Macy’s, Inc. (M) is reportedly seeking to raise as much as $5 billion in debt as it is struggling with depressed retail sales after government restrictions to contain the coronavirus pandemic forced the closure of all of the department chain’s stores.

According to the debt plan, the department chain will to use its inventory as collateral to raise $3 billion and real estate assets to raise $1 billion to $2 billion, CNBC reported.

All of the department chain’s 775 stores have been closed since March 18. Macy’s had also announced that it is suspending its quarterly dividend, drawing down on its credit line, freezing both hiring and spending, stopping capital spending, reducing receipts, and cancelling some orders and extending payment terms.

This month, Macy’s said that its CFO and Executive Vice President Paula Price will leave the company adding more uncertainty as to how the department chain will navigate its cost-cutting plan and saving measures as it grapples with an economy in turmoil amid the coronavirus-related global lockdowns.

Macy’s share price nosedived in recent months losing 70% of its value as result of the financial market downturn. Shares were up 1.7% at $5.31 in U.S. pre-market trading.

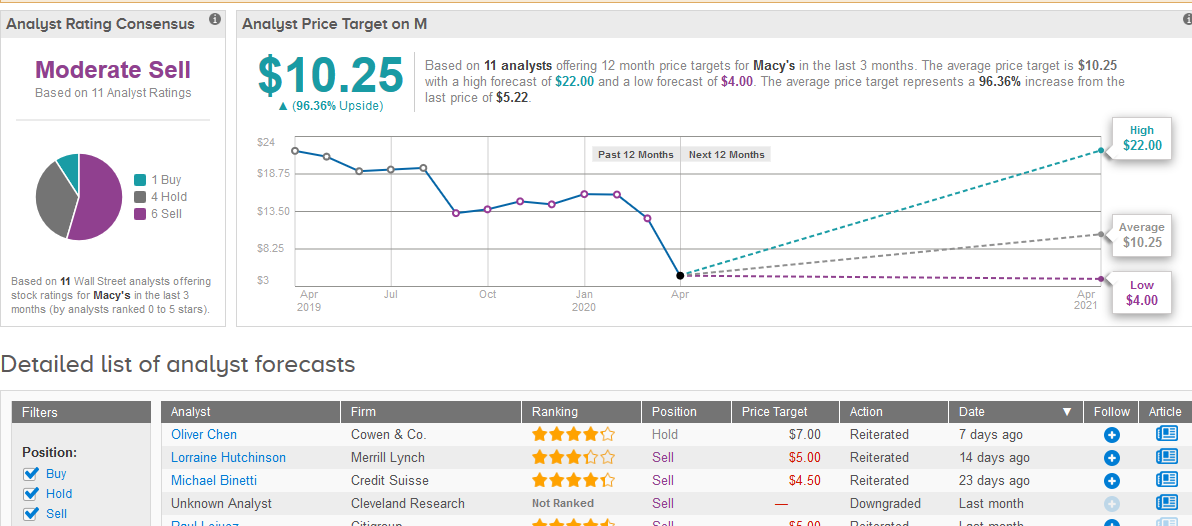

Four-star analyst Oliver Chen at Cowen & Co this month cut the company’s stock to $7 from $8, while maintaining a Hold rating.

The analyst community has a bearish stance on Macy’s stock as 6 say Sell, 4 Hold and 1 Buy adding up to a Moderate Sell consensus rating. The 12-month average price target of $10.25 suggests room for 96% upside potential in the coming 12 months. (See Macy’s stock analysis on TipRanks)

Related News:

United Airlines Seeks To Raise $1B With Massive Share Sale

Netflix Wins 15.8 million subscribers in Q1, Sees Growth Slowing in Virus Aftermath

Facebook Invests An Eye-Watering $5.7B in India’s Jio Platforms