Tiny biopharmaceutical company Milestone Pharmaceuticals (MIST) had a big day Thursday, first announcing the completion of one study (NODE-301) and the continuation of a second (NODE-301B, now to be renamed the “RAPID study”), that will, together, support a future New Drug Application submission to the FDA for its etripamil cardiovascular drug — then announcing a $25 million private placement (a “PIPE”) to raise cash to continue its work.

Milestone further advised that it has met with the FDA and agreed on “an efficient path to registration for etripamil which eliminates the need to start a new Phase 3 study.” Specifically, based on data from the NODE-301 study (and partially on the RAPID study as well), the FDA has agreed to modify how the RAPID study proceeds going forward. In particular, the latter study will now permit Milestone “to administer an additional dose of study drug 10 minutes after the first dose if [patients] still experience signs and symptoms of a supraventricular tachycardia (SVT) episode.”

The stock nearly tripled in value on the news — up 167% by day’s end after retreating from its highs.

How significant are these two studies? In a note discussing Milestone’s announcement, Cowen analyst Ritu Baral reminds that Milestone’s etripamil drug is an “intranasal novel calcium channel blocker” designed to treat paroxysmal supraventricular tachycardia, a type of heart arrhythmia.

The 5-star analyst sees the FDA’s decision as a bit of a surprise — but a good one. For one thing, she notes that the decision to allow Milestone to administer additional doses to a single patient “speaks highly of the drug’s safety profile from ‘301.” (Apparently, patients tolerate the drug quite well). For another, the chance that these additional doses will improve the drug’s effectiveness “allows for even better possible clinical efficacy from topline data.” Basically, if the first 70mg etripamil dose doesn’t do the trick, Milestone will be allowed to administer a second dose 10 minutes later — giving the drug a second chance to slow the patient’s heartbeat down to a normal rate and achieve a successful outcome.

In the analyst’s opinion, this leeway that the FDA is allowing Milestone means “the RAPID trial is well set up for success” when data comes out in late 2021 or early 2022, and “majorly derisks the program.”

Financially speaking, Baral is also pleased with the PIPE. At estimated burn rates, the extra $25 million that Milestone will be raising should suffice to fund Milestone’s research “into 2Q22,” says the analyst, and therefore “past topline RAPID data.” In short, it eliminates funding concerns throughout the clinical process (although additional capital raises may still take place if desirable).

Mind you, none of this means that Milestone is going to become a profitable enterprise in the immediate future. While the developments are positive, Baral still expects to see Milestone lose $1.83 per share this year (albeit that’s half what it lost last year), then perhaps lose $2.07 per share more next year.

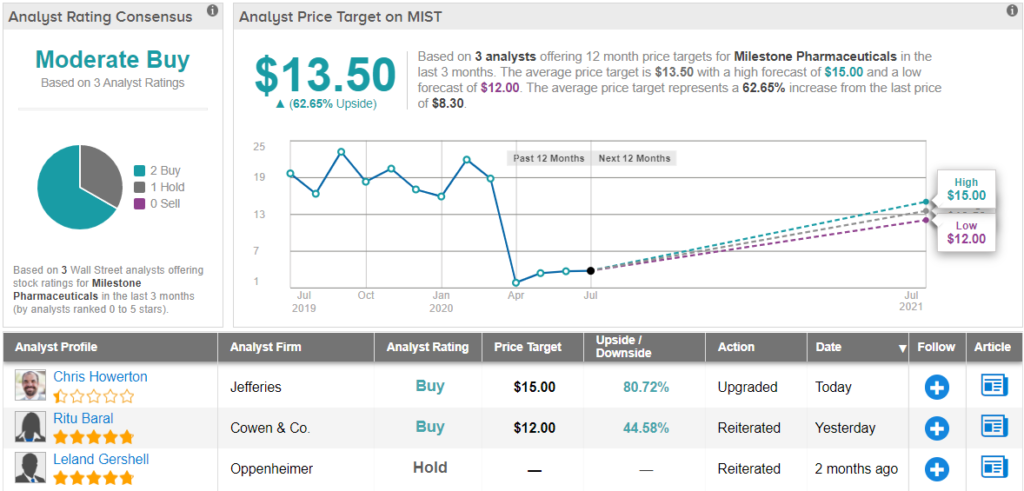

Regardless, the analyst is optimistic about the progress, assigns Milestone stock an “outperform” rating, and is doubling her price target to $12 a share. (To watch Baral’s track record, click here)

Overall, MIST holds a Moderate Buy rating from the analyst consensus, based on 2 “buy” ratings and 1 “hold.” Shares are selling for $8.29, and the average price target of $13.5 implies a healthy 64% upside.

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.