Sales at Kimberly-Clark Corp. (KMB), the producer of Kleenex toilet-paper, increased to $5 billion beating market estimates, as consumers stocked up on toilet and tissue paper.

In the three months ended March 31, total net sales surged 8% to $5 billion and above the $4.89 billion expected by analysts. Foreign currency fluctuations reduced sales by 2%, the company said. Adjusted earnings per share amounted to $2.13, beating analysts’ estimates of $1.98.

Sales volume jumped more than 8%, driven by increased shipments to meet demand as consumers piled up on their products amid the global coronavirus outbreak. Kimberly-Clark said that the stock-up shopping was experienced across all business segments, in particular for tissue products, and across all major geographies. Net selling prices and product mix each improved 1%.

“A combination of increased consumer demand for our products and strong execution by our teams is reflected in our first quarter results,” said Kimberly-Clark’s Chairman and Chief Executive Officer Mike Hsu. “We increased investments in our business and our market positions remain broadly healthy. In addition, we generated very strong cash flow and further strengthened our balance sheet by executing two long-term debt transactions in the quarter.

Hsu added that Kimberly-Clark is temporarily suspending its forward-looking guidance in light of the uncertainty of the potential effects of the pandemic on the global economy and the company’s business. It is also temporarily suspending its share repurchase program effective from April 24.

Cash from operations rose to $704 million in the first quarter compared with $317 million in the same period last year.

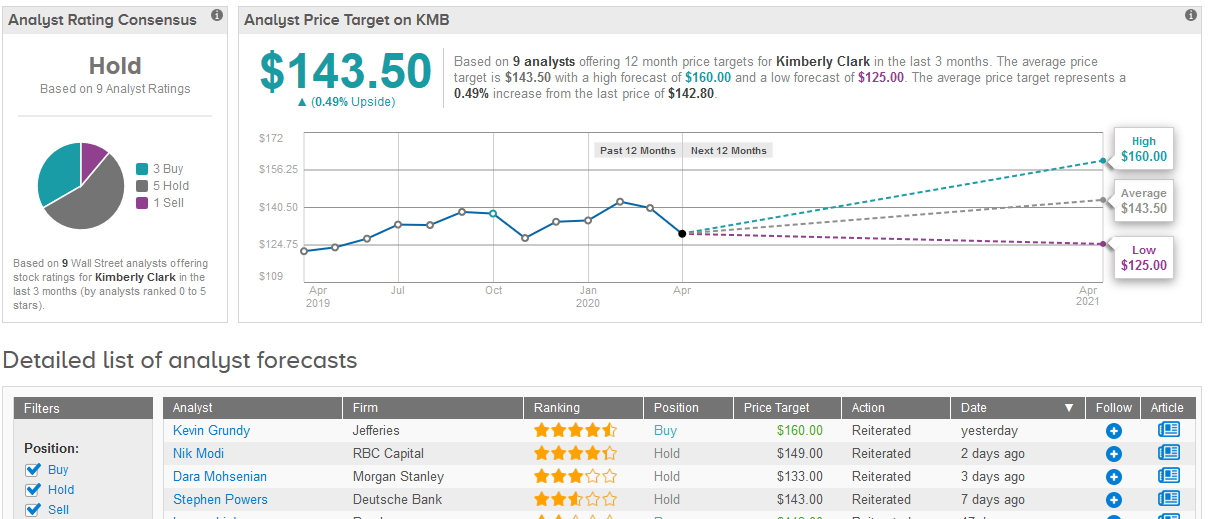

Kimberly-Clark shares advanced 2.4% to close at $142.80 in U.S. trading on Wednesday. Five-start analyst Kevin Grundy at Jefferies raised the price target on the stock to $160 from $149, while maintaining a Buy rating.

The rest of Wall Street analysts have a Hold consensus rating on the shares based on 5 Holds, 3 Buys and 1 Sell. The $143.50 average price target implies less than 1% upside potential suggesting that the market has already priced in share gains in the next 12 months. (See Kimberly-Clark stock analysis on TipRanks).

Related News:

Quest Diagnostics Beats Quarterly Earnings But Pulls 2020 Outlook

Daimler Sees 70% Drop in First-Quarter Earnings, Suspends 2020 Guidance

‘Safe Haven’ Lockheed Martin Approves Dividend Payout