Shares in MiRagen Therapeutics (MGEN) popped 39% in Thursday’s trading, and continued to climb 6% after-hours, after the company announced that the US Food & Drug Administration (FDA) has granted orphan drug designation to cobomarsen, for the treatment of T-cell lymphoma.

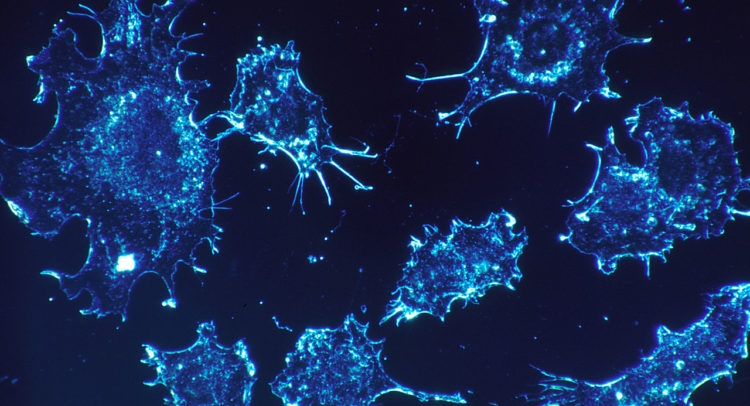

Cobomarsen is an inhibitor of miR-155 currently being developed by MGEN in two clinical programs to address different types of T-cell lymphoma, including a Phase 2 trial for cutaneous T-cell lymphoma (CTCL) and a Phase 1 trial for adult T-cell leukemia/lymphoma (ATLL).

“This is an important milestone in the development of cobomarsen. We believe the FDA’s decision to grant cobomarsen orphan drug designation underscores the need for new treatments for T-cell lymphomas such as ATLL and CTCL,” stated CEO William Marshall.

“In addition to the promising results we’ve observed for the potential treatment of patients with ATLL and CTCL, we believe that cobomarsen has the potential to be a broad-based therapy for the treatment of cancer patients with elevated levels of miR-155” he added.

T-cell lymphomas are lymphomas that affect T lymphocytes such as ATLL and CTCL. Together they make up less than 15% of non-Hodgkin lymphomas in the US. Overexpression of microRNA-155 has been associated with poor prognosis in a variety of T-cell lymphomas and other blood cancers.

Orphan drug designation is granted to drugs with potential for diagnosis and/or treatment of rare diseases that affect fewer than 200,000 people in the US. It can provide incentives for designated compounds and medicines, including eligibility for seven years of market exclusivity in the US after product approval, FDA assistance in clinical trial design and exemption from FDA user fees.

Shares in MGEN have exploded 210% year-to-date, and the stock has a very bullish outlook with a Strong Buy Street consensus and $5.50 average analyst price target (402% upside potential). (See MiRagen stock analysis on TipRanks)

“We are initiating coverage of MiRagen Therapeutics, a development stage biotechnology company working in hematologic cancers and fibrotic diseases, with a Buy rating and a 12-18 month $6.00 target price” commented Brookline Capital analyst Leah Cann on July 20.

The analyst estimates that the company will first have product revenue in 2024 resulting in total revenue that year of $300.0 million, potentially growing to $943.5 million in 2026, if both compounds, MRG-106 and MRG201, are successful in currently planned indications.

Related News:

NuVasive Spikes 5% After-Hours On Sharp Procedure Rebound

Intuitive Surgical Delivers Strong Quarter; But Analyst Says Sell Now

Is Novavax’s (NVAX) Super-High Valuation Justified? This Analyst Says ‘Yes’