Earnings season is upon us, and Netflix’s (NFLX) Q3 performance will be put under the microscope after market close today.

Ahead of the print, Wedbush analyst Michael Pachter shares some concerns on Netflix’s future trajectory.

Pachter expects Q3 revenue of $6.341 billion, EPS of $2.14, and overall global subscriber net additions of 2.55 million. These are roughly the same as consensus estimates and slightly higher than Netflix’s guidance for revenue of $6.327 billion, EPS of $2.09 and 2.50 million new subscribers.

So far, decent enough. However, looking further ahead, Pachter explains why he is currently Wall Street’s most prominent Netflix bear. Pachter believes the post-pandemic environment won’t be kind to the streaming king.

On the one hand, the pandemic has been great for Netflix. The stay-at-home measures led to outsized new subscribers in the year’s first half as viewers relished Netflix’s vast library of content. However, with the pandemic still far from extinguished across the globe, Netflix faces a problem.

“While a high level of consumption is desirable, it drives a need to constantly replenish the content consumed, as evidenced by the large number of new series and movies added in Q3 – Netflix’s highest quarter ever for original content,” Pachter noted.

The new subscriber base, Pachter believes, will tire of what’s on offer over the following months, and Netflix has nothing new to add. This will inevitably lead to viewers canceling subscriptions.

“The law of large numbers suggests to us that if the rate of subscriber churn grows by ‘only’ 100 basis points, Netflix could face a loss of 2 million subscribers per quarter beginning later this year or early next year,” the 4-star analyst said. “We suspect that this phenomenon has already begun and led to the company’s lackluster guidance for Q3 net additions.”

While COVID-19 has sent everyone sofa bound, it has also brought productions to a standstill. As a result, as soon as it can, Netflix will begin spending vast amounts on producing new content, causing “a return to large cash burn.” In the meantime, while Netflix might “bid up the price of available licensed content,” this is not a satisfying enough solution for Pachter, who concludes, “While we think it is possible that the company can grow free cash flow from there, we are not prepared to adjust our FCF forecast to a point where it would change our price target or rating.”

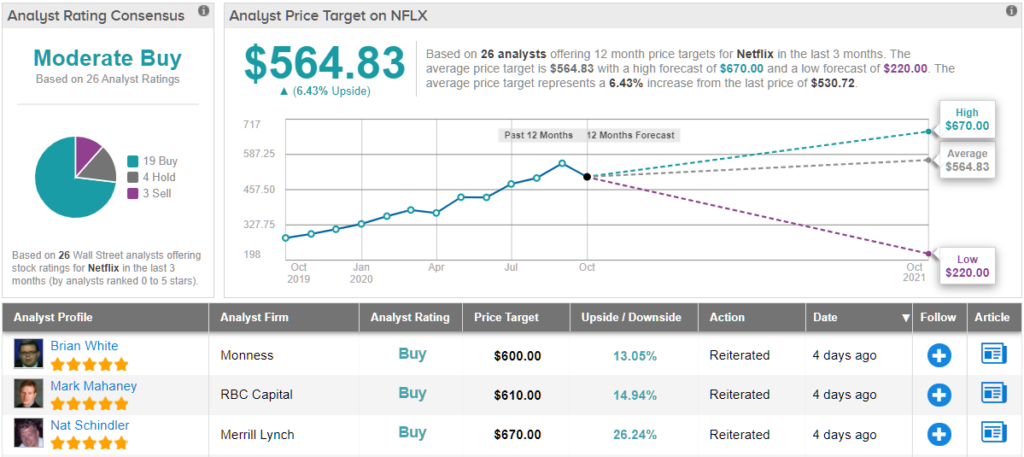

That rating stays an Underperform (i.e. Sell), while the price target remains at $220. This figure implies a steep 58% drop from the current share price. (To watch Pachter’s track record, click here)

The Wedbush analyst, however, is amongst a minority on the Street. Based on 19 Buys, 4 Holds and 3 Sells, Netflix has a Moderate Buy consensus rating. At $564.83, the average price target suggests shares will nudge upwards by 7% over the coming months. (See Netflix stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.