Micron Technology Inc (MU) beat third-quarter sales estimates lifting shares up by almost 6% in Monday’s after-market trading as work-from-home and online learning trends boost demand for cloud data center and notebooks services.

The stock rose to $51.95 in after-market trading after the U.S. memory chipmaker said that sales are also expected to remain strong in the second half of its fiscal year.

In the third quarter ended May 28, Micron earned 82 cents per share on a diluted basis, which is above the 77 cents per share estimate by analysts. Revenue during the same comparative period rose 13.6% to $5.44 billion, beating analysts’ estimates of $5.31 billion.

In the current fourth quarter, Micron forecasts revenue to be between $5.75 billion and $6.25 billion versus analysts’ consensus of $5.51 billion.

During the coronavirus pandemic, consumers are continuing to significantly increase online activity, including e-commerce, gaming and video streaming all of which drive additional data center capacity. Shares in Micron surged 42% since mid-March as trends like working-from-home and online learning boosted demand for its memory chips and chromebooks or tablets. The chipmaker said that cloud DRAM memory chip sales grew significantly quarter over quarter.

“Micron’s exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment,” said Micron CEO Sanjay Mehrotra. “We are ramping the industry’s most advanced DRAM technology into production and have delivered more than 75% of our NAND volume as high-value solutions, supported by record SSD revenue in the quarter. Our portfolio momentum positions us exceedingly well to leverage the long-term growth across our end markets.”

Mehrorta added that most of the chipmaker’s fab and assembly sites operated at full production throughout the reported quarter. Micron expects data center trends to continue to be strong, and new gaming consoles to be a tailwind to demand in the second half of the year.

Following the financial results, five-star analyst Hans Mosesmann at Rosenblatt Securities maintained a Buy rating on the stock with a bullish $100 price target (103% upside potential), saying that 2020 will be a recovery year for the industry with Micron in a significantly better cost competitiveness position relative to previous cycles.

“We like the setup for MU for the back half of 2020 and into 2021 on the notion that the memory cycle, while getting hit by COVID-19, is alive and well,” Mosesmann wrote in a note to investors. “The end markets, while clearly in uncertain times, are becoming broader than just work-from-home (WFH) driven by resumption in global economic activity, and for Micron, this scenario suggests to us a stronger cycle for the company given its much stronger position vs. the last cycle.”

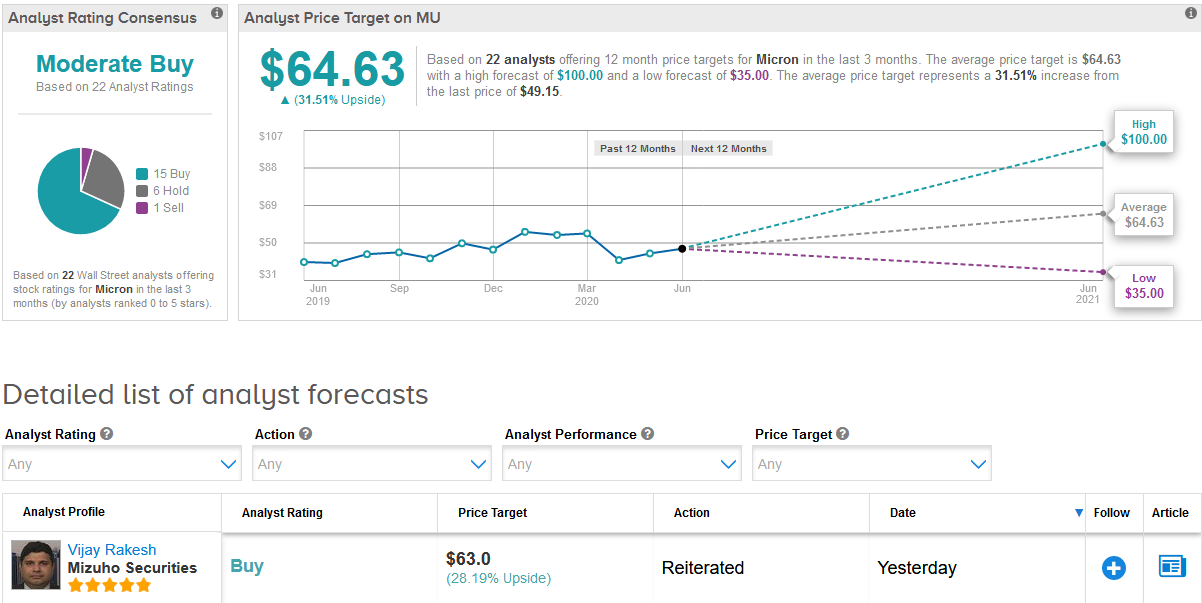

Overall, Wall Street analysts are cautiously optimistic on the stock. The Moderate Buy consensus shows 15 Buy ratings versus 6 Hold ratings and 1 Sell rating. The $64.63 average price target would provide investors with a potential 32% gain in the stock in the coming 12 months. (See Micron’s stock analysis on TipRanks).

Related News:

Microsoft’s Xbox Closes Mixer Live Streaming, Partners With Facebook Gaming

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform

Nintendo To Reduce Mobile Gaming Presence, Wedbush Downgrades Stock