One bright spot for investors last week was the unexpectedly strong GDP print. The figure rose 2.6% and outpaced the 2.3% forecast. But perhaps the most significant data point was the Fed’s own inflation gauge, which fell from 7.3% to 4.2%. While market watchers expect the Fed to raise rates again in its November meeting, there is some speculation that the central bank may start slowing down its rate hike policy as early as December.

In response to all of this, markets jumped on Friday. The S&P 500 gained more than 2.4%, and the Dow Jones added almost 200 points.

Looking at the market’s reaction, Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, says: “This market’s trading like [this] week we’ll see some real signs that the Fed’s winning its war on inflation, and they can, therefore, ease up on the rate hikes going forward… I wouldn’t be at all surprised if the market got it exactly right.”

While investors are seeing a clear ray of hope on the horizon, the risk of recession remains high. Given these conditions, Cramer is recommending two airline stocks for investors, as he sees travel in a ‘recession resistant’ position. In his words, “People aren’t shifting from online to in-person shopping. They’re going places. They’re doing things.” The result is strength for the travel industry as the post-COVID consumer wants to get out and about. And that translates to hot travel demand.

So let’s take a closer look at the airline stocks Cramer is recommending. We’ve opened up the TipRanks database to pull their latest stats, and we’ll add in recent commentary from the Street’s analysts. Both are Buy-rated, and both show double-digit upside potential. Here are the details.

Delta Air Lines, Inc. (DAL)

The first Cramer Pick we’re looking at is Delta Air Lines, one of the largest ‘legacy carriers’ in the airline industry. Delta, based in Atlanta, Georgia, operates some 4,000 daily flights to more than 275 destinations around the world, including more than 500 weekly flights to various European destinations. The company boasts a market cap of more than $22 billion, and brought in $29.9 billion in revenue last year. In the last 9 financial quarters, Delta has posted 7 sequential revenue gains, marking a strong rebound from the COVID pandemic shutdowns.

A large part of Delta’s revenue improvements came in the second and third quarters of this year, when the top line jumped from Q1’s $9.4 billion to $13.8 billion in Q2 and just under $14 billion for Q3, a company record. The jump in revenues came as consumers shift their spending to experiences rather than stuff, and travel is a major beneficiary of that shift. Delta’s CEO described the summer travel season as ‘hectic.’

In addition to high revenues, the airline reported a second quarter in a row positive earnings, showing that the switch from net loss in Q1 to net gain in Q2 has some staying power. Adjusted EPS in Q3 came in at $1.51, just under the $1.53 forecast but well above the $1.44 EPS posted in Q2.

On a negative note, Delta reported a 48% increase in fuel costs during Q3, an indication that the airline is not immune to inflationary effects. Balancing this, the company is predicting further revenue growth in 4Q22, a positive cash flow balance for 2022, and up to $4 billion in annual free cash flow by 2024.

In coverage for Morgan Stanley, analyst Ravi Shanker sees an upbeat future for Delta and writes: “We remain bullish the Airline space overall and DAL is one of our preferred ways to play the upside… DAL’s results, guide and call reinforced this positive view on the topline and dispelled any notion of cracks in demand. We expect to get further reinforcement of the booking curve into the holiday season (and into January) through the rest of airline earnings.”

“While inflation is persistent (as it is for the rest of the economy), the operating leverage that DAL will see as demand comes back into a network that is already resourced up to receive it, should help offset the inflation,” Shanker added.

Given all of the above, Shanker has high hopes. Along with an Overweight (i.e. Buy) rating, he keeps a $65 price target on the stock. This target puts the upside potential at 87%. (To watch Shanker’s track record, click here)

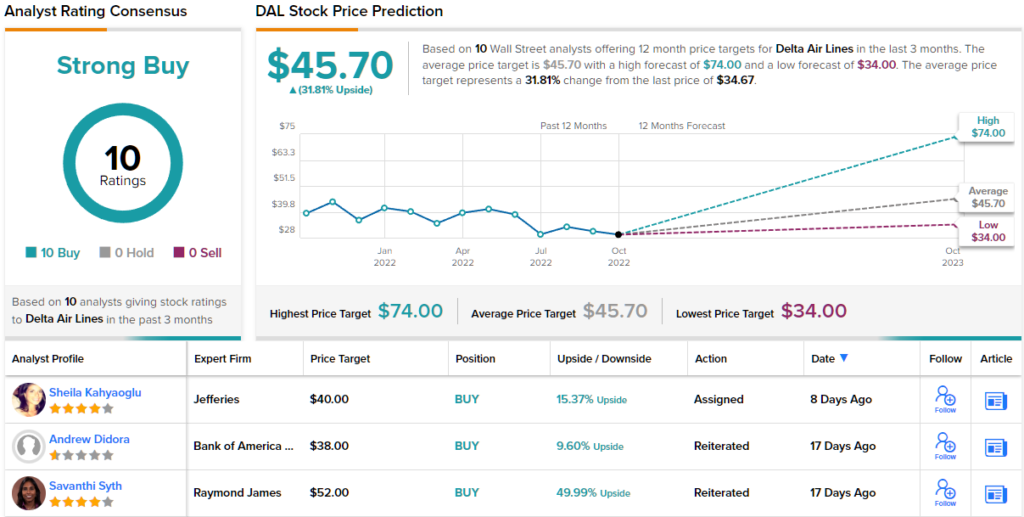

It’s clear from the Strong Buy consensus rating that the Street in on board with the bulls here – all 10 of the recent analyst reviews are positive, making that rating unanimous. The stock is trading for $34.67 and its $45.70 average price target suggests a gain of ~32% on the one-year timeframe. (See DAL stock forecast on TipRanks)

United Airlines Holdings (UAL)

Next on our list of ‘Cramer picks’ is Chicago-based United Airlines, another of the industry’s major legacy carriers, and with a $14 billion market cap, a legitimate giant of a corporation. United Airlines is North America’s largest passenger air carrier, and has more 3,100 daily flights to 400 US and international destinations. The company operates out of the major air hubs in Chicago, Houston, and San Francisco, and maintains a fleet of more than 800 aircraft.

United has been showing steady revenue gains since the COVID crisis of 2020, and in Q2 and Q3 of this year those gains accelerated. The company’s Q1 revenue was $7.6 billion, up more than double year-over-year, but revenue in Q2 hit $12.1 billion and in Q3, released in mid-October, it hit $12.9 billion. The Q3 result was up 65% y/y, and up 13% from the pre-pandemic 3Q19.

United’s earnings switched from negative to positive in Q2 of this year, and in Q3 the adjusted EPS of $2.81 beat the forecast of $2.28, and is up dramatically from the $1.02 EPS loss in Q3 of last year. United’s management is crediting the sharp gains in revenue and earnings to a surge in travel; the company’s CEO says that demand is strong now that workers are ‘untethered from the desk.’

This airline has attracted attention from Raymond James’ industry expert Savanthi Syth, who says of United: “We continue to believe 2023 revenue is likely to hold up better than for most U.S. peers due to outsized exposure to large corporate and international travel (still recovering), with somewhat unique cost tailwinds including the restoration of the widebody fleet that further stabilizes the operation, international capacity growth, and lower regional cost headwind (vs. American).”

To this end, Syth gives UAL shares an Outperform (i.e. Buy) rating, along with a $55 price target that indicates room for ~26% gain going forward into next year. (To watch Syth’s track record, click here)

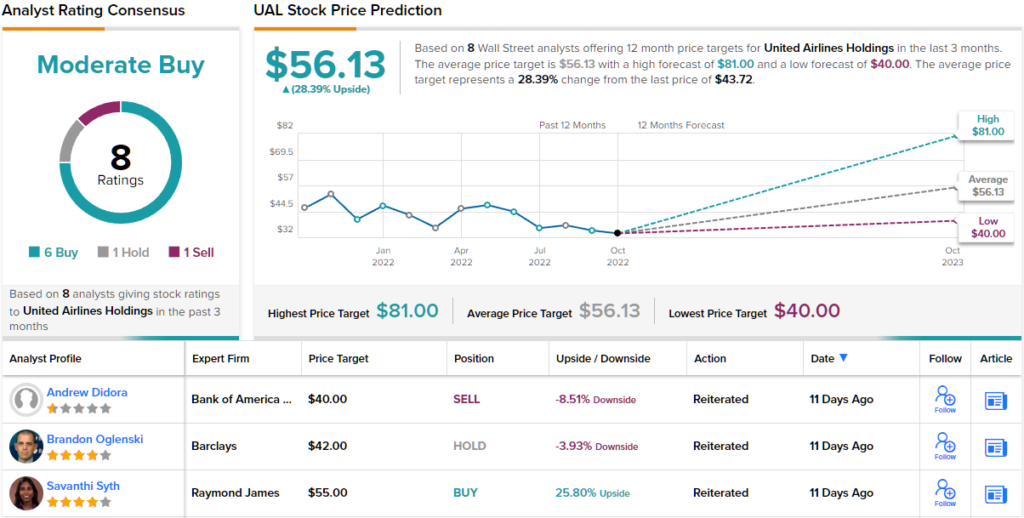

Overall, United’s stock has picked up 8 recent analyst reviews, and these include 6 Buys, 1 Hold, and 1 Sell for a Moderate Buy consensus rating. The stock is selling for $43.72 and its $56.13 average target suggests a potential upside of ~28% in the coming months. (See UAL stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.