By Gal Goldring

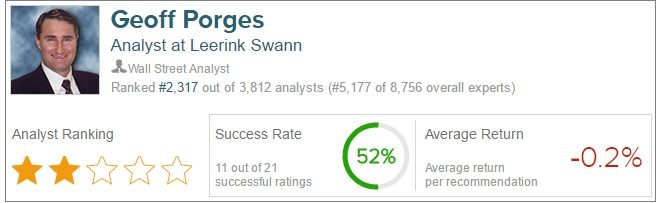

Leerink Swann analyst Geoff Porges weighed in today with mixed views on healthcare giants Gilead Sciences, Inc.(NASDAQ:GILD) and Biogen Inc (NASDAQ:BIIB). The analyst believes that Gilead HCV franchise proves durable in the face of increased competition, while Biogen’s Nusinersen opportunity is still not enough to offset other risks. Let’s take a closer look.

Gilead Sciences, Inc.

Porges was out pounding the table on Gilead today, reiterating an Outperform rating with price target of $127.00, which represents a 35% upside from current levels.

The analyst claims Gilead Hepatitis C franchise, namely Harvoni and Sovaldi, remains durable in the face of increased competition, pointing to competing products from Bristol-Myers Squibb, AbbVie, and Merck. The analyst explains, “We recently reinitiated coverage of Gilead with an Outperform rating, due in part to the significant cash generation of its HCV franchise, which generated $19bn in sales in 2015, or 59% of total revenue.”

Porges states that the current analysis and reviews of the largest payer plan formularies reveal that Gilead’s HCV DAAs continue to dominate the market, with modest share gains for rivals. He elaborates on this further, claiming, “We expect Gilead to maintain its dominant position in HCV relative to its competitors – at least in the near term – and we increasingly expect only modest incremental price erosion.” Seven weeks after the launch of Zepatier, a competing product from Merck, Sovaldi and Harvoni have retained a relatively favorable position at 65% of the top 20 largest commercial plans, and 70% of the top 10 largest government plans relative to ABBV’s Viekira Pak (20%, 30%, respectively).

According to TipRanks, based on the 18 analysts offering recommendations for GILD in the last 3 months, the overall consensus is Strong Buy. The average price target is $115.86 with a nearly 26% upside.

Biogen Inc

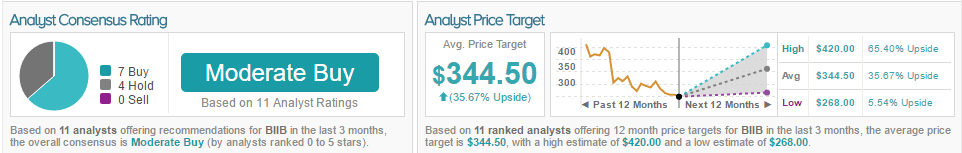

In light of recent weakness in Biogen’s stock, Porges was out today reviewing the company’s pipeline for value and potential opportunity. The analyst reiterated a Market Perform rating on the stock, while reducing the price target to $328 (from $335), due to lowered forecast.

Porges wrote, “Our new POS-adjusted revenue forecast is $900mm in 2020 compared to our prior $1.2bn, and is below current consensus of $1.2-1.3bn. Based on this new forecast, our overall revenue and earnings forecasts for the company are reduced by 2% in each year beginning in 2018. Our adjusted revenue forecast is modestly higher than consensus in 2017 and 2018 (1-2%) and modestly lower than consensus in 2019 and 2020 (1-2%). Our EPS estimates are 1-4% above recent consensus through 2018, and then 2% below consensus longer term.”

According to TipRanks, based on 11 analysts offering recommendations for BIIB in the last 3 months, the overall consensus is Moderate Buy, with an average price target of $344.50 with a 35.66% upside.