Global investment firm KKR & Co., Inc. (KKR) has agreed to buy an $800 million aviation loan portfolio from CIT Group Inc. (CIT). The portfolio will be serviced by AV Airfinance Limited, a newly launched global commercial aviation loan servicer started by a team of finance industry veterans together with KKR.

The loan portfolio spans across more than 50 loans for approximately 60 commercial aircraft, having an average yield in the mid-single digits and an average term remaining of approximately four years.

The portfolio will serve to seed the launch of KKR’s aviation lending business along with AV AirFinance. (See KKR stock analysis on TipRanks)

Dan Pietrzak, Partner and Co-head of Private Credit at KKR said, “This transaction marks an exciting new expansion of our asset-based finance strategy into directly originated and held commercial aviation loans, and we believe AV AirFinance is well positioned to become a premier lender for the global commercial aviation market.”

A bulk of the loans have already been transferred and the balance will be transferred by the end of the second quarter of 2021. Upon completion, this sale will mark CIT Group’s complete exit from the aircraft lending business.

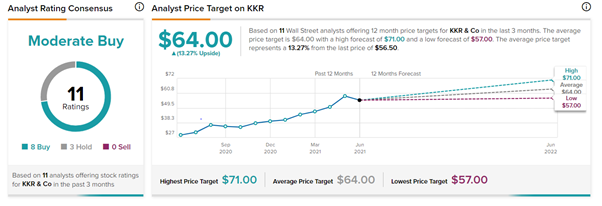

Following the company’s solid Q1 results, Morgan Stanley analyst Michael Cyprys maintained a Hold rating on the stock while lifting the price target to $64 (13.3% upside potential) from $60.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 3 Holds. The KKR average analyst price target of $64 implies 13.3% upside potential to current levels. Shares have gained 87.7% over the past year.

Related News:

FuelCell Energy Reports Disappointing Q2 Results; Shares Plunge 10.7%

Chewy Reports Better-Than-Expected Q1 Results; Shares Slip

Dave & Buster’s Delivers Solid Quarterly Results; Shares Jump