Worth $23 billion today, former math professor Jim Simons has become one of the most successful money managers of all time. Following his departure from the world of academia in 1978, he helped jumpstart the quant investing revolution using a data-driven approach and predictive algorithms. Armed with the skills and experience acquired as a mathematician and code breaker, Simons founded hedge fund Renaissance Technologies out of a Long Island strip mall in 1982.

Relying on an emotionless and hard data-focused strategy, his track record has surpassed that of other Wall Street greats like Steve Cohen, Ray Dalio and Warren Buffet, whose 20.5% annualized gains since 1965 pales in comparison to Simons’ 39% average return over the last 30 years. Additionally, since 1998, its Medallion Fund has seen annual returns reach 66% before fees.

Even though Simons doesn’t manage the Medallion Fund anymore, he remains a key player at Renaissance. Regardless, the man that pioneered a fundamentally different way of thinking about investing has left a lasting impact. Currently, 31% of all stock trading is done by hedge funds and other quant investors, with much of their efforts modeled after his approach.

It follows, then, that after Simons’ fund goes in on a particular name, Wall Street focus locks in. With this in mind, we used TipRanks’ Stock Screener tool to get all the data on three Buy-rated healthcare stocks Renaissance boosted its position in during the fourth quarter. Here’s what we found out.

Merck & Co., Inc. (MRK)

Throughout the last 125 years, healthcare name Merck & Co. has become one of the major players in the space. While shares have slipped in the previous six months, Simons’ fund just pulled the trigger.

According to the fund’s 13F filing, Renaissance bought 1,625,830 shares in the fourth quarter, reflecting a 41% increase. As its MRK stake now lands at 5,673,243, the total position is valued at almost $516 million.

After its recent earnings release, analysts are also optimistic when it comes to Merck’s long-term growth prospects. In terms of non-GAAP EPS, the figure came in 1 cent ahead of the consensus at $1.16. Sales, however, missed the mark at $11.9 billion, which was $85 million below the Street’s prediction. MRK also revealed that it would be spinning off the women’s health, legacy brands and biosimilars into a NewCo.

Weighing in on the company for Cantor Fitzgerald, Louise Chen writes that even though the print has caused investors to worry about slowing Keytruda sales, new data readouts for drugs that compete with MRK’s products and NewCo’s impact on EBITDA, the company is on track. The analyst highlights the fact that Keytruda, animal health, human health vaccines and overall worldwide sales all gained during the quarter. Not to mention through 2024, Merck expects solid revenue growth, which should accelerate thanks to the spin-off.

“As a result of the incremental growth that NewCo is expected to achieve, combined with the benefit of ongoing operating efficiencies at MRK enabled by the spinoff, the company expects MRK and NewCo to realize higher combined non-GAAP EPS within 12-24 months post-spinoff,” Chen argued.

Bearing this in mind, the analyst stayed with the bulls, reiterating an Overweight rating. At $107, the price target implies that a 30% twelve-month climb could be in the cards. (To watch Chen’s track record, click here)

Meanwhile, Guggenheim’s Seamus Fernandez thinks the spin-off is the primary takeaway. “More important is today’s news of the spin of the women’s health, legacy brands and biosimilars into a NewCo, which we view as financially creative and potentially compelling, but further levers MRK to Keytruda. The strategic plan highlights MRK’s conviction in its long-term growth prospects and, financially, we believe the decision makes sense long-term,” he explained. To this end, the five-star analyst left his Buy call and $105 price target as is. (To watch Fernandez’s track record, click here)

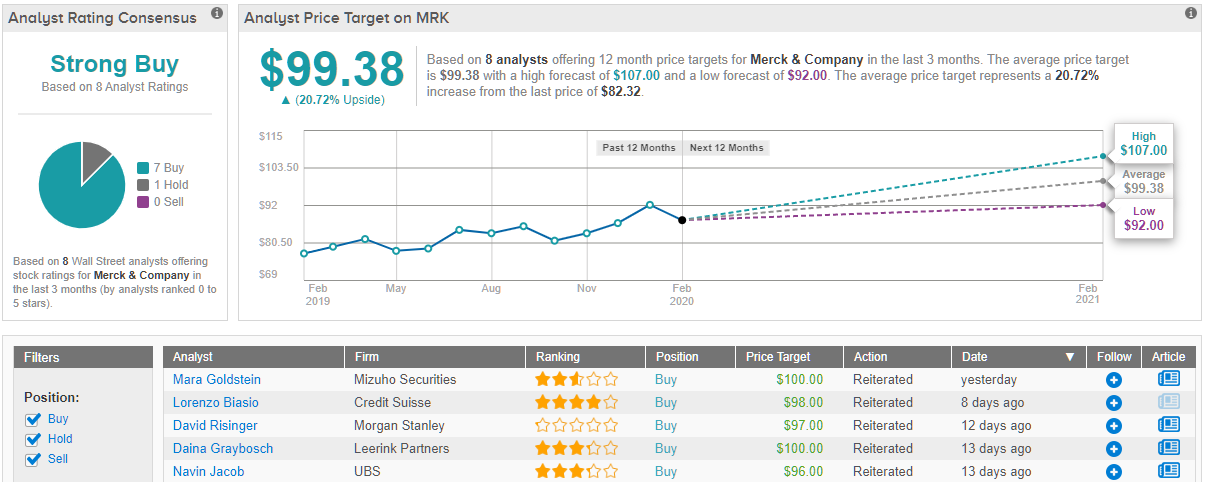

Looking at the consensus breakdown, 6 Buys and 1 Hold add up to a Strong Buy consensus rating. With a $99.38 average price target, the upside potential is 21%. (See Merck stock analysis on TipRanks)

AbbVie Inc. (ABBV)

AbbVie is known for being a research-driven biopharma company developing treatments to improve the lives of patients around the world. In the most recent quarter, the famous quant shop bumped up its ABBV holding by 62% after it picked up almost 4.5 million shares. Valued at over $1.04 billion, its overall holding is now made up of 11.8 million shares.

According to several members of the Street, the billionaire has more than enough reason to be optimistic. During the fourth quarter, management’s worldwide 2020 guidance for Skyrizi flew past the almost $1 billion consensus estimate at $1.2 billion. Not to mention for Rinvoq, more than 95% of commercial lives are now covered and both Imbruvica and Venclexta are still grabbing market share despite the steep competition. What’s more, ABBV unveiled 30 proof-of-concept candidates that could see data released in the coming three years.

UBS analyst Navin Jacob points out that the print wasn’t all positive, citing the disappointing results for Orilissa and HCV, but stated that he is still very much on board. “Strong Q4 print and even stronger 1020 guide (in-light of ABBV’s historical conservatism) provides confidence to back up TRx trends that we see weekly for Skyrizi and Rinvoq. We now expect ABBV to print more than $12 per share in 2021 EPS thus w/ dividend yield still at ~5% we think the stock will continue to work from here,” he explained.

In addition, Jacob says that its early stage pipeline hasn’t been factored into his estimates, so a positive readout could lend itself to a re-rate. Based on all of the above factors, his recommendation remains a Buy. Adding to the good news, the analyst lifted the price target from $96 to $105, implying 12% upside potential. (To watch Jacob’s track record, click here)

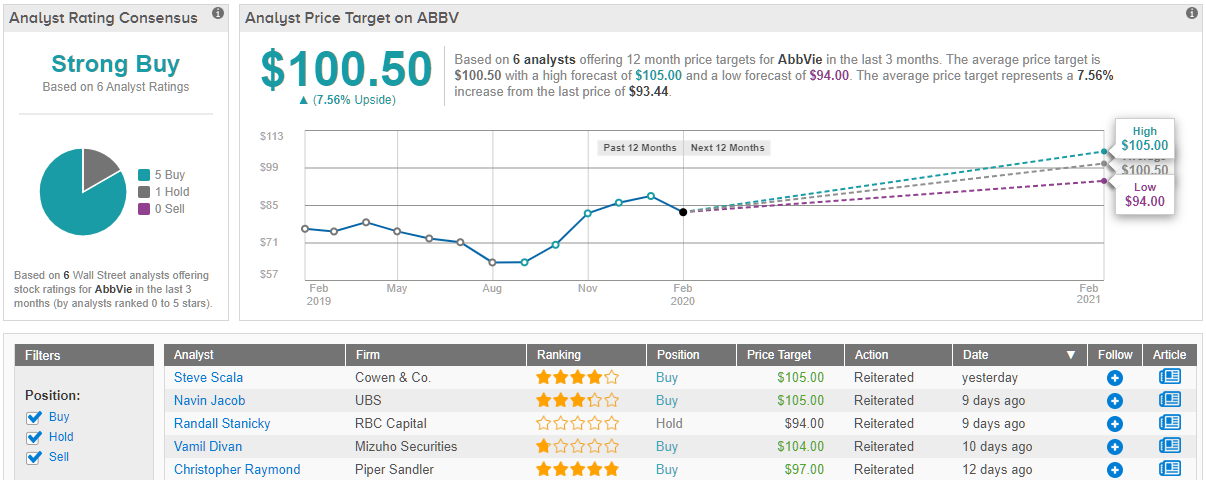

What do other analysts have to say about ABBV? It turns out that 5 out of 6 analysts that have published a recent review agree the stock is a Buy, making the consensus rating a Strong Buy. Given the $100.50 average price target, shares could surge 7% in the next twelve months. (See AbbVie stock analysis on TipRanks)

Bristol-Myers Squibb (BMY)

Simons’ fund also made a substantial purchase of pharmaceutical giant Bristol-Myers Squibb shares during the fourth quarter. With 11.9 million shares added, an 84% increase in the position’s size, Renaissance now owns over 60 million shares. All in all, the holding is worth a whopping $3.9 billion.

Taking a look at BMY’s most recent earnings release, the company’s overall performance didn’t disappoint. Sales results were solid, and it didn’t announce any major surprises in terms of its initial guidance after the Celgene acquisition was finalized.

As the healthcare company has $30 billion year end 2019 net debt and $18 billion of 2020 adjusted EBITDA, J.P. Morgan analyst Chris Schott believes that this year, it should be able to start deploying capital again. “Along these lines, the company announced an incremental $5 billion share repo program today. Overall, we see fairly meaningful capital deployment capacity for BMY over time and believe further tuck-in business development would be well received by the Street as the company looks to further build out its pipeline,” he noted.

On top of this, Schott argues BMY’s pipeline is especially promising. “From here, we see the BMY story largely driven by a range of expected 2020 pipeline readouts (additional Opdivo readouts, TYK-2 phase 3, CELG pipeline updates), which if successful we see translating to upside to what we view as conservative out-year expectations. While the company clearly faces a challenging 2026-plus LOE cycle longer-term, we believe the company has a window to address these headwinds through a mix of its internal pipeline and business development,” he stated.

It makes sense, then, that Schott raised the price target from $70 to $74 in addition to reiterating his Overweight call. This new target conveys his confidence in BMY’s ability to rise 12% over the next year. (To watch Schott’s track record, click here)

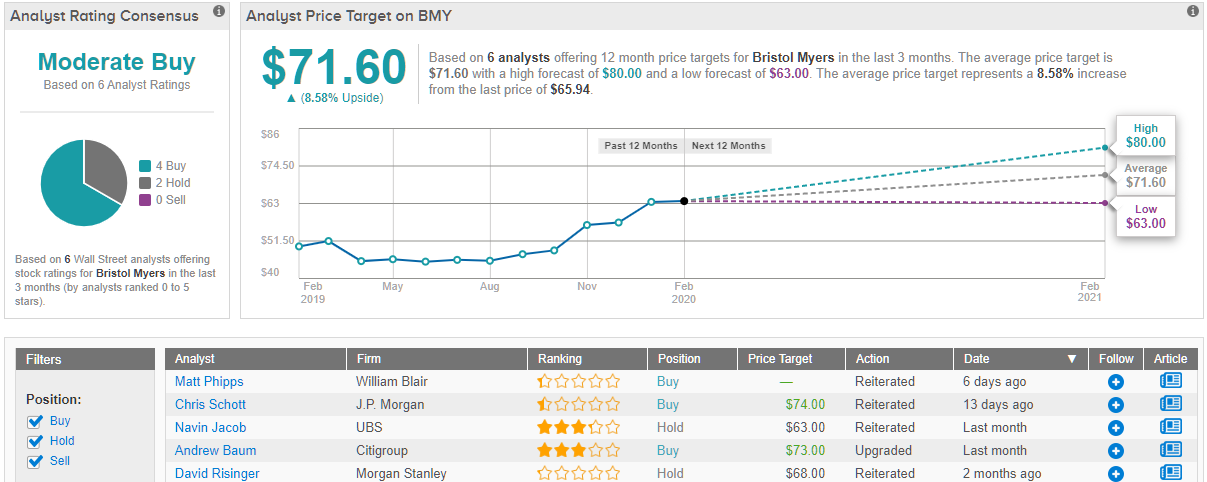

Turning now to the rest of the Street, a Moderate Buy analyst consensus breaks down into 4 Buys and 2 Holds assigned in the last three months. Should the average price target of $71.60 be met, an 8% twelve-month gain could be on the horizon. (See Bristol-Myers stock analysis on TipRanks)