The Middleby Corp. has agreed to acquire Welbilt Inc. in an all-stock deal. This acquisition is expected to enhance Middleby’s Commercial Foodservice platform with the addition of Welbilt’s products, brands, and technologies while also boosting Middleby’s growth in key global markets. Middleby shares were down about 7.5% in the pre-market session on Wednesday.

Middleby (MIDD) CEO Timothy FitzGerald said, “Today’s announcement represents a milestone event for Middleby, Welbilt, and the Commercial Foodservice Equipment industry. The combination of our two great companies creates a leading player with a comprehensive product line, global footprint, and advanced technologies and solutions that are well-positioned to serve our rapidly changing customer needs and capitalize on emerging industry trends.”

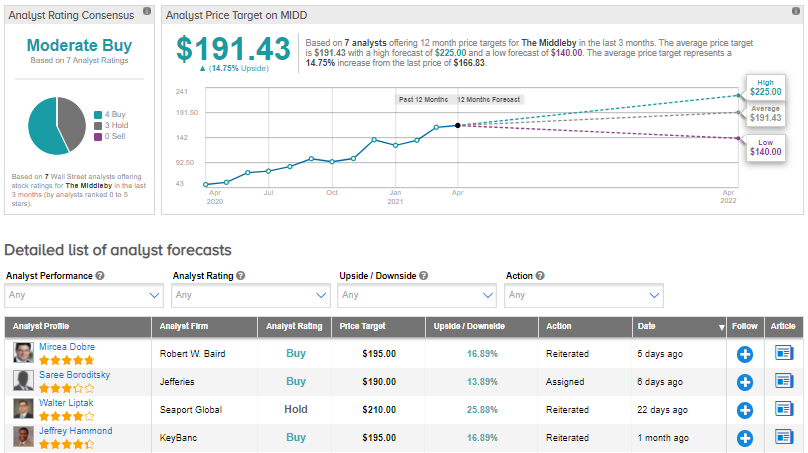

Under the agreement, investors of Welbilt will receive Middleby shares at an exchange ratio of 0.1240x. This implies an enterprise value of $4.3 billion for Welbilt and represents a 28% premium to Welbilt’s stock price. (See Middleby stock analysis on TipRanks)

Upon closure, Middleby investors will own 76% of the combined entity and the rest will be owned by Welbilt shareholders.

Furthermore, the largest stakeholder in Welbilt, Carl Icahn (8.4% stake), has entered into a support agreement favoring the acquisition. The acquisition is expected to close in late 2021.

On April 15, Jefferies analyst Saree Boroditsky reiterated a Buy rating on the stock and a $190 price target (13.9% upside potential).

After hosting a commercial foodservice distributor call, Boroditsky highlighted key takeaways: 2021 demand is poised to reach 2019 levels, there have been two rounds of price increases in 2021 so far, and a long lead time for products was caused by supply chain issues in combination with strong demand.

Boroditsky added, “Manufacturers are getting inundated with orders, and lead times have extended for some products from ~4 weeks until the end of August.” The analyst believes local manufacturers have more availability but the situation could change in the case of a shortage of components.

Consensus on the Street is that Middleby is a Moderate Buy, based on 4 Buys and 3 Holds. The average analyst price target of $191.43 implies upside potential of 14.8%. Shares have gained about 243.5% over the past year.

Related News:

Nvidia’s $40B Proposed Takeover of Arm Faces Scrutiny By UK Govt

Tesla Will Be Probed For Vehicle Crash Data By Texas Police – Report

Coca-Cola’s 1Q Results Beat Estimates Amid Uneven Global Economic Recovery