Merck & Co has entered into a definitive agreement to snap up all of the outstanding shares of drugmaker OncoImmune for an upfront payment of $425 million in cash. Shares advanced 2.2% in Monday’s pre-market trading session.

As part of the deal, Merck (MRK) will make sales-based payments and payments contingent to OncoImmune shareholders following the successful achievement of regulatory milestones. The closing of the acquisition, which is subject to regulatory approval, is expected before the end of 2020.

With the acquisition, Merck is adding OncoImmune’s lead therapeutic candidate, CD24Fc, for the treatment of patients with severe and critical COVID-19. The drugmaker recently published positive top-line findings for CD24Fc from an interim efficacy analysis of a Phase 3 study.

“Meaningful new therapeutic options are desperately needed for possibly millions of people around the world who will develop severe or critical COVID-19 disease,” said Roger M. Perlmutter, President of Merck Research Laboratories. “Recent clinical investigations support the view that CD24Fc may provide benefit beyond standard of care therapy for COVID-19 patients requiring oxygen support, and hence will represent an important addition to the Merck pipeline of investigational medicines and vaccines designed to address the COVID-19 pandemic.”

Interim analysis of data from 203 participants, or 75% of the planned enrolment, indicated that patients with severe or critical COVID-19 treated with a single dose of CD24Fc showed a 60% higher probability of improvement in clinical status, compared to placebo. The risk of death or respiratory failure was reduced by more than 50%. Detailed results are expected to be submitted for publication in a peer-reviewed medical journal.

In collaboration with Ridgeback Biotherapeutics, Merck is assessing molnupiravir, an investigational orally available anti-viral candidate, in two Phase 2/3 trials for the treatment of patients with COVID-19 in both the outpatient and inpatient settings. The company is also conducting clinical trials to evaluate two SARS-CoV-2/COVID-19 vaccine candidates: V590, being developed through a collaboration with IAVI, which utilizes a recombinant vesicular stomatitis vector, and V591, which uses a measles virus vector-based platform.

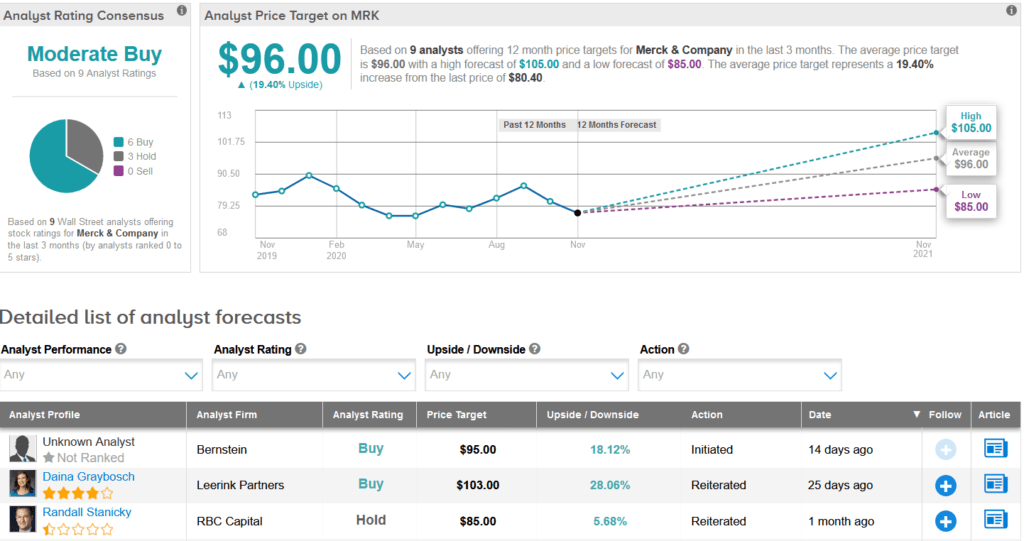

Merck shares have dropped 12% so far this year. The stock scores a Moderate Buy analyst consensus based on 6 Buys versus 3 Holds. Meanwhile, the average analyst price target of $96 implies 19% upside potential over the coming year.

Mizuho Securities analyst Mara Goldstein on Oct. 27 reiterated a Buy rating on the stock with a price target of $100 (24% upside potential).

“We like shares of MRK, as the company delivered 3Q20 EPS that exceeded revenue and EPS expectations and raised FY20 non-GAAP EPS guidance to $5.91 – $6.01 (previously $5.63 – $5.78). 3Q20 non-GAAP EPS was $1.74– above our estimate and consensus estimate of $1.34 and $1.44, respectively,” Goldstein wrote in a note to investors. (See MRK stock analysis on TipRanks).

Related News:

Regeneron’s Covid-19 Antibody Cocktail Wins FDA Emergency Use Nod

FDA To Review Pfizer-BioNTech Covid-19 Vaccine On Dec. 10

Eiger Pops 12% On FDA Approval For First Hutchinson-Gilford Progeria Treatment