Match Group (MTCH) shares have fallen sharply this year, down over 50%. Due to the significant downturn, Match Group is trading near 52-week lows, suggesting a bargain price given this profitable company’s growth potential.

While compelling, I would now refrain from using these low market valuations to Buy Match Group stock. Since the headwinds for this stock are likely to continue, I am bearish on the stock in the short term.

Interestingly enough, MTCH has a 2 out of 10 Smart Score rating, implying that it is likely to underperform the market for now.

Match Group is the parent company of dating services like Tinder, Match.com, OkCupid, Hinge, Plenty of Fish, and many others.

Further Downsides Ahead: The Triggers

Although people use the services of Match Group and its competitors even when the economy is not growing, this trend, which we observed during the COVID-19 crisis, still does not intrigue investors.

Investors believe the Federal Reserve’s monetary policy is not the right move to curb galloping inflation, as the issue is not demand-driven. Higher interest rates will hurt the economy and the stock market.

More headwinds for Match Group could also come from the two events briefly described below.

Following the Alphabet (GOOGL) (GOOG) lawsuit against Match Group for a breach of contract related to its Google Play Store billing system, Match Group’s stock price could be significantly reduced.

In addition, Match Group could be affected by the domino effect of Tesla (TSLA) owner Elon Musk’s decision to withdraw from the Twitter (TWTR) purchase agreement. Musk doesn’t trust Twitter’s stats on fake profiles, arguing that they don’t match the real number.

This doesn’t mean that there are too many fake profiles or ghost identities on social media, including those that specialize in dating services. However, there’s no doubt the incident increases user disenchantment, which can be psychologically debilitating with paid services.

Q1 2022 Saw Solid Growth and Profitability

Turning to the first quarter of 2022, in addition to a change in the board of directors, Match Group said total revenue grew 20% year-over-year to nearly $800 million, while adjusted operating income increased 19% to $273 million, for an adjusted operating margin of 34%.

Amid the most relevant business stats, the company reported a 13% increase in the number of payers to 16.3 million, while revenue per payer was $16, a 6% year-over-year increase.

The company also noted that its Tinder brand’s direct sales (up 18% year-over-year) increased, thanks to a higher number of payers (up 17% year-over-year to 10.7 million in Q1 2022) and higher revenue per payer (up 1% year-over-year).

All other brands as a unit saw an increase in the number of payers (up 7% year-over-year to 5.6 million) and revenue per payer (up 14% year-over-year). Total revenues of all other brands grew 22% year-over-year.

In addition, year-to-date cash flow from operations was $233 million vs. $102 million in the year-ago quarter, while total free cash flow was $215 million vs. $92 million in the year-ago quarter.

Q2-2022 Guidance Suggests More Growth to Come

For the second quarter, Match expects revenue in the range of $800 million to $810 million versus analysts’ median guidance of $805.95 million, implying around 13.5% growth at the midpoint. Operating income is expected to come in at $285 million to $290 million.

Safety-Oriented Growth Strategy

Match Group recently powered Tinder with the Garbo app, a non-profit background-checking platform that helps users spot potentially harmful and violent behavior behind profiles.

The company plans to extend this feature to other dating services and to continue its strategy to align with the need to increase the security of social networks against criminals.

As this type of cybernetic crime has increased in frequency enough to spark debate even at the institutional level, a company demonstrating its commitment to fighting this problem contributes positively to the image of its services.

The Balance Sheet Supports Growth Plans

The balance sheet, as of Q1 2022, appears to support the company’s strategy sufficiently.

While the $4 billion total debt versus total cash of $921.1 million raises some concerns about Match Group’s financial health, so much that its Altman Z-Score indicator is -0.3 (implying a relatively high risk of bankruptcy), the following two indicators are getting things going again.

Match Group’s interest coverage ratio of 5.9x says the company can easily pay interest charges accrued on the total debt. Even this high financial burden does not cause any problems. This ratio is calculated by dividing Match Group’s operating income of $208 million (for the three months ending March 2022) by interest expense of $35 million for the same period.

Additionally, a comparison of Match Group’s weighted average cost of capital of 9% with its return on invested capital of 23.5% shows that each investment yields more than it costs to raise the capital required to fund that investment project.

Wall Street’s Take on MTCH Stock

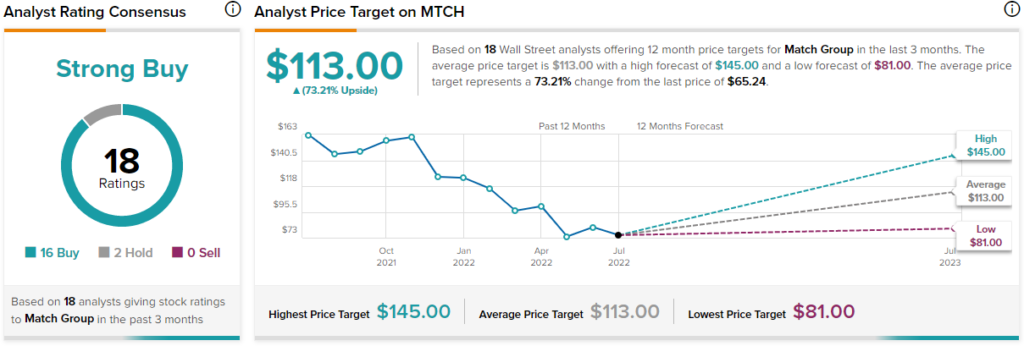

In the past three months, 18 Wall Street analysts have issued a 12-month price target for MTCH. The stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and zero Sell ratings.

The average Match Group price target is $113, implying 73.2% upside potential.

The Valuation Looks Relatively Cheap Based on Technical Factors

Shares are changing hands at $65.24 as of the writing of this article. MTCH has a market cap of $18.6 billion, a price/earnings ratio of 70.9x, and a price/sales ratio of 6x. The stock has a 52-week range of $63.33-$182.

Its current price is below its 50-day moving average of $74.95 and its 200-day moving average price of $111.26.

The stock seems cheap, but continued strong headwinds are likely to push the share price further down.

Conclusion – Excellent Upside Potential in the Long Term

This stock is a profitable venture with amazing upside potential once the bearish sentiment passes.

It is probably still too early to Buy shares, as prices are likely to reach lower levels for a number of well-considered reasons.