Over half the companies on the S&P 500 have delivered first quarter reports, and the print, so far, isn’t pretty. According to FactSet, blended earnings have declined by 13.7%, and if results remain the same, the quarter will represent the steepest decline in earnings since Q3 2009, (-15.7%).

But there are always outliers, and ones you would not necessarily expect – particularly in the current climate.

Which brings us to General Motors (GM). The auto giant sprung a surprise on Wall Street when it delivered a stronger than expected earnings report earlier this week. Following the company’s earnings call, RBC’s Jospeh Spak said, “While 2Q20 will be ugly, we believe market will write it off and look to a better 2H20 and return to cash generation.”

GM announced a first-quarter net profit of $294 million, which represents EPS of $0.62, well ahead of the Street’s consensus estimate of $0.33 per share. And while revenue declined year-over-year by 6.2% to $32.7 billion, the figure still beat Wall Street’s $31.12 billion estimate.

The results were particularly pleasing, considering Detroit rivals, Ford and Fiat Chrysler, both reported losses.

Spak, though, doesn’t deny COVID-19’s impact on the business has required “significant amounts of capital.” The analyst estimates that after exiting 2019 with a net cash position of $2.4 billion, in 2Q net debt will increase to $7 billion. However, Spak believes the debt will be reduced to $5 billion by the end of the year, which bodes well “in comparison to other OEMs that may have greater difficulty returning to cash generation.”

Spak further added, “This recent downturn driven by COVID-19 gives us solid confidence that GM can hold up in a downturn, as recent transformation actions that have focused on improving capacity utilization and producing fewer low profit cars benefit GM’s performance. We believe uncertainty around downturn performance has been a contributing factor weighing on the multiple, but we think investors should begin to fade the overly pessimistic view.”

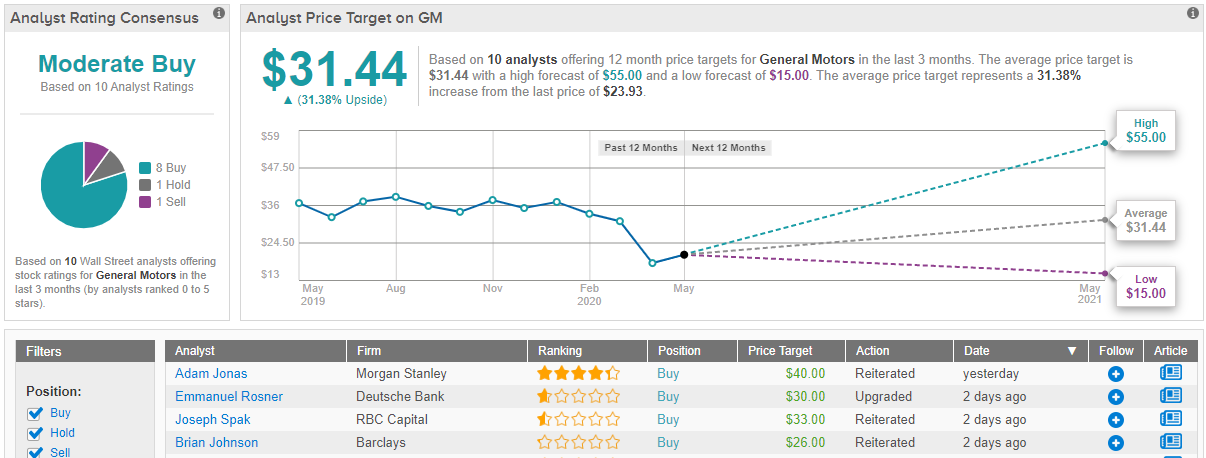

Spak reiterated an Outperform on GM in tandem with a $33 price target. Investors can expect upside of 51%, should the analyst’s prediction play out in the year ahead. (To watch Spak’s track record, click here)

The rest of the street is optimistic regarding GM, too. 8 Buys vs a Hold and Sell each, coalesce to a Moderate Buy consensus rating. Should the average price target of $31.44 be met in the next 12 months, expect returns in the shape of 31%. (See GM stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.