When is a company’s outstanding performance considered too good? RBC’s Mitch Steves ponders Advanced Micro Devices’ (AMD) significant outperformance year-to-date in anticipation of the company’s upcoming earnings report this evening.

So far in 2020, 2019’s star performer has added an extra 22% to its share price. To say the added muscle compares favorably with the overall market would be an understatement. AMD is considerably ahead of the game and has seen relatively little damage on account of the coronavirus. In contrast, so far this year, the S&P 500 is down 11%.

So, considering the aforementioned question, the answer, of course, is if the company is overvalued. But that is not the case, according to Steves. In fact, the 5-star analyst expects a solid report and promising Q2 guidance.

Rather, the analyst suggests to “remain neutral” due to the share gains. Yet should AMD follow the same path other companies have taken during these strange times, be ready to pounce.

“Given this set up, we would avoid a heavy trade into the print and look for opportunities to buy if the stock trades down on the removal of full year guidance,” Steves suggests.

Other than that, what else should one expect to find in the print? Considering rival Intel’s solid recent earnings, Steves anticipates positive upside. The analyst expects Q2 guidance to be a “tad better q/q as AMD’s exposure is more gaming/server vs. Intel which is more commercial/server based.”

Moreover, bucking the trend again, Steves believes CY20 should exhibit year-over-year growth, a “rarity for any semiconductor company in 2020.” Additionally, look out for “better than expected demand from data center/servers.”

Looking at the negatives, yes there are some, considering the uncertain current climate, the analyst believes AMD will not provide guidance for the rest of the year, which should create that previously noted “potential buying opportunity.”

Accordingly, Steves reiterates an Outperform on AMD along with a $66 price target. Investors stand to take home gains of 17%, should the 5-star analyst’s thesis play out. (To watch Steves’ track record, click here)

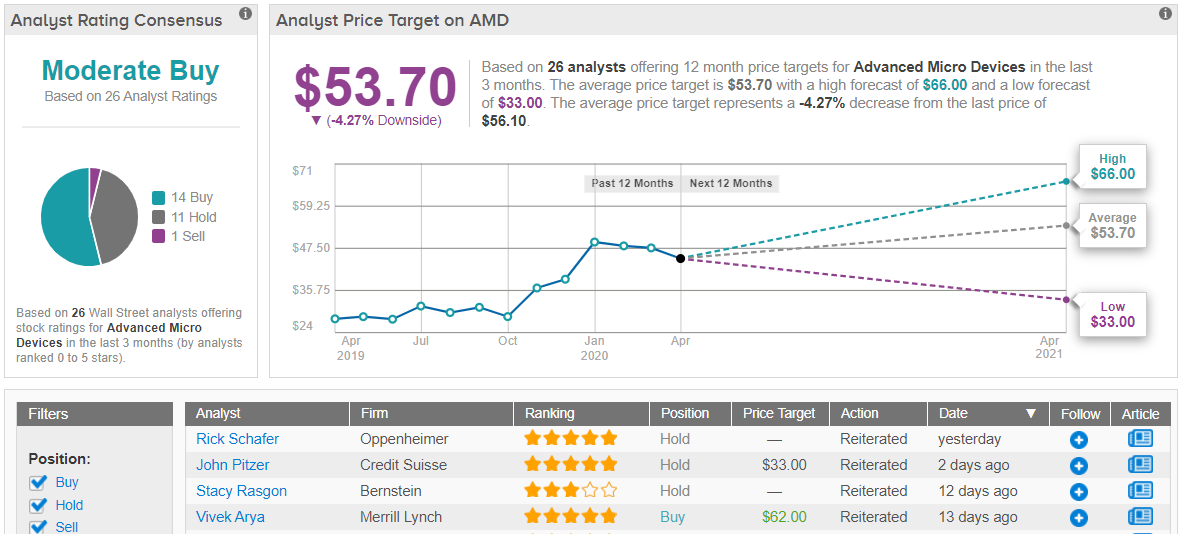

Turning now to the rest of the Street: AMD’s Moderate Buy consensus rating is based on 14 Buys, 11 Holds and 1 Sell. The average price target is $53.70, and suggests downside from current levels of 4%. (See AMD stock analysis on TipRanks)