Shares of luxury retailers LVMH Moët ($MC) and Hermès ($RMS) are each up nearly 10% on news that China’s government is taking steps to stimulate the country’s ailing economy.

The stocks of LVMH Moët and Hermès are up 9% on reports that The People’s Bank of China has announced a new stimulus package aimed at reinvigorating the economy in the nation of 1.4 billion people. LVMH Moët and Hermès are each known for their designer handbags and couture fashion that’s featured on runways around the world.

China is the world’s biggest consumer market and a key driver of luxury good sales. Shares of European luxury brands are trending higher as investors anticipate increased demand for their products within China as the economy recovers. Prior to today, the stock of LVMH Moët had declined 7% this year while Hermès share price had risen 16%.

Reviving China’s Slumping Economy

China’s economy has steadily weakened coming out of the Covid-19 pandemic. Over the past two years, consumer spending has pulled back and the economy has struggled with a debt crisis in the country’s property sector.

Earlier in September, two prominent Wall Street banks, Goldman Sachs ($GS) and Citigroup ($C) each lowered their full-year 2024 projections for China’s economic growth to 4.7%. Previously, Goldman Sachs had forecast full-year growth for the Chinese economy of 4.9%, while Citigroup had forecast growth of 4.8%.

The downward revisions from the banks come after data showed that industrial activity in China slowed to a five-month low in August. Economists and market analysts have been calling on officials in Beijing to introduce economic stimulus measures for more than a year. News that China’s government is taking steps to stimulate the economy has stocks whose fortunes are linked to the country rising.

Is LVMH Moët Stock a Buy?

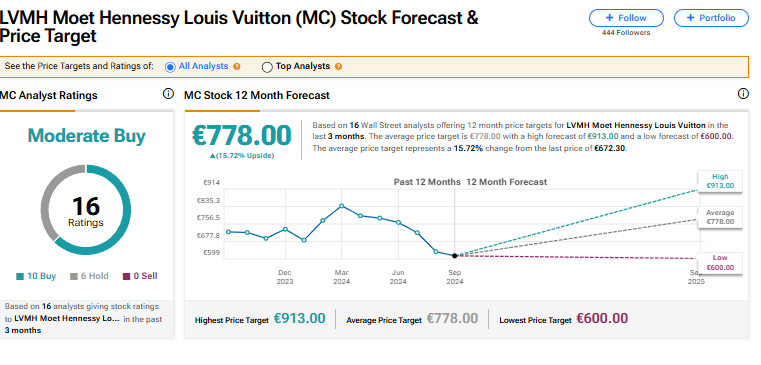

LVMH Moët stock currently has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on 10 Buy and six Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average price target of €778.00 (US$867.14) implies 15.72% upside from current levels.