Idaho-headquartered Micron Technology (MU) manufactures and sells semiconductors, along with other memory and storage products worldwide. I am bullish on MU stock.

Micron is the talk of the town on Wall Street, but not in a good way. July’s first day, also the first day of 2022’s second half, brought pain for Micron’s shareholders as the stock price fell and just couldn’t seem to get back up.

Adding insult to injury, a number of high-profile financial experts lowered their price targets on Micron stock. Is the company in major trouble, then? Should the shareholders dump their shares and never look back?

Short-term traders might find reasons to stay on the sidelines, as some of the bearish arguments have merit. Nevertheless, a buy-and-hold strategy with Micron stock could provide decent returns. After all, a stock has to fall before it can stage a spectacular comeback.

On TipRanks, MU scores a 5 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Weighing Down an Entire Sector

When bears attack, they often do it in groups. Such is the case with Micron’s critics, who had a field day on July 1, the day after Micron reported its results for fiscal 2022’s third quarter.

Frankly, the shareholders really needed a boost. Even before the quarterly results were revealed, Micron stock had already slipped from nearly $100 in January to around $55 in late June. That’s not entirely bad news, though, as Micron’s trailing 12-month P/E ratio had come down to a highly attractive level of 6.68. There’s also the silver lining that Micron continues to pay dividends, with the forward annual yield currently set at 0.69%.

So, did the shareholders get a boost after the results were announced? Not at all, as Micron stock dropped on July 1. It was so bad that practically the entire semiconductor sector of stocks suffered collateral damage that day. This just goes to show how Wall Street views Micron as a sector leader, for better or for worse.

So, were Micron’s quarterly results really all that bad? For Q3 FY2022, Micron generated $8.64 billion in revenue, beating the $7.42 billion reported in the year-earlier quarter, and only barely missing the analysts’ consensus estimate of $8.66 billion. In terms of non-GAAP diluted earnings per share (EPS), Micron’s quarterly result of $2.59 easily exceeded the year-ago quarter’s result of $1.88, as well as the analysts’ expectation of $2.44.

All of this sounds great, so far. What could the investors and financial experts possibly complain about? The answer lies not within the reported results, but in Micron’s soft forward guidance.

Cutting Deep

Looking ahead to the fiscal year’s fourth quarter, analysts projected that Micron would generate $9.14 billion in revenue. However, Micron came out with a forecast in a range between $6.8 billion and $7.6 billion, falling short of what the experts had in mind.

Furthermore, the analysts had expected Micron to post Q4 adjusted EPS of $2.57, but the company’s own estimate turned out to be much lower, falling into a range of $1.43 to $1.83. Suffice it to say, some analysts weren’t very pleased with this.

For instance, Mizuho analyst Vijay Rakesh wielded his proverbial knife, slashing his price target on Micron stock from $95 to $84 per share, and declaring, “While we had cut estimates below consensus, we did not cut enough.”

Raymond James analyst Melissa Fairbanks, meanwhile, chopped her price target on Micron stock from $115 to $75. Apparently, Fairbanks wasn’t too surprised by the company’s downbeat Q4 outlook as “the reset was generally expected given increasingly bearish macro concerns.”

The most painful cut of all, though, may have come from Bank of America (BAC) analysts, who downgraded Micron stock from Buy to Neutral and declared that recovery is “unlikely” this year. Additionally, Bank of America analyst Vivek Arya brought his price target on the stock down from $70 to $62, citing weak consumer demand for PCs and smartphones, COVID-19 lockdowns in China, and slower enterprise-segment sales.

Despite all of this negative sentiment – and in spite of the company’s soft guidance for Q4 – Micron CEO Sanjay Mehrotra seems surprisingly upbeat. “We are confident about the long-term secular demand for memory and storage and are well-positioned to deliver strong cross-cycle financial performance,” the CEO stated.

It’s also reassuring that, in Mehrotra’s words, Micron is “taking action to moderate our supply growth in fiscal 2023.” This could be a necessary step to align the company’s output with the demand for Micron’s tech components.

Wall Street’s Take

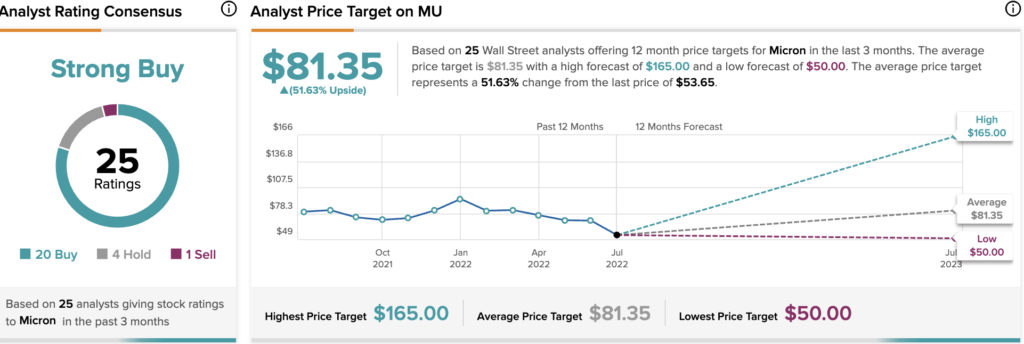

According to TipRanks’ analyst rating consensus, MU is a Strong Buy, based on 20 Buy, four Hold, and one Sell ratings. The Micron Technology price target is $81.35, implying 51.63% upside potential.

The Takeaway

It takes guts to hold a stock when some of Wall Street’s experts are issuing downgrades and price-target cuts. However, Micron readily acknowledged the company’s headwinds and soft forward guidance could provide a setup for an upcoming earnings beat.

Thus, deeply negative sentiment shouldn’t necessarily be viewed as a reason to bail on Micron stock. If you’re willing to sit tight through the next few quarters, Micron just might offer positive surprises for its boldest and most patient investors.

Read full Disclosure