2017 was a strong year for the market in general, but it was an exceptional year for the stocks listed below. Madrgical Pharma, for example, posted incredible gains of over 550%, no doubt making some lucky investors very happy! As we move into 2018, we take a look back at five of the best-performing stocks this year. Plus, using TipRanks analytics we can also assess whether these stocks make compelling investing opportunities for next year too. Indeed, as you will see all the stocks listed below still have an optimistic outlook from the Street. Micron for example can grow a further 100% in the next 12 months according to a top Rosenblatt analyst.

Let’s dive in and take a closer look now:

1. Madrigal Pharma (NASDAQ:MDGL): Gain 551%

Analyst consensus rating: Strong Buy, Average analyst price target: $135 (43% upside)

Analyst consensus rating: Strong Buy, Average analyst price target: $135 (43% upside)

Madrigal exploded in early December following positive data from key Phase 2 trials. In response, Evercore ISI analyst Josh Schimmer raised his price target on Madrigal Pharmaceuticals to $140 from $65 to reflect estimates of increased entry into the NASH market. Long term safety is “now the only thing standing between here and what we think will be a blockbuster therapy,” says Schimmer. NASH- non alcoholic fatty liver disease- is set to become the biggest cause of liver transplants by 2020.

We can also see from TipRanks’ latest tool- the Individual Investor Sentiment feature- that investors are Very Positive on Madrigal stock right now. Indeed investors have increased holdings in Madrigal over both the last week and the last month.

2. CymaBay Therapeutics (NASDAQ:CBAY): Gain 423%

Analyst consensus rating: Strong Buy, Average analyst price target: $14.40 (59% upside)

Intrestingly, another stock with huge gains, CymaBay, is also focused on treating liver diseases. The company’s lead product candidate, seladelpar, is in development for the treatment of PBC, an autoimmune liver disease. So far the drug has been attracting very positive attention from the Street. Indeed, we can see that the stock has received only buy ratings recently, while Oppenheimer listed CBAY as its top biotech idea for November-Decemeber.

Intrestingly, another stock with huge gains, CymaBay, is also focused on treating liver diseases. The company’s lead product candidate, seladelpar, is in development for the treatment of PBC, an autoimmune liver disease. So far the drug has been attracting very positive attention from the Street. Indeed, we can see that the stock has received only buy ratings recently, while Oppenheimer listed CBAY as its top biotech idea for November-Decemeber.

Seladelpar could be a ‘disruptive threat’ to the current PBC offerings according to Leerink’s Joseph Schwartz. After conducting a very encouraging phsycian survey, he ramped up his price target on the stock from $12 to $16. Schwartz says that while clinical data is still relatively limited, it has already stoked phsycian excitement for the treatment of patients with second-line PBC.

3. Weight Watchers International (NYSE:WTW): Gain 327%

Analyst consensus rating: Moderate Buy, Average analyst price target: $67.50 (37% upside)

Since Oprah Winfrey became the face of Weight Watchers the company has been reeling in new members. Shares in Weight Watchers skyrocketed in 2017 by a mind-blowing 327%. In November the company posted net income of $44.7 million for the fiscal third quarter, up from $34.7 million in the same period last year. Similarly, subscriber numbers also made massive gains with an 18% increase from the previous year.

Since Oprah Winfrey became the face of Weight Watchers the company has been reeling in new members. Shares in Weight Watchers skyrocketed in 2017 by a mind-blowing 327%. In November the company posted net income of $44.7 million for the fiscal third quarter, up from $34.7 million in the same period last year. Similarly, subscriber numbers also made massive gains with an 18% increase from the previous year.

On the news, Craig-Hallum analyst Alex Fuhrman raised his price target for Weight Watchers from $50 to $70 (42% upside). He says the company delivered a “strong” beat and raise with retention at multi-year highs. Encouragingly, Furhrman sees this momentum creating potential for significant upside to estimates in 2018.

4. LendingTree Inc (NASDAQ:TREE): Gain 235%

Analyst consensus rating: Strong Buy, Average top analyst price target: $361 (7% upside)

LendingTree is an online lending exchange that connects consumers with multiple lenders, banks, and credit partners who compete for business. The company is booming as customers increasingly shop around online before making big financial decisions. And according to TREE CEO Doug Lebda there is plenty of room for further growth ahead, “Lending is way behind every other industry in entering the Digital Age,” Lebda told Fortune earlier this year.

LendingTree is an online lending exchange that connects consumers with multiple lenders, banks, and credit partners who compete for business. The company is booming as customers increasingly shop around online before making big financial decisions. And according to TREE CEO Doug Lebda there is plenty of room for further growth ahead, “Lending is way behind every other industry in entering the Digital Age,” Lebda told Fortune earlier this year.

Five-star Needham analyst Kerry Rice seems to agree. He raised his price target from $300 to $375 on December 14 (11% upside). According to Rice, his expectations of “modest mortgage revenue growth of 10%-15%” may actually prove conservative based on historical precedent, while Credit Cards segment growth of 35% could also turn into a major revenue driver. Rice lists the company’s investment in new products, hiring in data analytics, and marketing/sales initiatives as reasons to stay bullish on TREE in 2018.

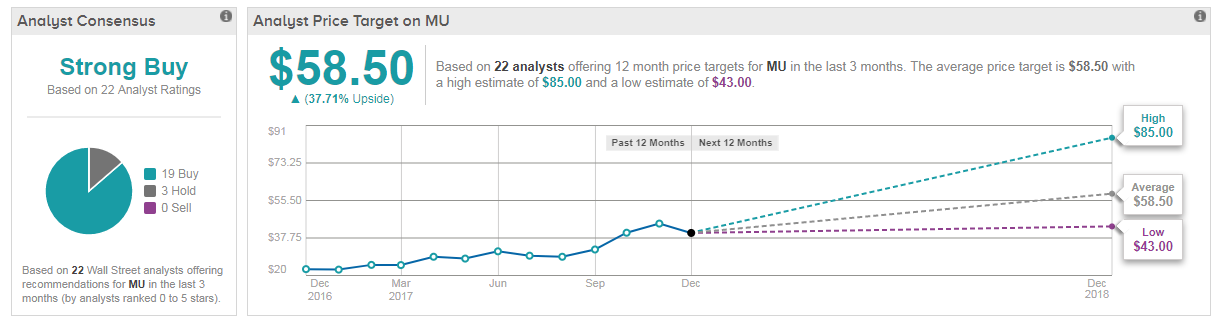

5. Micron Technology (NASDAQ:MU): Gain 94%

Analyst consensus rating: Strong Buy, Average analyst price target: $58.50 (38% upside)

This list wouldn’t be complete without semiconductor hot stock Micron. On December 19, MU released a very upbeat earnings report alongside an impressive profit forecast.

This list wouldn’t be complete without semiconductor hot stock Micron. On December 19, MU released a very upbeat earnings report alongside an impressive profit forecast.

Rosenblatt analyst Hans Mosesmann sets positive expectations for 2018. He says: “We continue to view the current memory industry as the best in semiconductor history with its duration (longer) and nature (content-driven) being key drivers within a rational oligopolistic industry. Specific to Micron we are encouraged by management’s very aggressive free cash flow deployment to de-levering activities (exit FY2018 in a net cash positive position), as this should lead to investor base diversification.”

As a result he maintains a buy rating on MU with a Street-high price target of $85 up from $75 previously- indicating 100% upside potential from the current share price.

Other stocks that recorded over 100% growth in 2017 include Solar Edge Technologies Inc (SEDG); Cai International (CAI); Conns (CONN); Overstock.com (OSTK); Sage Therapeutics (SAGE) and Electro Scientific Industries (ESIO). SAGE for example (up 220%) still has 26% upside potential, with RBC Capital calling the data ‘outstanding’ for its depression drug SAGE-217.

Find fresh investment ideas for 2018 with TipRanks research tools

TipRanks provides investors with all the tools required for analyzing and optimizing your portfolio. By tracking and ranking over 40,000 financial experts, investors can discover the latest market sentiment on any one of 5,000 stocks. Or, for investors looking for new stock ideas, use the TipRanks’ popular Trending Stocks tool to pinpoint ‘Strong Buy’ stocks that top analysts are recommending right now.