Shares of home goods retailer Bed Bath & Beyond (BBBY) dropped by over 20% in yesterday’s session, following an update on the company’s first two months (Dec/Jan) of fiscal 4Q’s performance. Needless to say, investors were beyond disappointed with the news.

Despite the benefit from the timing of Cyber Monday, during the quarter comparable sales dropped by 5.4% as opposed to the estimate’s call of -1.5%. Comps were down by 13% once adjusted for a calendar shift, and gross margins declined by about 300bps. Management explained low inventory in some merchandise categories was to blame for the downturn, along with increased promotional outlays.

The new data comes on the back of fiscal 2019’s previous three reports, in which the company posted both earnings and sales declines in all three. Following the disappointing Q3 print, management warned investors to expect weak sales and earnings trends to continue in Q4, in addition to withdrawing its full year guidance.

The disappointing announcement was all the more pronounced as the company had previously sought to calm investors with assurances it was on the right track to turn its fortunes around. In January, it announced a new real estate deal that provided the retailer with an extra $250 million. This was preceded by new CEO (ex-Target CMO) Mark Tritton’s ousting of six senior executives in December in the first stage of a reboot.

So, should investors stay away from BBBY right now? Not according to Merrill Lynch’s Curtis Nagle. Despite the disheartening report, Nagle thinks the results mark a low point, and believes it is “too early to throw in the towel.” Heading into 2020, Nagle cites several factors including a large rebasing of SG&A (selling, general and administrative expenses), direct sourcing initiatives and lowering lease costs which should stabilize operating earnings and lead to growth in 2021E.

Nagle further added, “BBBY remains a leading home furnishings retailer with opportunity to expand core and non-core concepts. After several years of declining productivity and heavy investment we believe BBBY could be positioned for earnings upside on cost reductions, store rationalization and unlocking value from secondary concepts… We maintain our view that Mr. Tritton will be a magnet for talent and the potential magnitude of a turnaround and BBBY’s current share price could be an appealing draw in terms of incentive comp.”

Therefore, the Merrill Lynch analyst kept his Buy rating intact. The negative news, though, have caused a reduction of the price target, down from $21 to $20. With BBBY currently trading at $11.79, the upside potential still comes in at a hefty 70%. (To watch Nagle’s track record, click here)

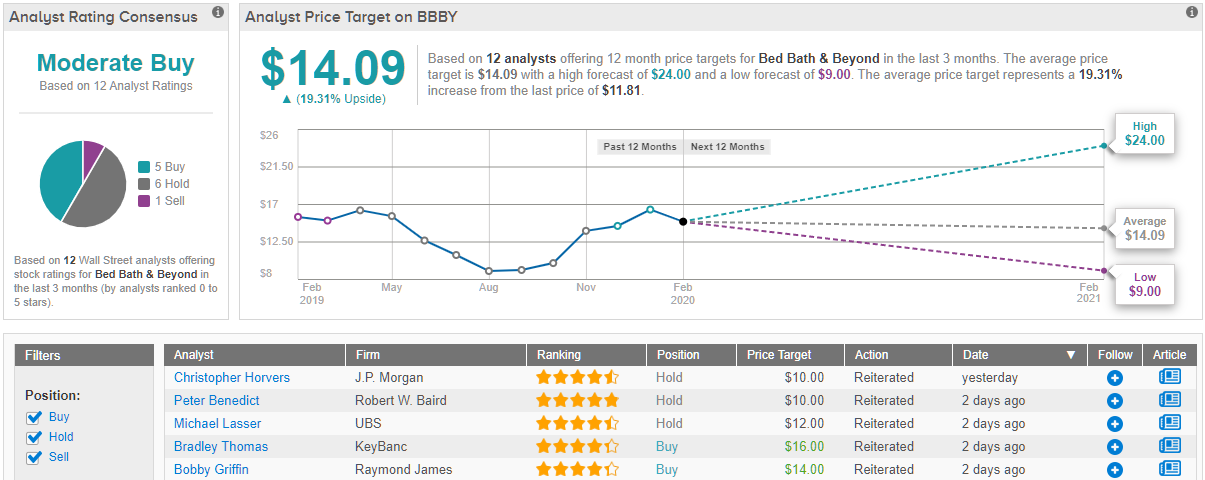

Out on the Street, the views on BBBY’s prospects are a mixed bag, yet the bulls are currently in control. 5 Buys, 6 Holds and 1 Sell add up to a Moderate Buy consensus rating. Investors will head to bed (bath & beyond) with a 19% gain, should the average price target of $14.09 be met over the coming months. (See BBBY stock analysis on TipRanks)