In this article, we’ll use TipRanks’ Comparison Tool to see where Wall Street stands on tumbling tech titans Meta Platforms (NASDAQ:META) and Block (NYSE:SQ) as they look to pivot. Both are standout technology companies that combined a name change with a big focus shift. Indeed, the brutal bear market has not been kind to either company. Amid concerns weighing down their traditional businesses (social media for Meta and payments for Block), both firms committed to evolving to keep the growth alive.

Indeed, tech companies must stay on their toes to stay on the cutting edge of innovation and resist the gravitational pull that tends to bring down their growth rates with time.

Though a looming recession and fading consumers may be mostly to blame for a few rough quarters at Meta and Block, it’s also arguable that competition has begun to get the better of them. Even as numbers begin to wane in a recession year, tech companies must continue to innovate and flex their muscles to retain and grow market share.

At the end of the day, every firm feels the pressure of an economic downturn. The companies that can take share will rebound with fury once it’s time to rebound. Firms that lose share may not be so quick to get back on their feet again and may be in a spot to face amplified pain, even amid a “mild” recession.

Fortunately, Meta and Block both have capable leaders. Though skeptics are scratching their heads over the strategic pivots of both firms, I think there are a lot of gains to be had by giving either founder CEO the benefit of the doubt.

Meta (META)

There aren’t too many believers in CEO Mark Zuckerberg’s metaverse project. It’s been a costly endeavor, and critics want to see the firm slow its aggressive push into the metaverse. With 11,000 workers laid off, a very “sorry” Mark Zuckerberg seems to be on the right track. Though, only a significant cut to the metaverse budget could be enough to power a rally from these depths.

Though Zuckerberg desires to go all-in on the metaverse (if he’s not already doing so with a multi-billion-dollar budget and company name change), market forces are pushing for cuts. Indeed, layoffs have been the big story in the big-tech Silicon Valley firms. As Meta looks to follow in the footsteps of its peers, there’s a good chance the firm’s metaverse ambitions could be curbed.

The social media business faces tremendous pressure amid weakness in ads. Advertiser budgets are feeling the pinch. With fourth-quarter revenue forecasts coming in on the low end in the $30-32.5 billion revenue range, it’s tough to tell when Meta’s cash cows (Facebook and Instagram) will see some relief.

As the cash engine slows further into a recession, so too could the metaverse push. Indeed, metaverse efforts haven’t really impressed thus far, and they may not for at least another few years. With such high stakes for virtual-reality dominance, activist investors pushing for colossal metaverse-spending cuts may not get what they want.

In any case, Meta’s valuation is starting to get absurd. The stock is down more than 70% from its 2021 high. At 10.7 times trailing earnings, investors stand to get a lot for their dollar, even if Meta’s metaverse pivot causes it to slip further.

In short, investors are no fans of Meta’s pivot. Zuckerberg will need to do a lot to win back trust as its growth rate stalls.

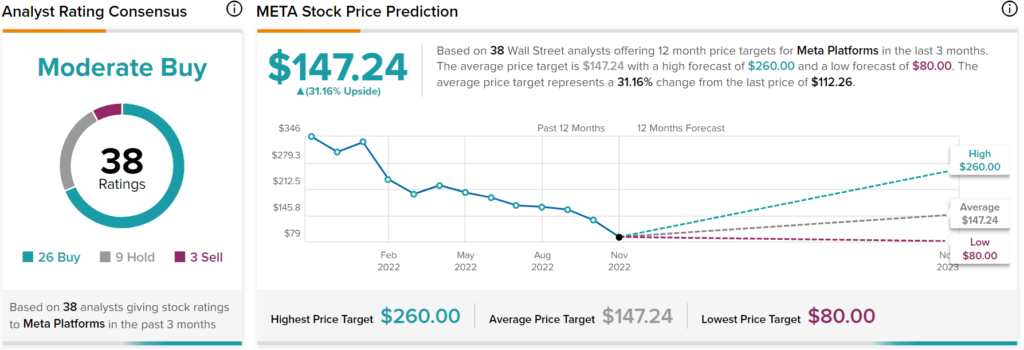

What is the Price Target for META Stock?

Wall Street loves Meta Platforms despite the hefty metaverse losses. Indeed, it has a Moderate Buy consensus rating based on 26 Buys, nine Holds, and three Sells assigned in the past three months. The average META stock price target of $147.24 is lower than it was a year ago but still implies a nice 31.16% gain.

Block (SQ)

Jack Dorsey’s Block (formerly Square) is attempting to climb back after a more than 80% fall from peak to trough. The Square payments business is under pressure amid weakening consumer spending.

Still, I think the pressure facing the firm goes beyond macro headwinds. The payments business is fiercely competitive. Apple’s (NASDAQ:AAPL) aggressive push to expand its Wallet and PoS (Point of Sale) capabilities could wallop Square well after the recession ends.

Fintech is not an easy place to compete in right now. Though Dorsey is pursuing Bitcoin (BTC-USD) projects and all the sort, it’s tough to tell when Block stock can draw a line in the sand after a historic drop.

Indeed, Block may be the company that brings forth a blockchain product that changes the game. However, there’s also a good chance that Block’s spending spree may flop. It’s hard to tell. That’s why I’d only bet on Block if you’re a believer in Dorsey.

For now, Cash App is a strong offering with powerful network effects. At 2.1 times sales, SQ stock is a very intriguing play that offers massive upside if its pivot goes right.

With a 2.36 beta, though, investors had better fasten their seatbelts, as shares will be far more volatile than the broader market averages.

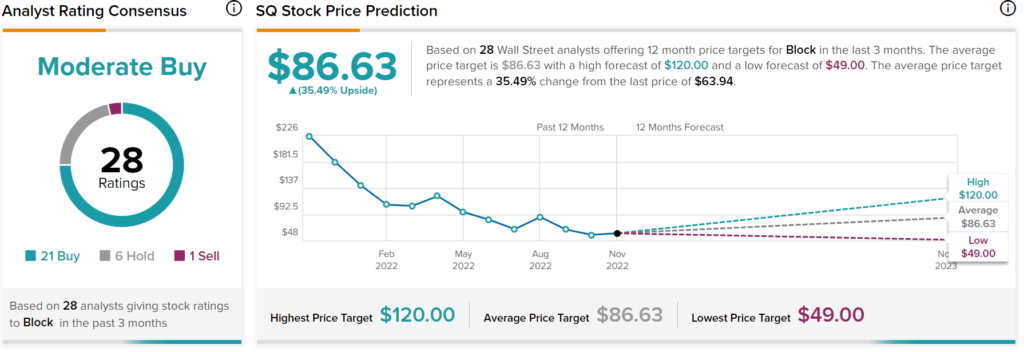

What is the Price Target for SQ Stock?

Wall Street is optimistic about Block, with a Moderate Buy consensus rating based on 21 Buys, six Holds, and one Sell assigned in the past three months. The average SQ stock price target of $86.63 implies 35.49% upside from here.

Conclusion: Markets Currently Don’t Like Money-Losing Projects

Meta is looking at the metaverse for growth, while Block is eyeing the blockchain for next-generation payment systems. The metaverse and the blockchain are two very intriguing areas of tech that could pay major dividends down the road. For now, though, such projects will be money losers, and in a rising-rate environment, the last thing investors want is a cash sink of a project with little clarity of success.