It hasn’t been a good week for biotech Amarin (AMRN). On Monday, a District of Nevada judge ruled against the company and in favor of two generic drug makers seeking to establish their own versions of Amarin’s treatment for high triglycerides, Vascepa, thereby, making mincemeat of Amarin’s six patent claims. Judge Du’s ruling caught the Street somewhat by surprise, as it was widely expected Amarin would prevail in the case. Alas, investors were not impressed and on Tuesday, the stock was sent tumbling by a merciless 70%.

The next step, naturally, involves an appeal. With this in mind, H.C. Wainwright’s Andrew Fein, a long standing Amarin bull, sought clarity on the probability of a successful turnaround following the biotech’s appeal.

After consulting the firm’s patent lawyer about Judge Du’s record, the statistics don’t look particularly promising. Judge Du is a designated patent judge, has officiated a large number of cases, and has a relatively low reversal rate. Specifically, there have been 246 appeals for reversals since 2013, of which only 18 have resulted in a turnaround.

“While we note that these numbers are specifically for all cases, and not just patent cases, we highlight they do provide an indication of her track record,” Fein noted.

While the ANDA filers (Dr. Reddy’s and Hikma Pharmaceuticals) are now free to move forward with their generic versions, such a move is currently unlikely and would be considered a “launch at-risk,” so long as Amarin is still pursuing a reversal of the verdict.

Due to “absent clarity on full ramifications of Judge Du’s decision and the full extent of the appellate options available to Amarin,” Fein keeps his Buy rating intact, along with the very bullish $51 price target. The contrarian act here, could yield the risk-tolerant investor a massive 1076% gain in the next 12 months, should Fein’s optimistic scenario play out. (To watch Fein’s track record, click here)

Fein concluded, “Going forward, we hope to gain further clarity specifically on: (1) possible competing ANDA approval; (2) potential generic manufacturing and launch capacity, albeit in the context of Vascepa’s characterized complex manufacturing requirements; and (3) traction in Amarin’s appeals process.”

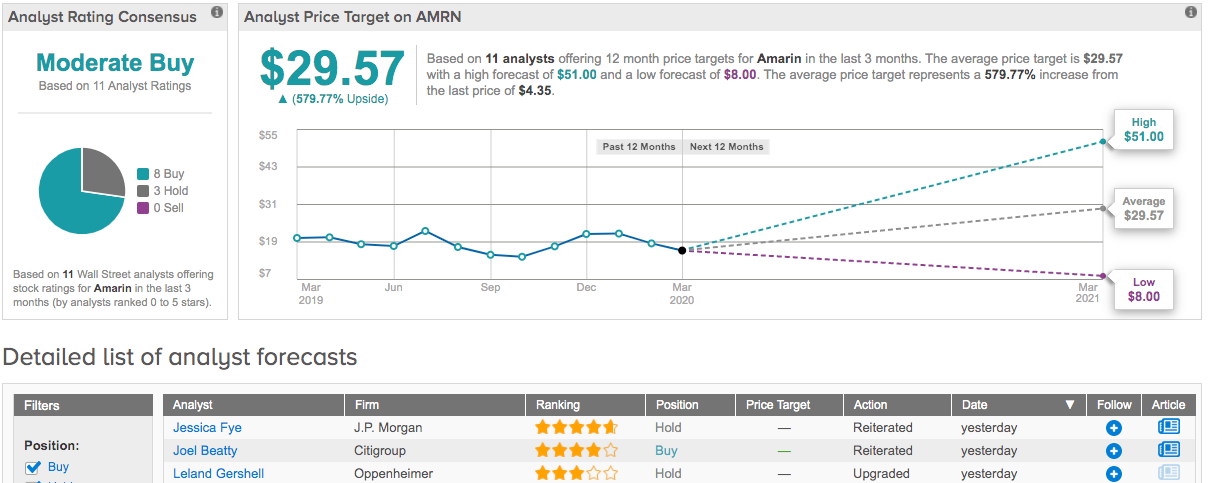

It is possible the majority of analysts haven’t yet managed to update their models following the ruling. Amarin’s Moderate Buy consensus rating breaks down into 8 Buys and 3 Holds. With an average price target of $29.57, the upside potential hits 580%. (See Amarin price targets and analyst ratings on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.