Some of the mega-caps are reporting earnings this week, with eagle eyed market watchers closely following proceedings.

Alphabet (GOOGL) will present its quarterly statement in just a few moments, and ahead of the anticipated report, Stifel Nicolaus analyst Scott Devitt outlines some key points to look out for.

Let’s start with Google’s position as the world’s largest digital advertising platform. With Google Search providing 59% of total gross revenue in 4Q19, investors will be keen to learn of COVID-19’s impact on its core business.

“We expect Google Search & Other revenue growth deceleration in 1Q from the 16.6% y/y growth reported in 4Q:19. We reflect approximately 500bps of deceleration in our 1Q advertising estimates,” said Devitt.

Although ad spend on Google Search will be the focal point, investors will be keen to find out how other parts of the business are holding up.

YouTube, for example; In last quarter’s report, YouTube advertising revenue grew by 30.8% year-over-year. Unlikely this time around, and in a similar vein to social media platforms’ fortunes, Devitt expects an uptick in engagement to be offset by lower ad demand.

Lastly, with lower revenue expected, how will Google tackle expenses? Earlier this month, there were reports of austerity measures being put in place to reduce spending. Investment plans and marketing budgets will probably be reined in. As far as hiring goes, the initial plan was to add 20,000 new employees in 2020, but the recent reports signify a slowing down of new workforce additions for the rest of the year.

Despite the current macro environment, though, and advising to “proceed with caution,” when considering the near-term, Devitt’s thesis for Alphabet remains overly positive.

The 5-star analyst concluded, “We currently forecast the most substantial impact on growth in 2Q (Stifel revenue +1.7% y/y; Street +0.5%) with gradual recovery beginning in 2H:20. Longer term we are positive on Alphabet’s earnings growth runway and view the current balance sheet position as strong with approximately $115B of net cash & equivalents at the end of 4Q:19.”

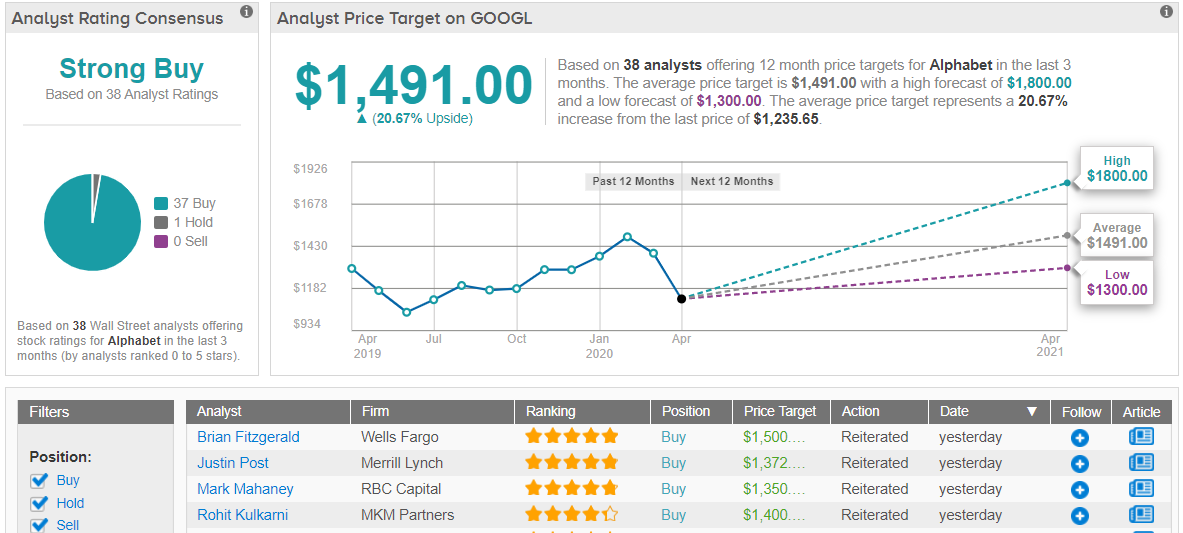

As a result, Devit reitereates a Buy rating on Alphabet shares along with a $1,300 price target. (To watch Devitt’s track record, click here)

All in all, barring a lone Hold rating, Google currently has full support from the Street, with 37 analysts recommending the stock as a Buy. A Strong Buy consensus rating is accompanied with a $1,491 price target, implying nearly 20% upside over the coming months. (See GOOGL stock analysis on TipRanks)

To find good ideas for internet stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.