Isaac Newton, in his mathematical description of gravity, explained to us just why whatever goes up must come down. But in market trading, the opposite can happen.

JPMorgan strategist Marko Kolanovic explains why what goes down, must come back up. He sees stocks entering an end-of-the-month rebalancing, and notes that equities have underperformed bonds. It’s a situation that, he says, could lead to stock markets gaining by the end of March. The strategist wrote, “…over the next 10 days we will get into the month-end rebalancing period, which would prompt significant buying of equities. The stark underperformance of equities vs. bonds MTD leaves fixed-weight asset allocation portfolios ~4% underweight equities, which suggests they are likely to do a large rotation out of bonds and into equities to rebalance back to target weights.”

Of course, not all stocks will gain should the markets follow Kolanovic’s model. Investors should expect some stocks to see substantially higher or lower gains. In fact, three of JPM’s stock analysts see such higher gains in the offing – on the order of 20% or better, for three of the market’s major players. We’ve used TipRanks database to pull the data.

Electronic Arts (EA)

First up is a major player in the online gaming segment. Electronic Arts, which owns such popular game titles as ‘The Sims,’ ‘Medal of Honor,’ and ‘Star Wars,’ as well perennial sports favorites like ‘Madden NFL’ and ‘NBA Live,’ is the second largest gaming company in the US and European markets. EA has seen a 11% decline year-to-date, which outperformed the S&P’s 30% fall. In a way, that outperformance should not be surprising, as the current downturn is fueled by quarantines and lockdowns – and online gaming is a niche uniquely suited to prosper in such times.

EA came into the current bear market after reporting upbeat fiscal Q3 results. The company brought in $1.98 billion in revenue, edging over the estimates and beating the year-ago number by $370 million. EPS was also strong, with the $2.79 reported beating the forecast by over 10%. It was the second quarterly EPS beat in a row for Electronic Arts.

Writing for JPM, analyst Alexia Quadrani points out important trends in the gaming sector that net positive for EA’s financial results: “EA is benefiting from the secular trends of increasing digital full-game downloads that have ~20% higher margins than physical disc sales, increased monetization of existing games with rapidly growing and higher-margin live services…”

With that in mind, Quadrani rates EA shares a Buy, and her $125 price target implies room for a 20% upside potential. (To watch Quadrani’s track record, click here)

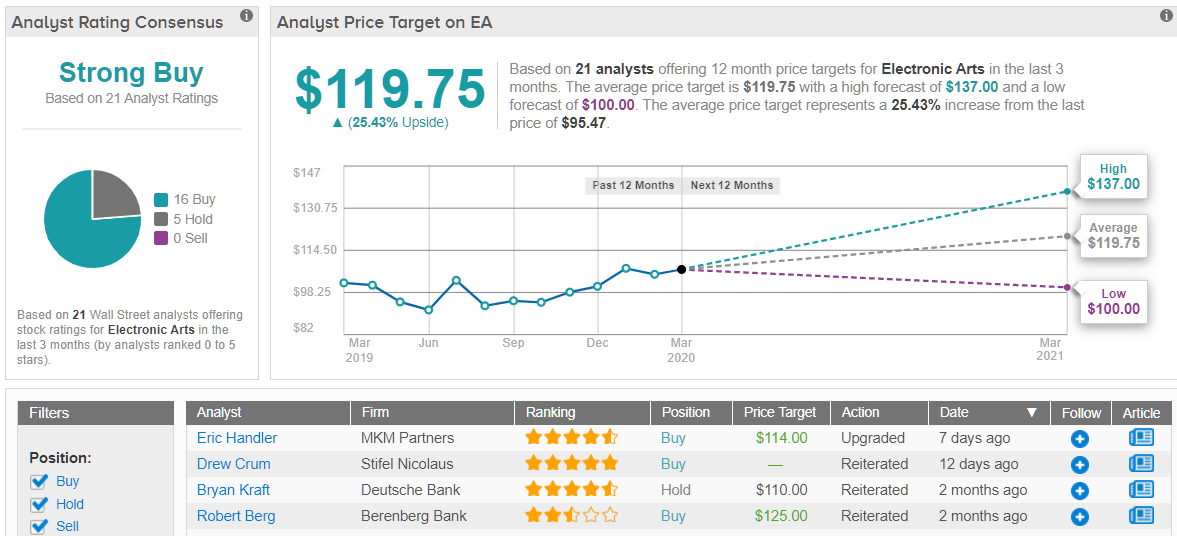

Overall, EA shares get a Strong Buy from the analyst consensus, based on 21 reviews including 16 on the Buy-side and 5 Holds. Shares are trading for $95.47, and the average price target of $119.75 suggests an upside potential of 25%. (See Electronic Arts stock analysis on TipRanks)

Apple (AAPL)

Our next stock needs no introduction. Apple is one of the 800-pound gorillas of the market, a company so big that even after losing 29% of its market cap in the current stock slide, it is still worth nearly $1 trillion. Apple may have the sheer size to survive the coronavirus hit and the concomitant disruptions of supply chains and trade patterns, but it was also uniquely vulnerable to the current market pressures. Apple’s flagship iPhone has already been showing lagging sales, as the smartphone replacement cycle matures, and a large part of the company’s suppliers and customers are based in China. Apple was one the earlier corporations to admit that the coronavirus downturn was going to hurt earnings.

On a positive note, Apple did enter the current downturn with strongly positive earnings. The company reported record revenues in the holiday season, bringing in $91.8 billion for fiscal Q1, and showing a net profit of $22.2 billion. All of Apple’s main divisions showed strong results, especially Services, which brought in $12.72 billion, and Wearables, which totaled $10.01 billion.

Samik Chatterjee, in his review of AAPL for JPMorgan, is careful to note that the company has lowered its guidance for 1H20, and that the current hit has been deeper than expected. He adds, however, that the deep hurt now may portent a strong rebound in the second half, writing, “…the primary driver of our forecast update is moderation of global demand, now including all hardware products including the iPhone, with challenges to consumer engagement leading from current COVID-related concerns. However, the temporary disruption in demand in 2020, partly drives expectations for even higher demand in 2021 and strengthens further 5G volume expectations…”

Chatterjee gives AAPL shares a price target of $350, implying an impressive 52% upside potential and backing his Buy rating. (To watch Chatterjee’s track record, click here)

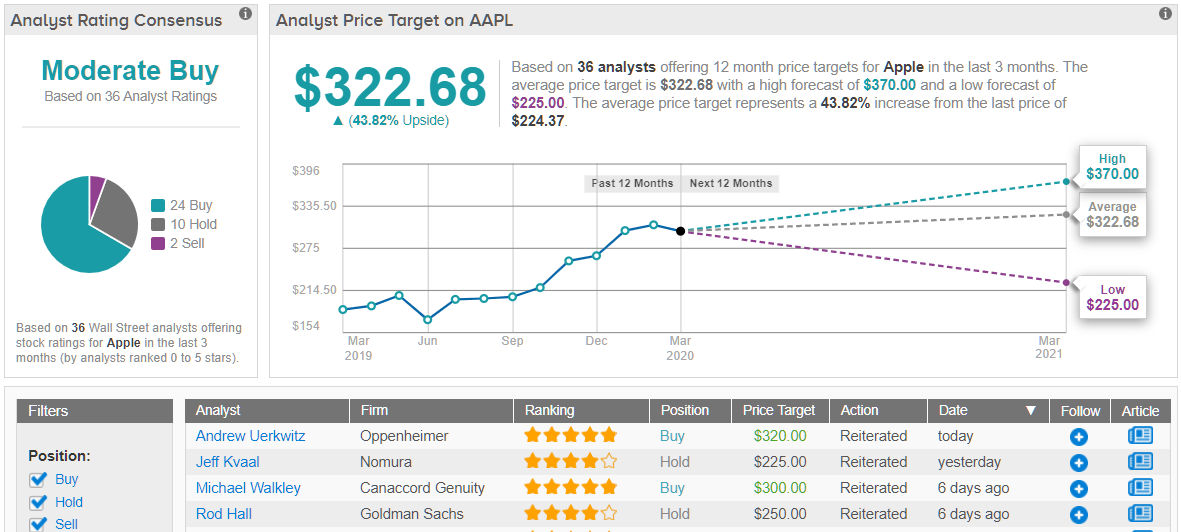

Even after the recent heavy losses, AAPL shares are selling for $224.37. The average price target, $324.68, suggests that there is room here for 44% upside growth in the coming year. The mix of reviews, including 24 Buys, 10 Holds, and 2 Sells, gives the stock a Moderate Buy rating from the analyst consensus. (See Apple stock analysis on TipRanks)

Square, Inc. (SQ)

We’ll wrap up with Square, a fascinating company inhabiting the digital payment niche. Square’s products allow small businesses and entrepreneurs to turn mobile devices – smartphones or tablets – into portable card readers or even cash registers. They bring flexibility to the small business, as well as mobility. For customers, Square offers peer-to-peer financial transactions through the Cash App.

Until markets turned down with the coronavirus hit this past February, Square had shown six straight months of solid performance, based on the popularity of its products. The current epidemic scare, however, has hurt the company. Consumer purchasing activity is down, as potential shoppers are stuck home in lockdowns or quarantines, and without shopping there are simply no payments for the payment processor to process. OK, it sounds like a tongue twister, but it’s a serious economic liability right now.

The overall strength inherent in Square’s model came through in the company’s Q4 report. SQ showed 23 cents EPS, beating the forecast of 20 cents and growing substantially from the year-ago figure of 14 cents. Revenue was also up, and at $1.31 billion it was 10% over the estimates and up 40% from Q4 2018. The final quarter of 2019 was the company’s third in a row to beat the earnings expectations. Like Apple, Square is able to face the current downturn from a position of strength.

5-star analyst Tien-Tsin Huang, covering Square for JPM, points out both positive elements of the company’s position and negative aspects of its customer base: “we believe ~60% of SQ’s clients are in the restaurant, retail and services industries. In the past, Square has said its revenue retention rate is at least 113%, suggesting there is positive selection in the sellers that Square serves. That said, social distancing and lockdowns will have a negative impact, but the mix might be healthier than perceived.”

Huang sees the positives outweighing the negatives in the long term, and rates the stock a Buy. His $86 price target shows the extent of his confidence – it implies a hefty 115% upside potential for the stock. (To watch Huang’s track record, click here)

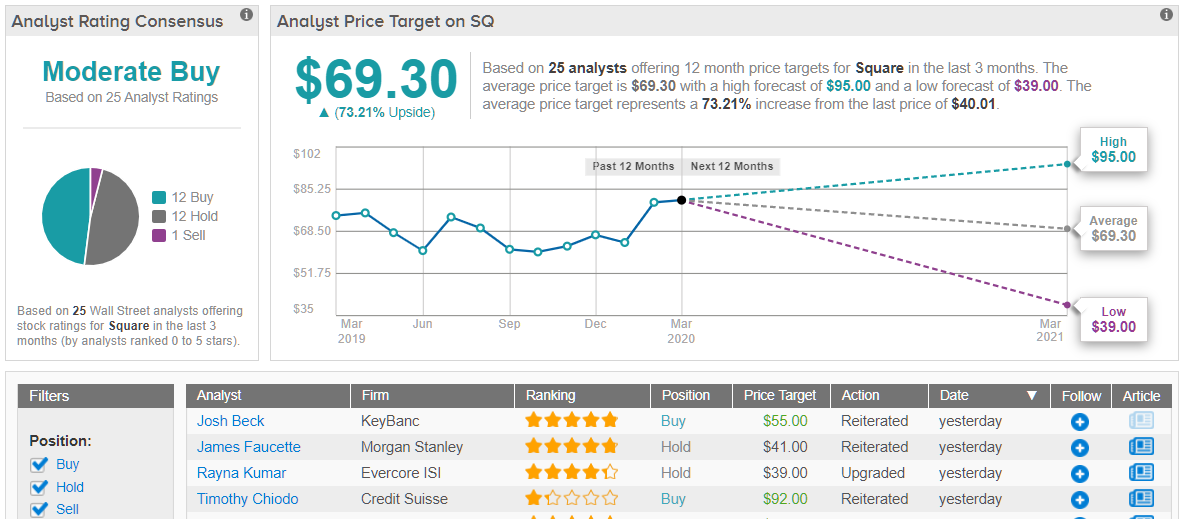

Overall, Square’s Moderate Buy analyst consensus rating is based on a near-even split: 12 Buys against 11 Holds and 1 Sell. The stock is currently priced at $40, and the average price target of $69.30 suggest room for 73% upside growth this year. (See Square stock analysis on TipRanks)