Kroger said that it became the latest victim of a file-transfer service hack. The company believes that personal data of some of its customers were hacked during Accellion’s file-transfer service.

Notably, Kroger (KR) uses Accellion’s services for third-party secure file transfers. Accellion informed the grocery and pharmacy retailer on Jan. 23, that “an unauthorized person gained access to certain Kroger files by exploiting a vulnerability in Accellion’s file transfer service.” Kroger reported the incident to federal law enforcement and discontinued the operations of the Accellion services following the data-security incident.

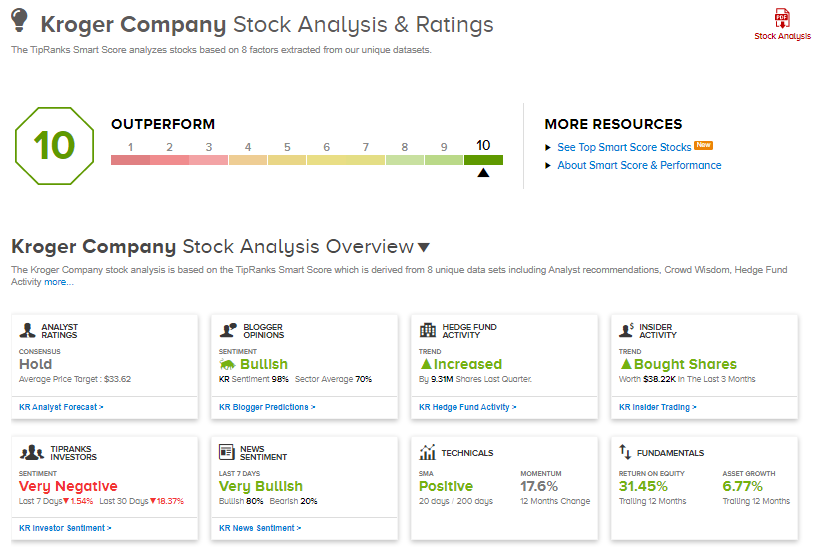

Kroger reported on Feb. 19 that it believes that “less than 1% of its customers, specifically customers of Kroger Health and Money Services, have been impacted.” The company added that the breach did not impact its “IT systems or grocery store systems or data.” Kroger further said that no personal data were accessed during the hack. (See Kroger stock analysis on TipRanks).

Earlier on Jan. 28, Telsey Advisory analyst Joe Feldman downgraded the stock to Hold from Buy, and lowered the price target to $39 (14.6% upside potential) from $43. In a note to investors, Feldman said, “Kroger could be a victim of its own success—as it laps difficult comparisons in 2021 related to the Covid-19 surge in demand of food products from the uptick in at-home consumption.”

Like Feldman, the rest of the Street also has a cautious outlook on the stock with a Hold consensus rating based on 13 Holds and 2 Sells. The average analyst price target of $33.62 implies downside potential of about 1.2% to current levels. Shares advanced about 17% over the past year.

Meanwhile, KR scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Shell Midstream’s 4Q Revenues Outperform On Volume Recovery

AG Mortgage Spikes 18% After 4Q Sales Crush Estimates

Frontline 4Q Sales Sink 48% On Weak Oil Tanker Demand