Johnson Controls has been awarded a contract worth $91 million with the US General Services Administration (GSA) to improve the energy efficiencies and facilities of landmark buildings.

The contract won by Johnson Controls (JCI) will result in improving facilities at landmark buildings including the Ronald Reagan Building and International Trade Center (RRBITC), the New Executive Office Building (NEOB), the Eisenhower Executive Office Building (EEOB), Jackson Place, the Winder Building and the Civil Service Building.

Johnson Controls’ chairman and CEO, George Oliver said, “Sustainability, energy efficiency and working toward the goal of net zero are top of mind for government leaders across the United States. This is reflected in the Biden-Harris Administration’s recent infrastructure bill as well as our nation’s re-joining of the Paris Agreement.”

“Partnering with the GSA to make these historic buildings more environmentally friendly and energy efficient is an honor, and we look forward to upgrading more buildings around the U.S. in the coming years to create healthier places and do our part to support a healthier planet,” Oliver added.

The improvement in facilities will result in reduction of 20,000 tons of greenhouse gases per year and energy savings. As per the contract, JCI will upgrade water conservation, energy management systems, lighting and heating, ventilation and air conditioning systems (HVAC) at these landmark buildings and will use the company’s OpenBlue approach of using digital tools, services and connected solutions.

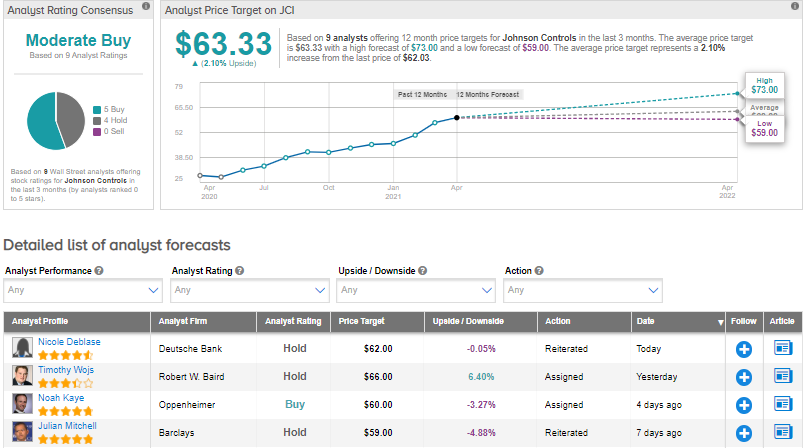

On April 13, Deutsche Bank analyst Nicole DeBlase raised the price target on JCI from $54 to $62 and reiterated a Hold rating on the stock. DeBlase said that while she expects JCI earnings to beat estimates this quarter, the beat could “look less extreme”.

Deblase also opined that the company could leave its guidance unchanged for the rest of the year due to the possibility of supply-chain constraints and “price/cost margin pinch as the recovery marches on.”

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating based on 5 analysts suggesting a Buy and 4 analysts recommending a Hold. The average analyst price target of $63.33 implies around 2.1% upside potential to current levels.

According to the TipRanks Smart Score system, JCI scores a 7 out of 10 indicating that the stock is likely to perform in line with market averages.

Related News:

Uber Reports Record Gross Bookings Of $30B In March

Beyond Meat To Expand Product Distribution Across Europe

Sorrento’s Subsidiary Scilex Gets FDA Nod For ZTlido Label Expansion