Microsoft ($MSFT)-backed OpenAI revealed several new tools at its DevDay on Tuesday. This included a public beta version of the “Realtime API” that will allow developers to create AI-driven speech-to-speech interactions in their apps through a single set of instructions.

According to a Financial Times report, Kevin Weil, chief product officer at OpenAI, emphasized the company’s vision by stating, “We want to make it possible to interact with AI in all of the ways that you interact with another human being.”

OpenAI Unveils Other Tools on DevDay

On top of this, OpenAI announced increased access to its new model series called o1, which features enhanced reasoning abilities, as well as GPT-4o’s advanced voice capabilities. This technology will be available to developers in real-time, enabling AI to understand voice commands and converse in a live setting, similar to a phone call. OpenAI believes that this push to bring AI agents to the public is a key part of its strategy for driving future profits.

OpenAI Aims to Complete a Funding Round this Week

While revealing new tools, the startup that has taken the world of AI by storm is also aiming to complete a $6.5 billion funding round this week at a valuation of $150 billion. The company has been courting investors, and its discussions have involved key players like Microsoft, Nvidia ($NVDA), and SoftBank ($SFTBY).

In addition to this, the company has undergone a slew of changes over the past month, from changing its corporate governance to giving a stake to founder Sam Altman and the CTO’s abrupt exit.

Is Microsoft a Buy or Sell?

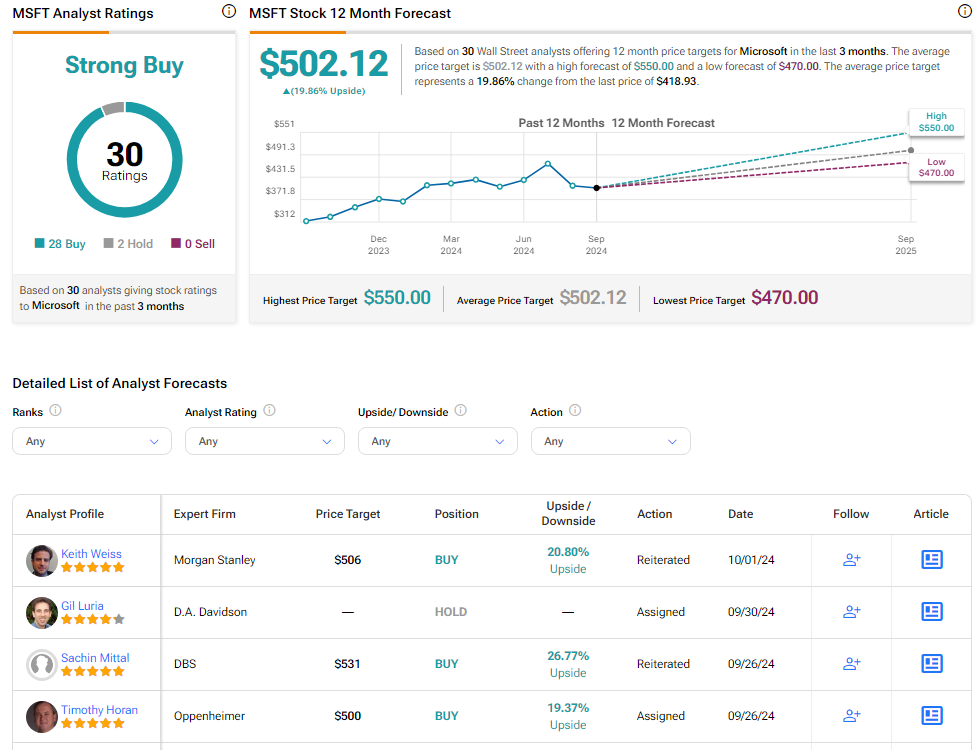

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 28 Buys and two Hold recommendations assigned in the past three months, as indicated by the graphic below. After a more than 30% rally in its share price over the past year, the average MSFT price target of $502.12 per share implies 19.9% upside potential.