Canadian grocery store chain Metro ($TSE:MRU) posted earnings that showed profits down amid growing competition.

Metro’s Fiscal fourth-quarter profit came in at $219.9 million. In 2023’s fourth quarter, the company posted $222.2 million. However, there was something of a saving grace as profit came out to $0.98 per diluted share against the $0.96 per diluted share back in 2023. That was connected to a reduced number of total shares outstanding in 2024 when compared to 2023.

Quarterly sales totaled $4.94 billion. That was down from 2023’s fourth quarter, when Metro brought in $5.07 billion in sales. Food purchases were up 2.2%, and online food sales surged 27.6%. And pharmacy sales also gained ground, up 5.7%. CEO Eric La Fleche declared this a “transition year,” and considered the numbers turned in to be well within the company’s guidance.

A Competitive Market

Meanwhile, La Fleche faced a new and unexpected challenge from his own government, as officials in Ottawa are looking to bring in foreign grocery store chains to Canada. La Fleche declared the Canadian grocery retail market to be “very competitive” already.

While La Fleche did not encourage the Canadian government to rebuff such plans outright, he did note that there was already substantial competition within the field. Between “…large global players…,” “…strong regional and national competitors…,” “…strong local independents….” and major online brands like Amazon ($AMZN), there is no shortage of competition.

Is Metro Stock a Buy?

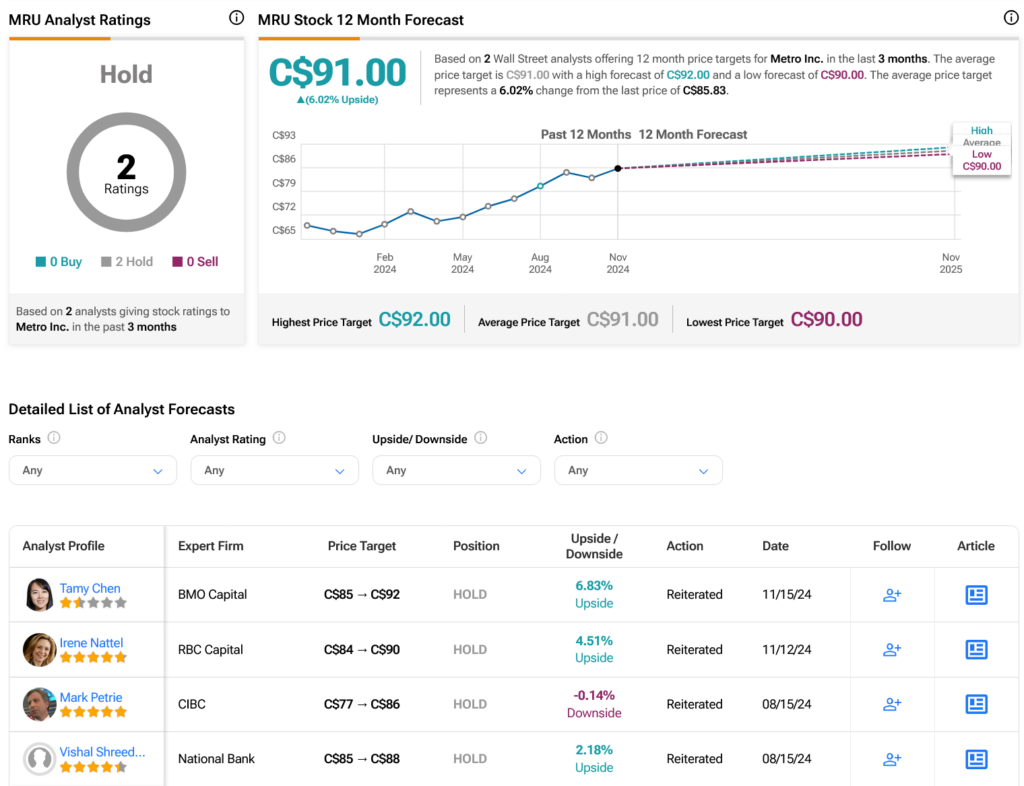

Turning to Wall Street, analysts have a Hold consensus rating on TSE:MRU stock based on two Holds assigned in the past three months, as indicated by the graphic below. After an 26.96% rally in its share price over the past year, the average TSE:MRU price target of C$91 per share implies 6.02% upside potential.