Moderna (MRNA) is scheduled to report second-quarter 2021 earnings on August 5, before the market open.

Moderna is a biotech business that has been around for approximately ten years, but its COVID-19 vaccine catapulted it into the spotlight. After massive shares gains in 2020, the stock is up almost 246% year-to-date and 392.6% over the past year.

Now, upbeat Q2 earnings should give the stock a further drive, so let’s take a closer look at what analysts on the Street are expecting.

Q2 Expectations

For Q2, Street expects Moderna to report EPS of $6.01 and revenues of $4.28 billion.

Meanwhile, the Earnings Whisper number, or the Street’s unofficial view on earnings, stands at $6.75 per share. (See Moderna Dividend Date and History on TipRanks)

For 2021, Moderna anticipates product sales to be $19.2 billion. Operating expense is expected to increase sequentially every quarter in 2021 to support commercial and research and development activities related to COVID-19 vaccines.

Moderna’s Prior Quarter Snapshot

Moderna reported mixed Q1 results, with earnings per share coming in above the analysts’ expectations while revenues fell short.

Moderna recorded earnings of $2.84 per share in Q1, compared to the loss of $0.35 recorded in the prior-year quarter. Analysts were expecting the company to report EPS of $2.39.

Q1 was the company’s first profitable quarter in its history, owing to the success of its COVID-19 vaccine, mRNA-1273.

However, the total revenue of $1.94 billion missed analysts’ expectations of $2.44 billion.

Factors to Note

Moderna, known for its success in the COVID-19 vaccine, has recently joined the S&P 500 Index, putting itself in the big league.

This quarter, investors will be looking at how the demand for COVID-related vaccinations has impacted Moderna’s top and bottom-line figures.

Without a doubt, the epidemic has sparked a race to develop vaccinations and treatment options, resulting in the new economic potential for Moderna. Furthermore, the recent spread of the Delta variant has spurred debate regarding the need for booster shots, resulting in an increase in already high vaccine demand. (See Coronavirus Vaccine Stock Comparison on TipRanks)

Also, according to a CNN report, as part of the endeavor to deal with the Covid problem, President Joe Biden has made it essential for all federal employees to certify that they have been vaccinated, or face rigorous safety protocols.

Not only this, some major companies are making it mandatory for their employees to get vaccinated before returning to company campuses.

Given the burgeoning demand for vaccines, it seems reasonable to expect that the company’s revenues have increased in the upcoming quarter.

Notably, the company had delivered 102 million doses of mRNA-1273 in Q1 and anticipated to deliver 200 million to 250 million doses in Q2.

Some Major Announcements from Moderna

Investors should take note of the recent announcements and developments because they will give a clearer picture of Moderna’s strategy for meeting the growing demand for vaccines.

On August 3, the company was granted Fast Track designation for mRNA-1345, the company’s vaccine candidate for the respiratory syncytial virus (RSV) from Food and Drug Administration (FDA). It only applies to people over 60 years old.

If Moderna can commercialize the drug, it could be a great win for Moderna, as this drug will help the company expand its top-line growth beyond the pandemic.

Last month, the company announced two new supply agreements with Taiwan and Argentina, to deliver additional 35 million doses and 20 million doses of COVID-19 vaccines, respectively.

In addition, on July 20, the company partnered with Takeda Pharmaceutical Co. Ltd. (TAK) and the Japanese government to supply an additional 50 million doses to Japan.

In June, the company had filed for emergency/conditional use authorization in the United States, Europe, and Canada for adolescents (aged 12 years to less than 18). However, the company has yet to hear anything from the FDA on the topic.

On the second-quarter results call, investors are likely to inquire about the timeline for the potential launch of the vaccine for teenagers. A shorter timeline should help Moderna to further expand its sales figures.

Moderna released encouraging preliminary data from mid-stage research on booster doses of its COVID-19 vaccine in May. During the earnings call, the company may provide an update related to the progress of its booster vaccine candidates as well as an outlook on booster demand.

Moderna sales cannot be underestimated. If boosters are on the way, it clearly indicates that more revenue is on the horizon for Moderna – depending upon it being authorized and recommended.

Analyst Recommendations

On August 2, Moderna revealed that it has initiated the phase I research for mRNA-6231, an mRNA-encoded IL-2 modified for regulatory T cell growth.

Leah R. Cann of Brookline Capital Markets feels positive about the announcement, saying, “mRNA-6231 could enter the market in 2029, and conservatively estimate it will achieve an 1.0% market penetration in this setting in 2030, resulting in worldwide estimated sales for mRNA-6231 of $1.45 billion in 2030.”

Cann reiterated a Buy rating on the stock but increased the price target to $353.00 from $352.00. This implies an 8.7% downside potential to current levels.

Ahead of the second-quarter earnings announcement, Goldman Sachs analyst Salveen Richter reiterated a Buy rating on the stock but increased the price target to $299.00 from $228.00. This implies 22.6% downside potential to current levels.

Richter predicts MRNA to generate $4.2 billion in COVID-19 vaccine sales in Q2 and $21.6 billion in 2021. Furthermore, given “supply/pricing dynamics,” the analyst anticipates possible upside to forecasts in 2022.

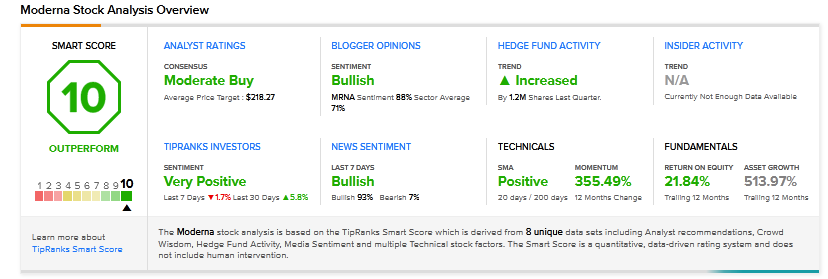

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 7 Buys, 4 Holds, and 2 Sells. The average MRNA price target of $218.27 implies 43.5% downside potential from the current levels.

Moderna scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Disclosure: Shalu Saraf held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.