Microsoft Corp. (MSFT) has announced a development in hydrogen fuel cells by using them to power its Azure datacenter for 48 consecutive hours.

Shares were up 1% on July 29 at $203.72.

The tech giant says that it has developed a 250-kilowatt fuel cell system that is enough to power a full row of datacenter servers. Microsoft says that the price for hydrogen fuel cells has decreased to the point where they are now affordable for mass deployment as an alternative to diesel-powered backup generators.

In a July 27 press release, Microsoft Principle Infrastructure Engineer Mark Monroe talked about diesel-powered datacenters saying, “They are expensive. And they sit around and don’t do anything for more than 99% of their life.” He added, “And the idea of running them on green hydrogen fits right in with our overall carbon commitments.”

The news is considered a milestone for Microsoft as it marches toward its goal of being carbon negative by 2030. The company says that the process for refueling the fuel cells is similar to diesel fuel with long-haul vehicles that pull up to datacenters to refill their tanks.

Microsoft Chief Environmental Officer Lucas Joppa said, “All of that infrastructure represents an opportunity for Microsoft to play a role in what will surely be a more dynamic kind of overall energy optimization framework that the world will be deploying over the coming years.”

Joppa is also Microsoft’s representative on the Hydrogen Council, which represents leading energy, industry, and transport companies seeking to jumpstart the hydrogen economy.

Microsoft says its next steps are to acquire and test a hydrogen fuel cell system that is 3-megawatts in power, which is roughly equivalent to a diesel-powered backup generator used for an Azure data center.

On July 23, Mizuho Securities analyst Gregg Moskowitz commented on Azure, saying, “Revenue doesn’t tell the whole story as MSFT noted an increase in the number of larger, longer-term Azure contracts.” He added that this is “evidenced by strong commercial bookings growth and commercial RPO growth.” He reiterated a Buy rating on the stock and a price target of $225, which implies 10% upside potential.

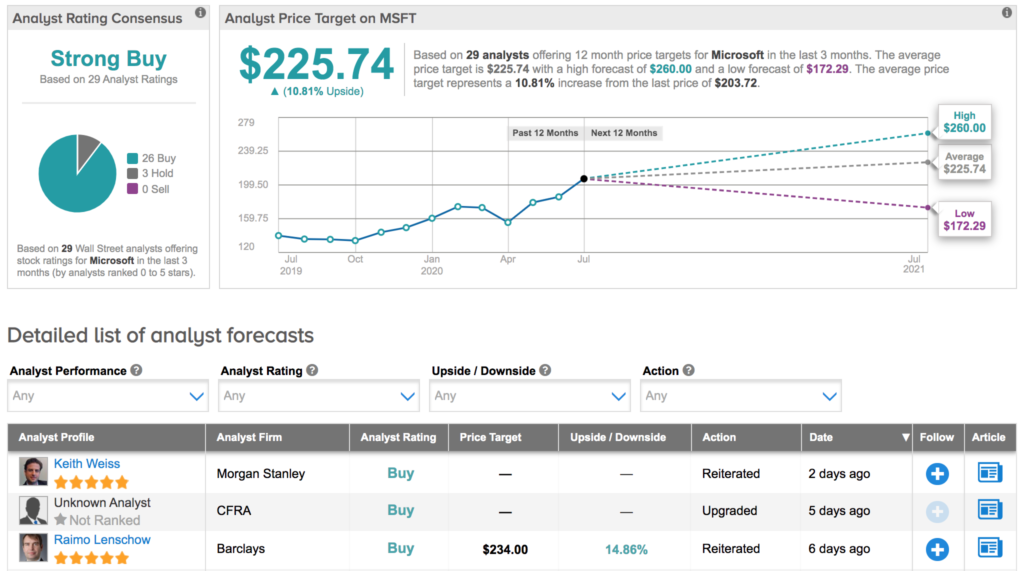

Microsoft’s stock is up 29% year-to-date with a Strong Buy analyst consensus that breaks down into 26 Buy ratings versus 3 Hold ratings and no Sell ratings. The $225.74 average price target suggests 11% upside potential for the shares in the coming 12 months. (See Microsoft’s stock analysis on TipRanks).

Related News:

Slack Files EU Complaint Against Microsoft For Trying To Eliminate Competition

Microsoft Plans To Become Carbon Neutral By 2030

Apple Announces Plan To Become Carbon Neutral By 2030