KB Home (KBH) declared a quarterly cash dividend of 9 cents per share after the U.S. homebuilder beat first-quarter earnings.

KB Home said its board of directors approved the quarterly cash dividend which will be payable on May 21, 2020 to stockholders of record on May 7, 2020. The annual yield on the dividend is 1.6%.

At the end of March, KB Home reported first-quarter net income of $59.7 million, or 63 cents a share, and up from $30 million, or 31 cents a share, in the year-ago period. Revenue increased to $1.08 billion from $811.5 million in the year-ago period. Analysts had estimated earnings of 45 cents a share on revenue of $957.7 million.

In addition, KB Home said that it was withdrawing its 2020 guidance due to the uncertainty induced by the COVID-19 pandemic.

“While our performance in the first quarter was strong, with underlying market conditions that were robust, these results preceded the COVID-19 pandemic declaration, and we are now taking actions to adjust our business in this period of uncertainty,” said Jeffrey Mezger, KB Home’s Chairman, President and Chief Executive Officer. “KB Home is well positioned given our strong balance sheet and over $1.2 billion in liquidity.”

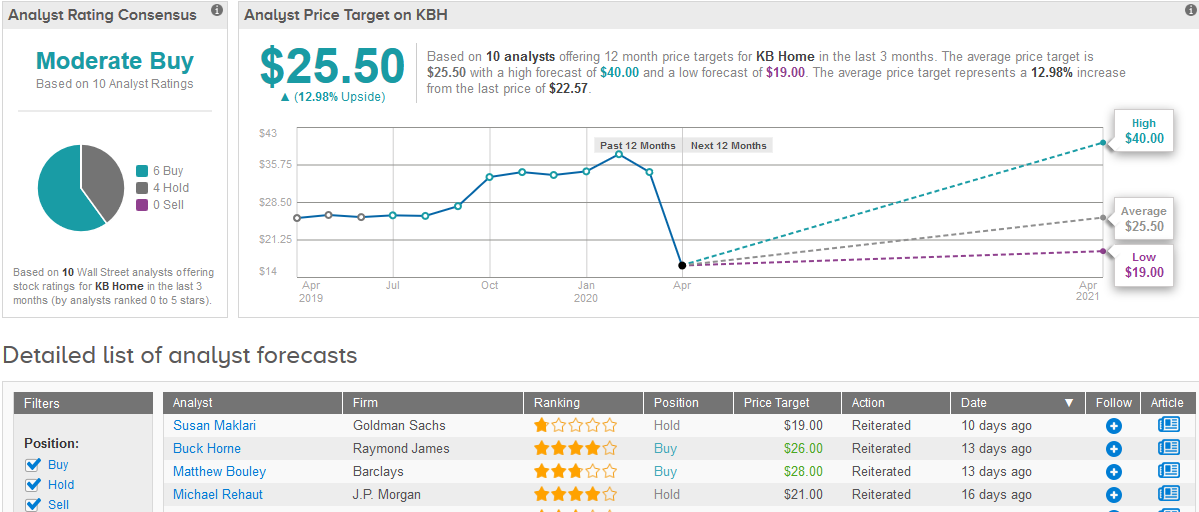

Four-star analyst Kenneth Zener at Keybanc recently raised the homebuilder’s rating to Buy from Hold with a price target of $25, citing “greater comfort in the policy response of key government entities” and “a very reasonable valuation, with book valuation (0.6x) offering a historic support basis”.

Overall Wall Street analysts are more divided over KB Home’s rating split between 6 Buys and 4 Holds adding up to a Moderate Buy consensus rating. The $25.50 average price target implies 13% upside potential in the coming 12 months. (See KB Home stock analysis on TipRanks).

Related News:

Honeywell Secures $1.5 Billion Revolving Credit Line

PayPal Gets Okay to Participate in U.S. Government’s $350 Billion Relief Package

S&P Cuts General Electric’s Credit Outlook to Negative Amid Debt Concern