheet. By virtue of CTO’s $17M of subsurface interests and mitigation credits, the $46M structured investments portfolio, and the value of its common stock ownership and management agreement with Alpine Income Property Trust, we think the company has more levers for growth available relative to the majority of our REIT coverage,” Gorman opined.

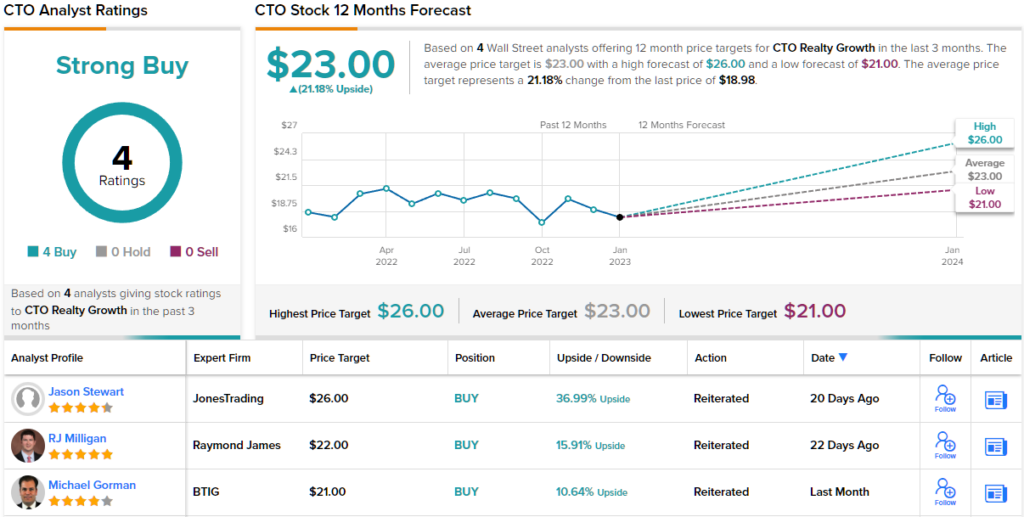

Looking ahead from here, Gorman rates CTO shares a Buy, and his price target of $21 implies a one-year upside potential of 11%. Based on the current dividend yield and the expected price appreciation, the stock has 19% potential total return profile. (To watch Gorman’s track record, click here)

What does the rest of the Street think about CTO’s long-term growth prospects? It turns out that other analysts agree with Gorman. The stock received 4 Buys in the last three months compared to no Holds or Sells, making the consensus rating a Strong Buy. (See CTO stock forecast)

Dynex Capital, Inc. (DX)

Sticking with REIT’s, well turn to the mortgage-backed security niche. Dynex Capital focuses on mortgage loans and securities, investing in these instruments on a leveraged basis. The company’s approach to portfolio development is based on several simple rules, including capital preservation, disciplined capital allocation, and stable returns on the long term.

From an investor perspective, those returns include a high-yield dividend, paid out monthly. The most recent payment was declared earlier this month for a February 1 payment at 13 cents per common share. This payment annualizes to $1.56, and gives a yield of 10.8%. The company’s history of reliable payments goes back to 2008, a clear positive for investors to consider. And with inflation still running at 6.5% annualized, the attractions of Dynex Capital’s steady, high-yield payment are clear.

Dynex’s operations brought in a total interest income of $20.4 million, as of 3Q22. This compares favorably to the previous quarter’s total of $18.3 million – although it is down significantly from the $56.1 million reported for 3Q21. Over that same time period, Dynex saw its net income to common shareholders switch from $91.4 million to a loss of $42.5 million. The net loss reflects a sharp decline in the company’s book value, which management attributed to increasing domestic interest rates combined with a difficult geopolitical situation.

However, the company’s liquidity remains solid. Supporting the dividend, the company reported a non-GAAP earnings available for distribution (EAD) of 24 cents per common share, and had cash holdings of $260.3 million.

Even though DX is facing headwinds, Credit Suisse 5-star analyst Douglas Harter recently upgraded his rating on the stock from Neutral to Outperform (i.e. Buy). Backing his bullish stance, Harter writes: “We view the stock as the most attractive among the Agency-focused mREITs to capture potential tightening of MBS spreads. This is based on a higher level of confidence in the sustainability of the dividend (lowest required yield among Agency-focused), attractive P/B valuation (87% of book compared to 97% for other Agency-focused peers), and a stronger relative track record of protecting book value in volatile period.” (To watch Harter’s track record, click here.)

Overall, this REIT has picked up 3 analyst reviews recently, and they are all positive and give the stock its unanimous Strong Buy consensus rating. (See DX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.