Shares in Moderna dropped almost 4% on Friday, after its CEO told CNBC that the company was slowing down enrollment of its Phase 3 clinical trial for its Covid-19 vaccine candidate to make sure that minorities, which are most at risk, are sufficiently represented.

The stock closed at $62.60 on Friday. Moderna (MRNA), which initiated the trial on July 27, said on its website it had already enrolled 21,411 of the 30,000 planned participants. As of Friday, approximately 26% of participants enrolled in the study cumulatively are from diverse communities. Moderna’s data show that two-thirds of those enrolled are White, 20% are Hispanic or Latino and 7% are Black.

“We believe we could have one of the best vaccines,” Moderna CEO Stephane Bancel told CNBC. “We want to ensure we have data for all the people who could benefit and be protected.”

Bancel said the company’s goal is for enrollment to line up with US Census Bureau numbers, adding that “a small delay to have a better quality trial is the right decision in the long run.”

“I would rather we have higher diverse participants and take one extra week,” Bancel told CNBC. Diversity “matters more to us than speed.”

Moderna’s candidate mRNA-1273 is an mRNA vaccine against COVID-19 encoding for a prefusion stabilized form of the Spike (S) protein and is being co-developed with investigators from the National Institute of Allergy and Infectious Disease’s (NIAID) Vaccine Research Center.

The biotech company recently reiterated that it remains on track to deliver about 500 million doses of the potential vaccine per year, and up to 1 billion doses per year, beginning in 2021. Initial funding of $1.3 billion for Moderna to begin producing mRNA-1273 was secured from investors in the company’s most recent public equity offering in May 2020.

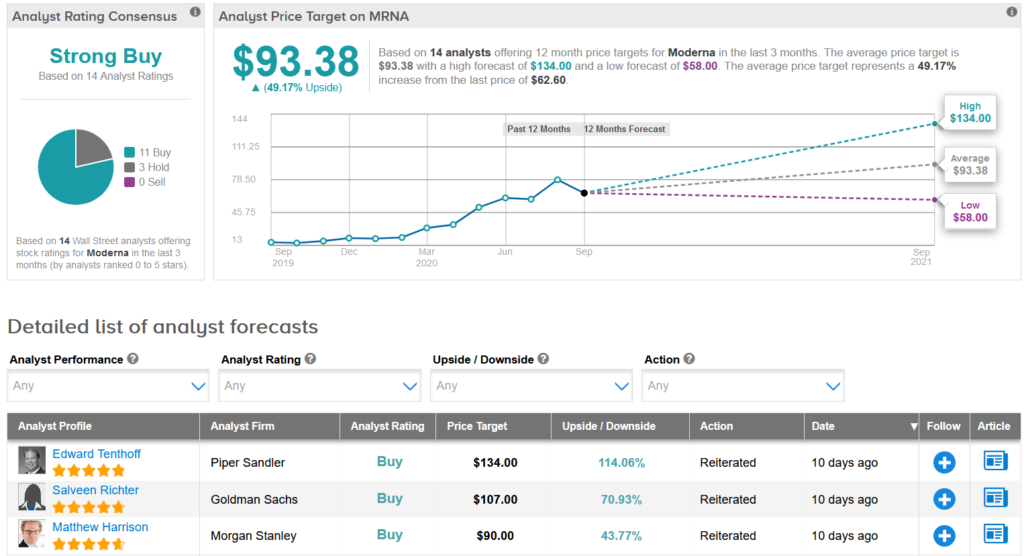

Shares in Moderna have dropped 15% over the past month but have exploded 220% so far this year. Wall Street analysts still have a Strong Buy consensus on the stock’s outlook. Looking ahead, the $93.38 average price target suggests additional 49% upside potential lies ahead.

JPMorgan analyst Cory Kasimov said that although the vaccine candidate appears to be showing a “promising profile”, he still wants to see “the Phase 3 results with mRNA-1273, which are anticipated sometime this fall, to see how the data evolves.”

Kasimov maintains a Hold rating on the stock as he is somehow still sceptical of Moderna’s “ability to generate long-term meaningful revenues that justify prevailing market values.”

Related News:

AbbVie Inks Deal To Develop, Sell I-Mab’s Cancer Therapy

Novavax Pops 8% On Covid-19 Vaccine Data; Analyst Says Buy Amid Pullback

Medtronic’s First-Of-Its Kind Diabetes System For Young Children Approved