COVID is receding and the economy is rebounding. Talk about it, and most analysts will focus on consumer spending, government stimulus, and the rise and fall of jobs numbers. These are important metrics, and they merit their headlines, but they don’t necessarily give a full picture.

While the US economy is consumer based – and consumer spending makes up almost three-fourths of the GDP – we cannot discount heavy industry. The steel sector may be old technology, but it’s still a foundational sector in the world’s supply chains. China dominates global production – but the US is still an important player in high-end steel output.

Watching the US steel sector for JPMorgan, analyst Michael Glick takes a long view of the industry. Getting into detail, Glick describes an environment in which “The U.S. is seeing accelerating demand across nearly all key steel-consuming sectors (construction, autos, machinery), which seems likely to continue as the country emerges from the pandemic, with the rest of the world, notably Europe, nearing a similar resurgence.”

With this in mind, Glick has selected two steel stocks that investors should seriously consider buying into. Opening up the TipRanks database, we’ve pulled up the details on both of Glick’s picks to see whether they could be a good fit for your portfolio.

Steel Dynamics (STLD)

We’ll start with Steel Dynamics. This Indiana-based company is the third-largest producer of carbon steel products in the US, and is consistently the most profitable of America’s steel producers. The company boasts a production capacity exceeding 10 million tons and has been a clear beneficiary of the US economic rebound.

That’s clear from the numbers, as far as numbers can tell the story. Steel Dynamics reported record results in 1Q21, with the top line jumping to a company quarterly record of $3.5 billion. Earnings also came in high, and at $2.03 per share were up 130% year-over-year. A combination of rising prices and high production totals (2.8 million tons for the quarter) fueled the strong results.

The company has not just been sitting on the laurels of its record sales and income. Steel Dynamics announced during Q1 that it will be making major investments in its flat-roll steel coating lines. The capital investments will include $225 million to open two new flat-roll coating line facilities in the Southern US, and $175 million to open two similar lines in the Midwest. The new production capacity is expected to come online in 2H22. These new plants are in addition to Steel Dynamics’ new Sinton, Texas flat-roll mill, which will ramp up production over the course of this year.

Along with new production investment, Steel Dynamics was confident enough in Q1 to declare a 26-cent per share common share dividend payment. The company has a long-standing commitment to its dividend, and the payment was raised three times in the past two years. At $1.04 annualized, the dividend gives a modest yield of 1.65%; the key point here is its reliability.

In his initiation of coverage notes on Steel Dynamics, JPM’s Glick writes of the company, “We believe STLD is one of the highest quality mini-mill steel producers in the U.S., and the timing of the company’s Texas steel mill, which has among the most advanced capabilities in the world for an EAF, could not be more ideal. The company has exceptional financial metrics, with a strong balance sheet, a runway of free cash flow generation, which is likely to drive the company’s base dividend higher.”

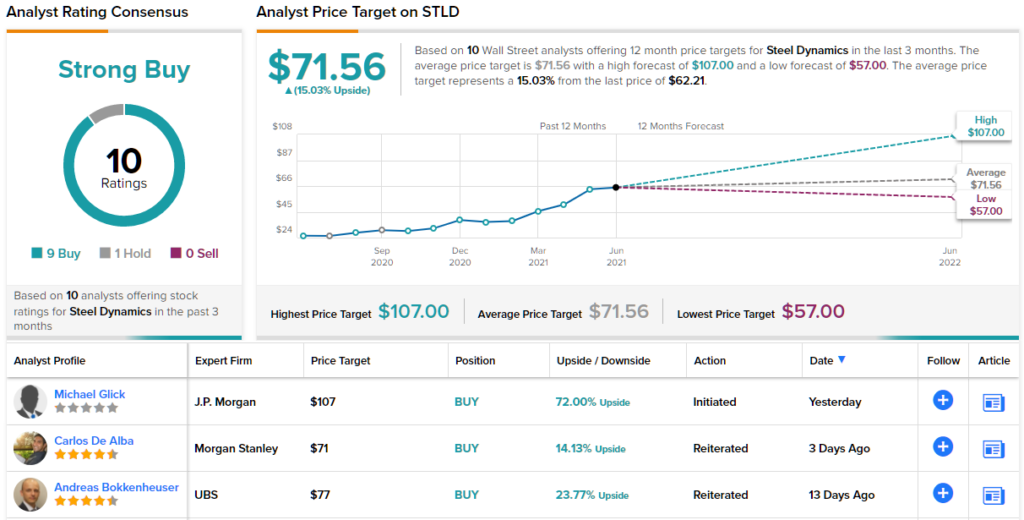

To this end, Glick sets a $107 price target on the stock, to go along with his Overweight (i.e. Buy) rating. At current levels, this target suggests a 72% one-year upside. (To watch Glick’s track record, click here)

The Strong Buy consensus rating on this stock – based on 10 analyst reviews, including 9 Buys and 1 Hold – shows that Glick is no outlier. The average price target is $71.56, implying a 15% upside from the current share price of $62.21. (See STLD stock analysis on TipRanks)

Cleveland-Cliffs (CLF)

The second stock we’ll look at, Cleveland-Cliffs, is the largest flat-rolled steel producer in the US, and has a more diversified production portfolio than Steel Dynamics above. Cleveland-Cliffs did not start out in the steel industry; rather, its roots are in iron mining, and the company still operates mines in northern Minnesota and in Michigan’s Upper Peninsula. These mines – along with steelmaking, stamping, and tooling production facilities – allow Cleveland-Cliffs to boast that it is a self-sufficient steel company, from the ground to the rolling mill.

The company’s steel mills were acquired last year, and those acquisitions are paying off handsomely now. First quarter revenue for the current calendar year was over $4 billion, a company record – and far higher than the $385 million reported in the year-ago quarter.

EPS did better. The adjusted earnings of 7 cents per share came in far higher than the 18-cent loss reported in 1Q20. Along with sound earnings, Cleveland-Cliffs finished the first quarter with $1.8 billion in liquid assets.

Citing a strong cash flow, company management announced in May that Cleveland-Cliffs will be paying off the full outstanding amount of a $396 million senior note issue. The notes are due in 2025, and will be redeemed using the company’s available liquidity.

Glick is suitably impressed with Cleveland-Cliff’s business model, and the company’s presence at all levels of the iron industry.

“Cliffs’s integrated model provides a significant amount of tactical flexibility in the current environment. By operating at all ends of the value chain, Cliffs can optimize returns based on individual business conditions… We like CLF’s tactical flexibility with raw materials and steel and its setup in terms of contract negotiations… and believe the management team has a track record of solid capital allocation, which we believe is critical given the cash windfall the company is set for,” Glick noted.

In line with his bullish stance, Glick rates CLF an Overweight (i.e. Buy), and his $39 price target implies room for a 72% upside potential in the next 12 months.

All in all, CLF gets a Moderate Buy rating from the analyst consensus, based on 8 recent reviews. These break down 5 to 3 in favor of Buy over Hold. The share price here is $22.66, and the stock has an average price target of $28.36. This implies a 25% one-year upside from current trading levels. (See CLF stock analysis on TipRanks)

To find good ideas for steel stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.