The global economy is already in the early throes of a recession, but business is booming at Amazon (AMZN). As Deutsche Bank’s Lloyd Walmsley puts it: “it may not be judicious for the company to be perceived as profiting from the COVID-related turmoil.”

The proof is in the pudding. While unemployment figures have risen dramatically since the viral outbreak has sent millions of workers home, Amazon has set in motion the hiring of an additional 100,000 employees to help with the surging demand. According to the NY Times, orders for Amazon groceries are 50 times higher than normal during this stay-at-home period.

The news has prompted Walmsley to touch down with a “logistics consultant intimately familiar with Amazon’s operations,” to gain insight on how the additional labor costs will impact the balance sheet. “We come away optimistic that near-term higher volumes on existing infrastructure and lower energy prices can help offset higher wages,” the 5-star analyst said.

Furthermore, Amazon has increased the warehouse hourly wages for the period, (from $15 to $17). This, along with overtime increasing from 1.5x to 2x regular wages, means costs will increase significantly, but these should be balanced out by higher sales.

“If we look at an incremental 15% retail revenue, or about 20% above our previous estimates, we could see a more significant $1.4B of contribution profit in 2Q, or about $454M/month, based on our back-of-the-envelope analysis. This sort of scenario helps put into perspective the incremental labor costs of $264M per month for higher wages and the $204M associated with new warehouse employees,” Walmsley said.

Tying it all together, in a bullish scenario, Walmsley believes the company will see an extra $1.4 billion from retail in the quarter, to be offset by the same amount in wages, so essentially back to square one. But lady luck is on amazon’s side again; The decline in energy prices means gas-related savings tip the scale by adding $378 million in 2Q.

To this end, Walmsley supports his bullish stance on Amazon shares with a “buy” rating. (To watch Walmsley’s track record, click here)

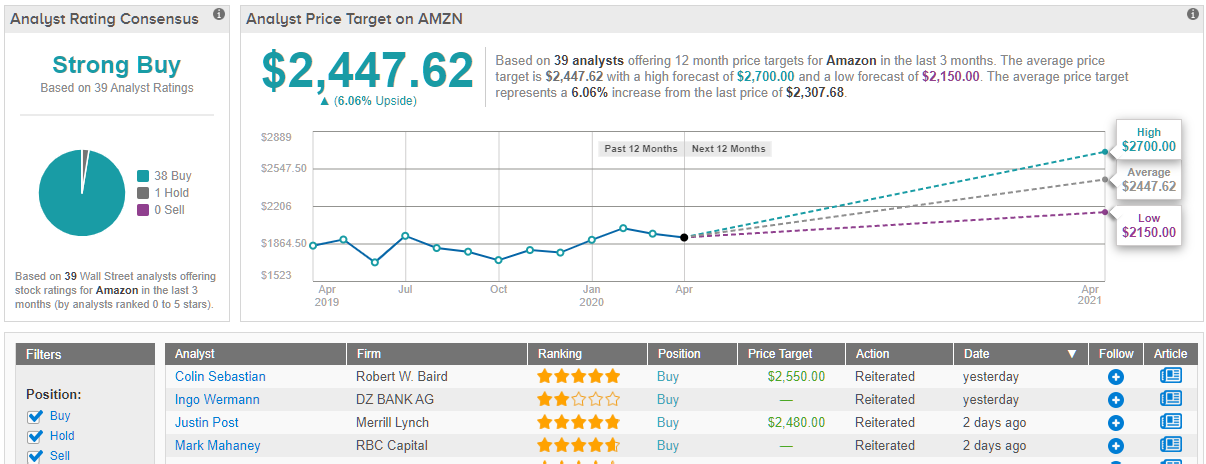

The rest of the Street shares the bullish thesis. Amazon’s Strong Buy consensus rating is based on 38 Buys and a single Hold. The average price target comes in at $2,429.97 and implies possible upside of 15%. (See Amazon stock analysis on TipRanks)