Times right now are unprecedented. The COVID-19 pandemic, the overarching government responses, the social and economic shutdowns – all are putting extraordinary pressures on financial markets. From the sudden equity collapse that started in late February, to the bear market rally we’re experiencing now, investors simply haven’t got the usual market signals they rely on.

Covering the overall situation, JPMorgan chief of Equity Strategy Dubravko Lakos-Bujas points out, “The sharp ~30% recovery in S&P 500 from the Mar 23 trough, even as earnings expectations and macro outlook were steadily being revised lower by the street, has come as a surprise to many.” Lakos-Bujas also notes that government stimulative policies have matched the extraordinary conditions with equally extraordinary liquidity injections – and that the fiscal and monetary stimulus has put a floor in the equity markets.

Looking ahead, the analyst says, “[We] have been arguing that this unprecedented stimulus and liquidity boom will outlast the health crisis. Our valuation models imply that the equity risk premia remains attractive…”

In line with JPM’s official analysis of market risks, the firm’s stock analysts have been picking possible winners – and losers. We’ve looked at three of those stocks through the lens of the TipRanks database, to find out what makes two of them compelling buys – and what makes the third a stock to avoid.

Federated Hermes (FHI)

We’ll start with a financial company. Federated Hermes is an asset management company, controlling an equity portfolio worth $68 billion and holding $606 billion in assets under management. AUM hit a record in the first quarter of this year.

While Q1 2020 saw EPS fall – the COVID-19 epidemic has been painful across the board – the 63 cents reported was still up 16% year-over-year. The company credits long-term assets for 56% of quarterly revenue.

Solid earnings support a reliable dividend. FHI has grown the payment slowly over recent years, and currently pays out 27 cents per share quarterly. At $1.08 annualized, this makes the dividend yield 5.1%, or more than double the average yield among peer financial sector stocks.

This company’s strong position has brought it to JPM’s attention. Analyst Ken Worthington upgraded the JPM view on FHI from Neutral to Buy. He set a $27 price target for the end of 2020, suggesting an upside potential here of 28%. (To watch Worthington’s track record, click here)

In his comments on the stock, Worthington wrote, “…Federated could keep more of the earnings driven by the massive increase in money market fund assets. We see the rest of Federated’s business performing adequately and better than most, leveraging some good positioning, solid performance and its strengthening brand in ESG.”

Overall, Wall Street is cautious on FHI shares. The analyst corps has delivered 2 Buy ratings – but 4 Holds, making the analyst consensus rating a Moderate Buy. The average price target is $23.20, which indicates a modest upside of 10%. (See Federated Hermes stock analysis on TipRanks)

AbbVie, Inc. (ABBV)

Next up is a pharmaceutical company, one of Big Pharma’s major names. Pharmaceutical and biotech companies are known for their combination of high risk and high reward potential. The rewards and risks are both typified in Humira, the company’s successful immunosuppressive anti-inflammatory drug. Humira is expected to bring in ~40% of AbbVie’s 2020 drug division revenues – but with an expired patent, competition is growing. Last year, Humira accounted for 50% of drug revenues.

AbbVie is fortunate to have a strong product line-up, with new drugs Skyrizi and Rinvoq beating the expectations on their launches and projected to bring in $4.5 and $5 billion in revenue, respectively, by 2025.

The company saw solid earnings in 2019, and in Q1 2020, despite the coronavirus disruptions to economic activity, ABBV reported a substantial sequential earnings increase. EPS grew 9.5% to $2.42, and beat the forecast 6.6%.

Earnings growth has allowed ABBV to keep up a reliable dividend, one of the best in the pharmaceutical sector. The company has increased its dividend payment four times in the past three years, including in Q1 2020. The current payment is $4.72 annualized, with quarterly payments of $1.18. The yield is nearly 5.2%, which simply blows away the healthcare sector average yield of 1.75%.

Chris Schott, in his note on ABBV for JPM, sees a clear path forward for the company. He writes, “On the core portfolio, we anticipate ~9% annual growth in the company’s $30bn non-Humira business led by … Skyrizi and Rinvoq… ABBV’s pipeline represents another potential upside driver with little value being assigned to the company’s mid-stage assets… we see the company’s dividend as highly sustainable…”

In line with his comments, Schott initiates coverage of ABBV for JPM with a Buy rating. His $105 price target implies a healthy upside potential of 15%. (To watch Schott’s track record, click here)

The Wall Street view of ABBV shares is almost as bullish as Schott’s. The Moderate Buy consensus rating is based on 10 reviews, including 7 Buys and 3 Holds. Shares in this pharma giant are selling for $91.20, and the average price target of $101.13 suggests it has room for 11% growth this year. (See AbbVie stock analysis on TipRanks)

Quidel Corporation (QDEL)

Last up is a big player in the diagnostic healthcare segment. Quidel, and American company based in San Diego, operates worldwide. Earlier this month, Quidel scored a major coup: it received authorization from the US FDA, the regulatory body for the health care and pharmaceutical sector, to produce a COVID-19 antigen test.

This authorization shows up Quidel’s strength in the ‘Age of Corona:’ the company produces diagnostic tests, and those are in high demand. Such high demand that, while the markets generally turned bearing in February, QDEL shares started climbing – bringing year-to-date gains to 148%.

With earnings up and an approved authorization for development and production if a COVID-19 diagnostic test, it would seem that QDEL is primed for gains. And yet JPM says to sell this stock. Why the bearish call?

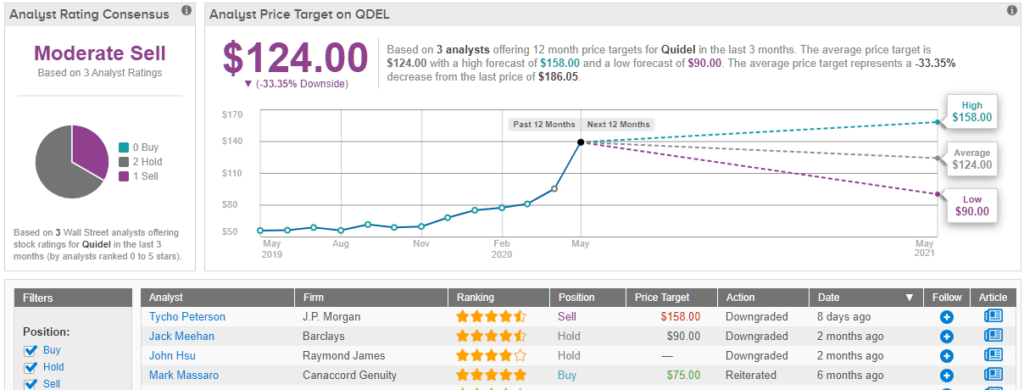

In short, Quidel’s recent steep share price gains have overvalued this stock. As 5-star analyst Tycho Peterson says in his review of QDEL shares, “…while not ruling out the COVID-19 antigen testing opportunity, we believe it may be overstated due to the nascent market, scale-up of competitive tests and potential for avaccine in 12-18 months, leaving us skeptical of the opportunity implied by the stock move.”

Peterson is careful not to blast the company, but he does downgrade his stance of QDEL from Neutral to Sell. His $158 price target projects a 15% downside for the shares this year. (To watch Peterson’s track record, click here)

The market’s collective wisdom agrees. QDEL has a Moderate Sell consensus rating, based on 2 Holds and 1 Sell rating. At $124, the average price target implies a 33% downside from the current share price of $186.05. (See Quidel stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.