Netherlands-based Just Eat Takeaway.com said it entered into an agreement to buy the food delivery company Grubhub Inc. (GRUB) in an all-stock deal valued at $7.3 billion.

Grubhub shares rose 4.4% to $61.65 in extended trading on Wednesday after the two companies said that the deal will create the world’s largest online food delivery company outside of China, measured by gross merchandise value (GMV) and revenues.

Under the terms of the deal, Grubhub shareholders will be entitled to get American depositary receipts (ADRs) representing 0.6710 Just Eat Takeaway ordinary shares in exchange for each Grubhub share. This in turn reflects an implied value of $75.15 for each Grubhub share, based on the closing price of Just Eat Takeaway on June 9th of €98.602.

Upon completion of the transaction, Grubhub shareholders are expected to own ADRs representing about 30% of the combined companies on a fully diluted basis.

According to the statement, the combined group will be built around four of the world’s largest profit pools in online food delivery: the U.S., the U.K., the Netherlands and Germany and it aims to become a significant player in North America. In addition, Just Eat Takeaway owns the Canadian business SkipTheDishes. The two companies processed about 593 million orders in 2019 and together they have more than 70 million combined active customers globally.

Just Eat Takeaway generated 1.5 billion euros ($1.7 billion) in revenues in 2019, compared with Grubhub’s $1.3 billion.

“Combining the companies that started it all will mean that two trailblazing start-ups have become a clear global leader,” said Grubhub CEO Matt Maloney. “We share a focus on a hybrid model that places extra value on volume at independent restaurants, driving profitable growth.”

The transaction is still subject to the approval of both Just Eat Takeaway’s and Grubhub’s shareholders, as well as other customary completion conditions. The deal is expected to close in the first quarter of 2021.

The combined group will be headquartered in Amsterdam with its North American headquarters in Chicago.

Following the announcement, five-star analyst Brad Erickson at Needham reiterated a Hold rating on the stock, saying that he expects Grubhub holders to be more than pleased with this outcome though there may be some consternation about the future of the stock it is acquiring versus alternatives.

“The combination doesn’t really change or improve GRUB’s positioning in the U.S. which had seen lagging growth rates versus competitors and a bigger competitive hit in NYC particularly through COVID-19 relative to Uber Eats or DoorDash,” Erickson said in a note to investors.

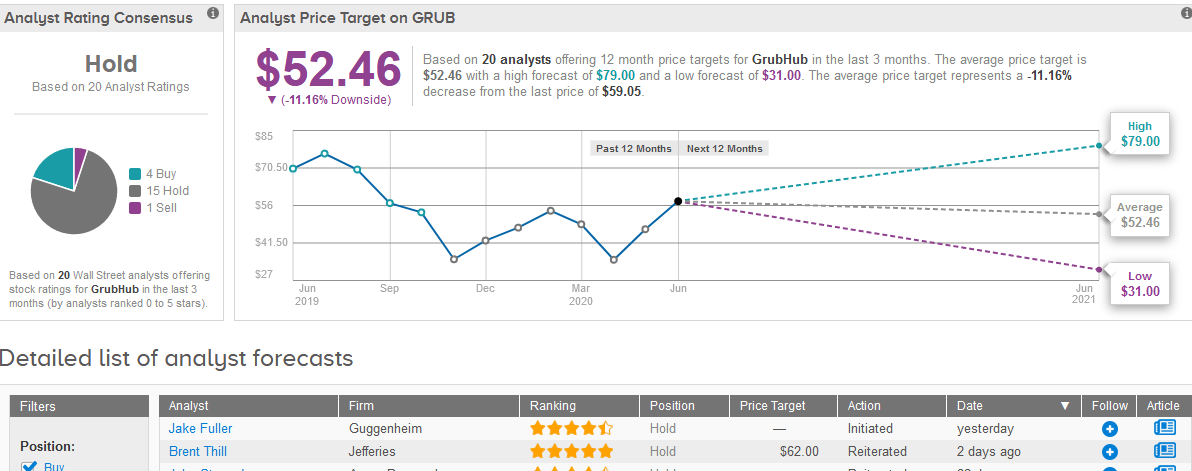

In line with Erickson’s rating, a recent review of analysts shows that the stock has 15 Holds versus 4 Buys and 1 Sell adding up to a Hold consensus. The $52.46 average analyst price target now indicates 11% downside potential in the shares over the coming year after their value almost doubled since March. (See Grubhub stock analysis on TipRanks).

Related News:

Grubhub Shares Lifted On Report Of European Acquirers Lining Up

Lululemon Earnings Preview: Will LULU Live Up To The Hype?

Apple Seeks To Boost Sales Via Mac Trade-Ins, Payment Plans- Report